Advance Auto Parts 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-20

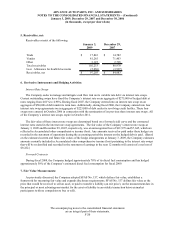

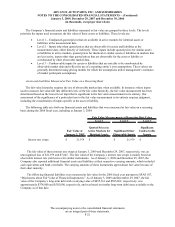

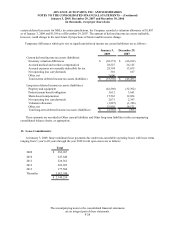

5. Receivables, net:

Receivables consist of the following:

January 3, December 29,

2009 2007

Trade 17,843$ 14,782$

Vendor 81,265 71,403

Other 3,125 2,785

Total receivables 102,233 88,970

Less: Allowance for doubtful accounts (5,030) (3,987)

Receivables, ne

t

97,203$ 84,983$

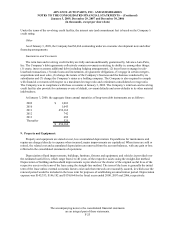

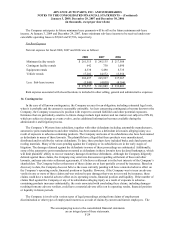

6. Derivative Instruments and Hedging Activities:

Interest Rate Swaps

The Company seeks to manage and mitigate cash flow risk on its variable rate debt via interest rate swaps.

Current outstanding swaps have fixed the Company’s interest rate on an aggregate of $275,000 of hedged debt at

rates ranging from 4.01% to 4.98%. During fiscal 2007, the Company entered into an interest rate swap on an

aggregate of $50,000 of debt under its term loan. Additionally, during fiscal 2006, the Company entered into four

interest rate swap agreements on an aggregate of $225,000 of debt under its revolving credit facility. These four

swaps were entered in October 2006 in connection with the termination of its previous three interest rate swaps. All

of the Company’s interest rate swaps expire in October 2011.

The fair value of these interest rate swaps are determined based on a forward yield curve and the contracted

interest rates stated in the interest rate swap agreements. The fair value of the Company’s interest rate swaps at

January 3, 2009 and December 29, 2007, respectively, was an unrecognized loss of $21,979 and $7,645, which are

reflected in Accumulated other comprehensive income (loss). Any amounts received or paid under these hedges are

recorded in the statement of operations during the accounting period the interest on the hedged debt is paid. (Based

on the estimated current and future fair values of the hedge arrangements at January 3, 2009, the Company estimates

amounts currently included in Accumulated other comprehensive income (loss) pertaining to the interest rate swaps

that will be reclassified and recorded in the statement of earnings in the next 12 months will consist of a net loss of

$9,222.)

Forward Contracts

During fiscal 2008, the Company hedged approximately 70% of its diesel fuel consumption and has hedged

approximately 50% of the Company’s estimated diesel fuel consumption for fiscal 2009.

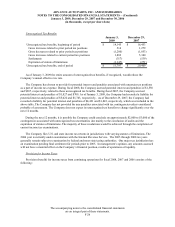

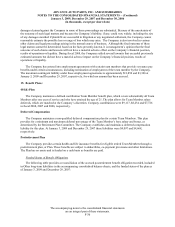

7. Fair Value Measurements:

As previously discussed, the Company adopted SFAS No. 157, which defines fair value, establishes a

framework for measuring fair value and expands disclosure requirements. SFAS No. 157 defines fair value as the

price that would be received to sell an asset, or paid to transfer a liability (an exit price), on the measurement date in

the principal or most advantageous market for the asset or liability in an orderly transaction between market

participants (with no compulsion to buy or sell).