Advance Auto Parts 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-17

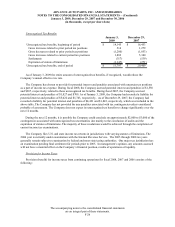

Effective December 30, 2007, the Company adopted the provisions of SFAS No. 159, “The Fair Value Option

for Financial Assets and Financial Liabilities.” SFAS No. 159 permits entities to choose to measure many financial

instruments and certain other items at fair value. The Company elected not to apply fair value on its existing

financial assets and liabilities upon adoption. Therefore, this adoption did not have a material effect on the

Company’s financial position, results of operations or cash flows.

3. Inventories, net:

Merchandise Inventory

Inventories are stated at the lower of cost or market. The Company uses the LIFO method of accounting for

approximately 95% and 93% of inventories at January 3, 2009 and December 29, 2007, respectively. Under LIFO,

the Company’s cost of sales reflects the costs of the most recently purchased inventories, while the inventory

carrying balance represents the costs for inventories purchased in fiscal 2008 and prior years. Prior to fiscal 2008,

the Company’s overall costs to acquire inventory for the same or similar products had been decreasing in recent

years due to the Company’s significant growth. However, in fiscal 2008, the current cost to replace inventory was

greater under LIFO. As a result of utilizing LIFO, the Company recorded an increase to cost of sales of $12,555 for

its fiscal year ended 2008 while having recorded a reduction to cost of sales of $11,005 and $9,978 for fiscal years

ended 2007 and 2006, respectively.

Product Cores

The remaining inventories are comprised of product cores, which consist of the non-consumable portion of

certain parts and batteries, which are valued under the first-in, first-out ("FIFO") method. Product cores are included

as part of the Company’s merchandise costs and are either passed on to the customer or returned to the vendor. Since

product cores are not subject to frequent cost changes like the Company’s other merchandise inventory, there is no

material difference when applying either the LIFO or FIFO valuation method.

Inventory Overhead Costs

The Company capitalizes certain purchasing and warehousing costs into inventory. Purchasing and warehousing

costs included in inventory, at FIFO, at January 3, 2009 and December 29, 2007, were $104,594 and $107,068,

respectively.

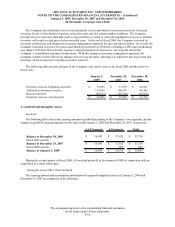

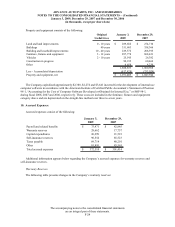

Inventory Balances and Inventory Reserves

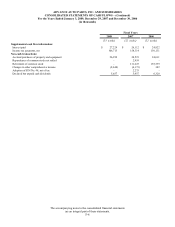

Inventory balances at year-end for fiscal years 2008 and 2007 were as follows:

January 3, December 29,

2009 2007

Inventories at FIFO, net 1,541,871$ 1,435,697$

Adjustments to state inventories at LIFO 81,217 93,772

Inventories at LIFO, ne

t

1,623,088$ 1,529,469$

Inventory quantities are tracked through a perpetual inventory system. The Company uses a cycle counting

program in all distribution centers and PDQs® to ensure the accuracy of the perpetual inventory quantities of both

merchandise and product core inventory. For our retail stores, we began completing physical inventories during our

third quarter of fiscal 2008 in addition to cycle counting to ensure the accuracy of the perpetual inventory quantities

of both merchandise and core inventory in these locations. As of January 3, 2009, the Company had completed

physical inventories in approximately one-third of its retail stores. The Company establishes reserves for estimated

shrink based on results of completed physical inventories, actual results from recent cycle counts and historical

results from the Company’s cycle counting program.