Advance Auto Parts 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-18

The Company also establishes reserves for potentially excess and obsolete inventories based on (i) current

inventory levels, (ii) the historical analysis of product sales and (iii) current market conditions. The Company

provides reserves when less than full credit is expected from a vendor or when the liquidation of excess or obsolete

inventory will result in retail prices below recorded costs. At the end of fiscal 2008, the Company reviewed its

inventory productivity and changed its inventory management approach for slow moving inventory. As a result, the

Company increased its reserve for excess and obsolete inventories by $34,084, excluding a LIFO and warehousing

cost impact of $3,400. This non-cash expense is also presented as an increase to cost of goods sold in the

Company’s consolidated statement of operations. With this change in inventory management approach, the

Company intends to more effectively manage slow moving inventory allowing it to add faster moving custom mix

inventory which is expected to increase inventory turnover.

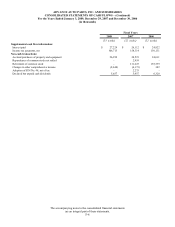

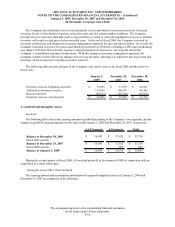

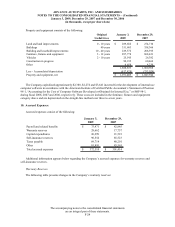

The following table presents changes in the Company’s inventory reserves for fiscal 2008 and the prior two

fiscal years.

January 3, December 29, December 30,

2009 2007 2006

Inventory reserves, beginning of period 35,565$ 31,376$ 22,825$

Additions to inventory reserves 113,605 106,387 94,206

Reserves utilized (86,272) (102,198) (85,655)

Inventory reserves, end of perio

d

62,898$ 35,565$ 31,376$

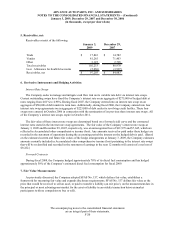

4. Goodwill and Intangible Assets:

Goodwill

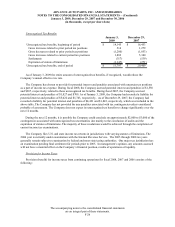

The following table reflects the carrying amount of goodwill pertaining to the Company’s two segments, and the

changes in goodwill carrying amounts, for the years ended January 3, 2009 and December 29, 2007, respectively:

AAP Segment AI Segment Total

Balance at December 30, 2006 16,093$ 17,625$ 33,718$

Fiscal 2007 activity - - -

Balance at December 29, 2007 16,093$ 17,625$ 33,718$

Fiscal 2008 activity - 885 885

Balance at January 3, 2009 16,093$ 18,510$ 34,603$

During the second quarter of fiscal 2008, AI recorded goodwill in the amount of $885 in connection with an

acquisition of a small retail chain.

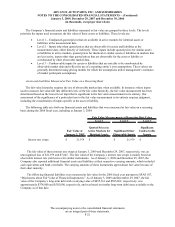

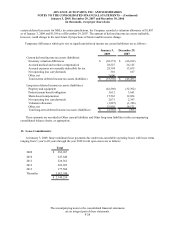

Intangible Assets Other Than Goodwill

The carrying amount and accumulated amortization of acquired intangible assets as of January 3, 2009 and

December 29, 2007 are comprised of the following: