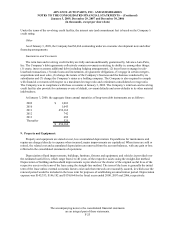

Advance Auto Parts 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-25

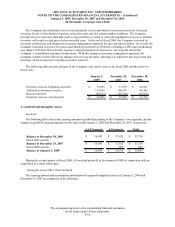

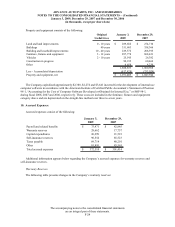

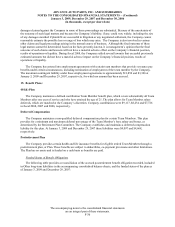

January 3, December 29, December 30,

2009 2007 2006

Warranty reserves, beginning of period 17,757$ 13,069$ 11,352$

Additions to warranty reserves 38,459 24,722 17,352

Reserves utilized (27,554) (20,034) (15,635)

Warranty reserves, end of period 28,662$ 17,757$ 13,069$

Effective December 30, 2007, the Company began including in its warranty reserve the warranty obligation on

certain other products sold in addition to batteries. A portion of this obligation is funded by the Company’s vendors.

The overall increase in the Company’s warranty reserves is primarily attributable to an increase in the quantity and

cost of batteries sold during fiscal 2008 as well as an increase in related warranty claims.

Self-insurance Reserves

The following table presents changes in the Company’s self-insurance reserves:

January 3, December 29, December 30,

2009 2007 2006

Self-insurance reserves, beginning of period 85,523$ 71,519$ 54,899$

Additions to self-insurance reserves 89,315 102,641 97,201

Reserves utilized (84,284) (88,637) (80,581)

Self-insurance reserves, end of period 90,554$ 85,523$ 71,519$

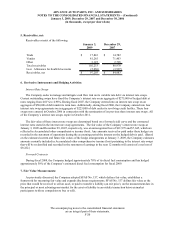

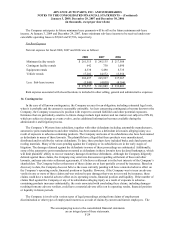

11. Stock Repurchase Program:

On May 15, 2008, the Company’s Board of Directors authorized a new $250,000 stock repurchase program.

The new program cancelled and replaced the remaining portion of the Company’s previous $500,000 stock

repurchase program (authorized on August 8, 2007). The program allows the Company to repurchase its common

stock on the open market or in privately negotiated transactions from time to time in accordance with the

requirements of the Securities and Exchange Commission.

During fiscal 2008, the Company repurchased 6,136 shares of its common stock at an aggregate cost of

$216,470, or an average price of $35.28 per share, of which 4,563 shares of common stock were repurchased under

the previous $500,000 stock repurchase program. Additionally, the Company settled $2,959 on shares repurchased

at the end of fiscal 2007.

As of January 3, 2009, the Company had repurchased 1,573 shares of its common stock at an aggregate cost of

$61,089, excluding related expenses, under its $250,000 stock repurchase program leaving $188,911 remaining

under this program, excluding related expenses.

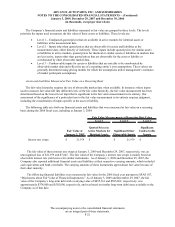

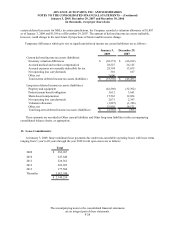

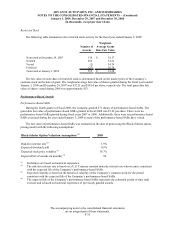

12. Income Taxes:

The Company adopted the provisions of FIN 48 on December 31, 2006 and upon adoption the Company

recorded an increase of $2,275 to the liability for unrecognized tax benefits and a corresponding decrease in its

balance of retained earnings. The following table lists each category and summarizes the activity of the Company’s

unrecognized tax benefits for the fiscal years ended January 3, 2009 and December 29, 2007: