Advance Auto Parts 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

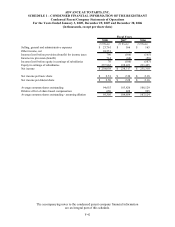

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-32

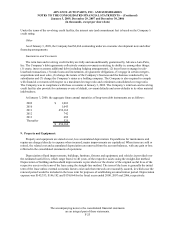

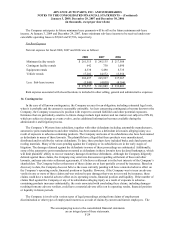

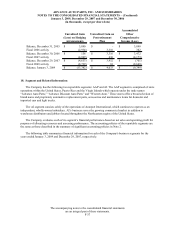

Amount

2009 915$

2010 919

2011 930

2012 914

2013 892

2014-2017 3,580

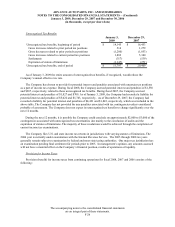

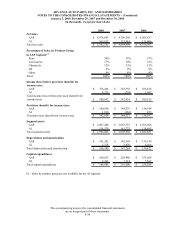

The Company adopted the measurement date provisions of SFAS No. 158 on December 30, 2007. The change

in the measurement date did not have a material impact on the Company’s financial condition, results of operations

or cash flows. The Company previously adopted the recognition provisions of SFAS No. 158 on December 30,

2006. As a result, the Company recorded an actuarial gain of $3,316, net of tax, to Accumulated other

comprehensive loss, net of tax, and recognized previously unamortized prior service cost that had not yet been

included in net periodic postretirement benefit cost as of December 30, 2006. The adoption of the recognition

provisions of SFAS No. 158 had no impact on net income.

At January 3, 2009, the net unrealized gain on the postretirement plan consists of an unrealized gain of $4,693

related to prior service cost and an unrealized net gain of $1,848 related to actuarial gains. Approximately $581 of

the unrealized gain related to prior service cost and $96 related to the actuarial gain are expected to be recognized as

a component of Net periodic postretirement benefit cost in fiscal 2009.

The Company reserves the right to change or terminate the employee benefits or plan contributions at any time.

The Company also continues to evaluate ways in which it can better manage these benefits and control costs. Any

changes in the plan or revisions to assumptions that affect the amount of expected future benefits may have a

material impact on the amount of the reported obligation, annual expense and projected benefit payments.

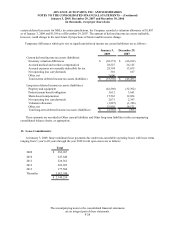

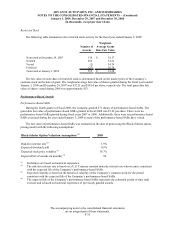

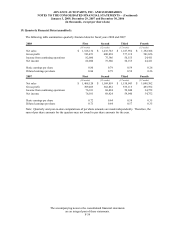

16. Share-Based Compensation:

Overview

The Company grants share-based compensation awards to its employees and members of its Board of Directors

as provided for under its Long-Term Incentive Plan, or LTIP. Prior to fiscal 2007, the Company granted equity

compensation to its employees in the form of fixed stock options and deferred stock units, or DSUs, that vest over

time. Beginning in fiscal 2007, the Company phased out the granting of stock options by primarily granting stock

appreciation rights, or SARs, and restricted stock (considered nonvested stock under SFAS 123R), which also vest

over time.

During the fourth quarter of fiscal 2008, the Company shifted its annual LTIP grant cycle from the first quarter

to the fourth quarter of the fiscal year, which will enable performance targets and awards to be put in place prior to

the commencement of the performance period. Therefore, the Company made two annual share-based grants during

fiscal 2008. Additionally, the Company granted awards to executives hired earlier in fiscal 2008. Thus, the number

of awards granted during fiscal 2008 was significantly higher than prior years.

General Terms of Awards

Time Vested Awards

The terms of the SARs granted are similar in several respects to the stock options previously granted. The SARs

generally vest over a three-year period in equal annual installments beginning on the first anniversary of the grant

date, with the exception of SARs granted to our Chief Executive Officer and Chief Financial Officer hired in early

fiscal 2008. The 2008 grants to our CEO and CFO provide for 25% of the SARs to vest immediately with exercise

restrictions during the first year and the remainder of the award to vest in equal installments over a three-year period