Advance Auto Parts 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

• a $43.2 million decrease in financed vendor accounts payable driven by the transition of our vendors from

our vendor financing program to our customer-managed services arrangement;

• a reduction of $78.6 million in net borrowings primarily under our credit facilities; and

• a $7.3 million decrease in additional tax benefits associated with the decreased number of stock options

exercised.

For fiscal 2007, net cash used in financing activities increased by $100.3 million to $204.9 million.

Cash flows from financing activities increased as result of:

• an $11.8 million cash inflow resulting from the timing of bank overdrafts;

• a $17.8 million increase in financed vendor accounts payable, which reflected the growth in our vendor

financing program;

• a $25.3 million increase from the issuance of common stock, resulting from an increase in the exercise of

stock options mainly associated with the departure of our former CEO and another executive officer during

fiscal 2007; and

• a $6.6 million cash inflow from additional tax benefits realized from the increased level of stock options

exercised.

Cash flows from financing activities decreased as a result of:

• a reduction of $14.3 million in net borrowings primarily under our credit facilities;

• $6.0 million of additional cash dividends paid due primarily to the timing in payments; and

• an additional $145.4 million of common stock repurchased under our stock repurchase program.

Off-Balance-Sheet Arrangements

As of January 3, 2009, we had no off-balance-sheet arrangements as defined in Regulation S-K Item 303 of the

SEC regulations. We include other off-balance-sheet arrangements in our contractual obligation table including

operating lease payments, interest payments on our credit facility and letters of credit outstanding.

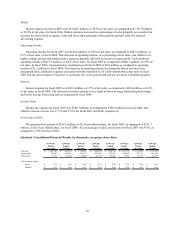

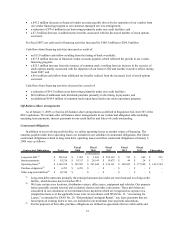

Contractual Obligations

In addition to our revolving credit facility, we utilize operating leases as another source of financing. The

amounts payable under these operating leases are included in our schedule of contractual obligations. Our future

contractual obligations related to long-term debt, operating leases and other contractual obligations at January 3,

2009 were as follows:

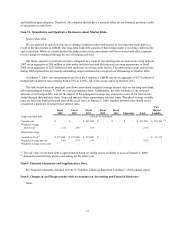

Fiscal Fiscal Fiscal Fiscal Fiscal

Contractual Obligations Total 2009 2010 2011 2012 2013 Thereafter

Long-term debt

(1)

456,164$ 1,003$ 1,043$ 452,162$ 742$ 689$ 525$

Interest payments 59,216$ 19,317$ 20,149$ 19,675$ 44$ 24$ 7$

Operating leases

(2)

2,149,234$ 282,967$ 247,640$ 226,361$ 202,022$ 177,500$ 1,012,744$

Purchase obligations

(3)

6,291$ 6,291$ -$ -$ -$ -$ -$

Other long-term liabilities

(4)

68,744$ -$ -$ -$ -$ -$ -$

(in thousands)

(1) Long-term debt represents primarily the principal amounts due under our term loan and revolving credit

facility, which become due in October 2011.

(2) We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property

leases generally contain renewal and escalation clauses and other concessions. These provisions are

considered in our calculation of our minimum lease payments which are recognized as expense on a

straight-line basis over the applicable lease term. In accordance with SFAS No. 13, “Accounting for

Leases,” as amended by SFAS No. 29, “Determining Contingent Rental,” any lease payments that are

based upon an existing index or rate, are included in our minimum lease payment calculations.

(3) For the purposes of this table, purchase obligations are defined as agreements that are enforceable and