Advance Auto Parts 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-22

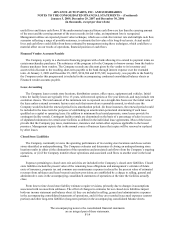

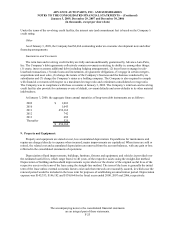

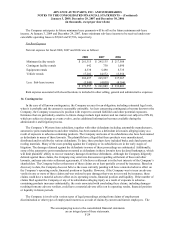

8. Long-term Debt:

Long-term debt consists of the following:

January 3,

2009 December 29,

2007

Senior Debt:

Revolving credit facility at variable interest rates

(4.81% and 5.93% at January 3, 2009 and December 29,

2007, respectively) due October 2011 251,500$ 451,000$

Term loan at variable interest rates

(3.02% and 6.19% at January 3, 2009 and December 29,

2007, respectively) due October 2011 200,000 50,000

Other 4,664 4,672

456,164 505,672

Less: Current portion of long-term debt (1,003) (610)

Long-term debt, excluding current portio

n

455,161$ 505,062$

Term Loan

As of January 3, 2009, the Company had borrowed $200,000 under its unsecured four-year term loan. The

Company entered into the term loan on December 4, 2007, with the Company’s wholly-owned subsidiary, Advance

Stores Company, Incorporated, or Stores, serving as borrower. As of December 29, 2007, the Company had

borrowed $50,000 under the term loan. The entire $200,000 proceeds from this term loan were used to repurchase

shares of the Company's common stock under its stock repurchase program. The term loan terminates on October 5,

2011.

The interest rate on the term loan is based, at the Company’s option, on an adjusted LIBOR rate, plus a margin,

or an alternate base rate, plus a margin. The current margin is 1.0% and 0.0% per annum for the adjusted LIBOR

and alternate base rate borrowings, respectively. The Company has elected to use the 90-day adjusted LIBOR rate

and has the ability and intent to continue to use this rate on its hedged borrowings. Under the terms of the term loan,

the interest rate is based on the Company’s credit rating.

Revolving Credit Facility

In addition to the term loan, the Company has a $750,000 unsecured five-year revolving credit facility with

Stores serving as the borrower. The revolving credit facility also provides for the issuance of letters of credit with a

sub limit of $300,000, and swingline loans in an amount not to exceed $50,000. The Company may request, subject

to agreement by one or more lenders, that the total revolving commitment be increased by an amount not exceeding

$250,000 (up to a total commitment of $1,000,000) during the term of the credit agreement. Voluntary prepayments

and voluntary reductions of the revolving balance are permitted in whole or in part, at the Company’s option, in

minimum principal amounts as specified in the revolving credit facility. The revolving credit facility terminates on

October 5, 2011.

As of January 3, 2009, the Company had $251,500 outstanding under its revolving credit facility, and letters of

credit outstanding of $101,254, which reduced the availability under the revolving credit facility to $397,246. (The

letters of credit generally have a term of one year or less.) A commitment fee is charged on the unused portion of

the revolver, payable in arrears. The current commitment fee rate is 0.15% per annum.

The interest rate on borrowings under the revolving credit facility is based, at the Company’s option, on an

adjusted LIBOR rate, plus a margin, or an alternate base rate, plus a margin. The current margin is 0.75% and 0.0%

per annum for the adjusted LIBOR and alternate base rate borrowings, respectively. The Company has elected to use

the 90-day adjusted LIBOR rate and has the ability and intent to continue to use this rate on its hedged borrowings.