Advance Auto Parts 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

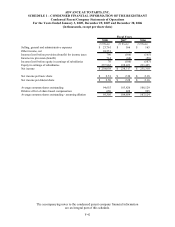

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-33

consistent with all other Company SARs granted. Additionally, all SARs granted are non-qualified, terminate on the

seventh anniversary of the grant date and contain no post-vesting restrictions other than normal trading black-out

periods prescribed by the Company’s corporate governance policies.

Restricted stock shares granted during fiscal 2007 vest at the end of a three-year period. During this period,

holders of restricted stock are entitled to receive dividends and voting rights. The shares are restricted until they vest

and cannot be sold by the recipient until the restriction has lapsed at the end of the three-year period. Beginning in

fiscal 2008, all new restricted stock awards granted vest pro-rata over a three-year period in equal annual

installments beginning on the first anniversary of the grant date (with the exception of certain shares of restricted

stock granted to its Chief Executive Officer and Chief Financial Officer hired in early fiscal 2008, which vest at the

end of a three-year period following the grant date).

Performance-Based Awards

Although the Company will continue to grant SARs and restricted stock, a portion of each respective award will

be performance-based. The actual number of shares vested is determined at the end of a three-year performance

period based on results achieved versus company performance goals. Depending on the Company’s results during

the three-year performance period, the actual number of shares vesting at the end of the period may range from 0%

to 200% of the targeted shares granted.

Deferred Stock Units

The Company grants share-based awards annually to its Board of Directors in connection with its annual

meeting of stockholders. In addition to SARs, the Company grants DSUs as provided for in the Advance Auto Parts,

Inc. Deferred Stock Unit Plan for Non-Employee Directors and Selected Executives, or the DSU Plan. Each DSU is

equivalent to one share of common stock of the Company. The DSUs are immediately vested upon issuance but are

held on behalf of the director until he or she ceases to be a director. The DSUs are then distributed to the director

following his or her last date of service. Additionally, the DSU Plan provides for the deferral of compensation as

earned in the form of (i) an annual retainer for directors, and (ii) wages for certain highly compensated employees of

the Company. These deferred stock units are settled in common stock with the participants at a future date, or over a

specified time period as elected by the participants in accordance with the DSU Plan.

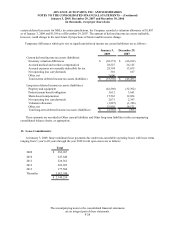

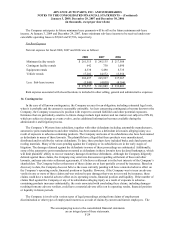

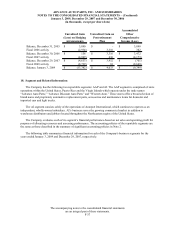

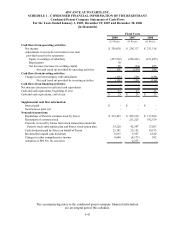

Share-Based Compensation Expense & Cash Flows

The expense the Company has incurred annually related to the issuance of share-based compensation is

included in Selling, general and administrative expense. The Company also receives cash upon the exercise of stock

options, as well as when employees purchase stock under the employee stock purchase plan, or ESPP. Total share-

based compensation expense and cash received included in the Company’s consolidated statements of operations

and consolidated statement of cash flows are reflected in the table below, including the related income tax benefits,

for fiscal years ended January 3, 2009, December 29, 2007 and December 30, 2006 as follows:

2008 2007 2006

Share-based compensation expense 17,707$ 18,096$ 19,052$

Deferred income income tax benefit 6,640 6,822 7,145

Cash received upon exercise and from ESPP 35,220 42,547 17,203

Excess tax benefit share-based compensation 9,047 11,841 5,272

As of January 3, 2009, there was $27,405 of unrecognized compensation expense related to all share-based

awards (excluding DSUs) that is expected to be recognized over a weighted average period of 2.1 years.