Advance Auto Parts 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

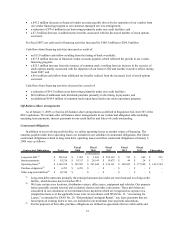

Vendor Financing Program

Historically, we have negotiated extended payment terms from suppliers that help finance inventory growth,

and we believe that we will be able to continue financing much of our inventory growth through such extended

payment terms. We have a short-term financing program with a bank for certain merchandise purchases. In

substance, the program allows us to borrow money from the bank to finance purchases from our vendors. This

program allows us to further reduce our working capital invested in current inventory levels and finance future

inventory growth. At January 3, 2009 and December 29, 2007, $136.4 million and $153.5 million, respectively, was

payable to the bank by us under this program.

We are anticipating the balance in financed vendor accounts payable to diminish as we transition our

merchandise vendors to a customer-managed services arrangement, or vendor program, entered into during the

fourth quarter of fiscal 2008. Under this vendor program, a third party provides an accounts payable tracking system

which facilitates participating suppliers’ ability to finance our payment obligations with designated third-party

financial institutions. Participating suppliers may, at their sole discretion, make offers to participating financial

institutions to finance one or more of our payment obligations prior to their scheduled due dates at a discounted

price. Our obligations to suppliers, including amounts due and scheduled payment dates, are not impacted by

suppliers’ decisions to finance our accounts payable due to them under this arrangement. Our goal in entering into

this arrangement is to capture overall supply chain savings in the form of pricing, payment terms or vendor funding,

created by facilitating our suppliers’ ability to finance payment obligations at more favorable discount rates, while

providing them with greater working capital flexibility.

As of January 3, 2009, we had $14.3 million in outstanding payables under our vendor program and had

remaining availability of approximately $25 million. It is possible any ongoing or worsening deterioration in the

credit markets could adversely impact our ability to secure funding for any of these programs, which would reduce

our anticipated savings, including but not limited to, causing us to increase our borrowings under our revolving

credit facility.

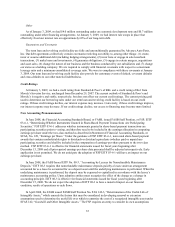

Stock Repurchase Program

On May 15, 2008, our Board of Directors authorized a new $250 million stock repurchase program. The new

program cancelled and replaced the remaining portion of our previous $500 million stock repurchase program

(authorized on August 8, 2007). This program allows us to repurchase our common stock on the open market or in

privately negotiated transactions from time to time in accordance with the requirements of the Securities and

Exchange Commission.

During fiscal 2008, we repurchased 6.1 million shares of common stock at an aggregate cost of $216.5 million,

or an average price of $35.28 per share, of which 4.6 million shares of common stock were repurchased under the

previous $500 million stock repurchase program during the first quarter of fiscal 2008. After May 15, 2008, we

repurchased 1.5 million shares of common stock for $61.1 million, leaving $188.9 million remaining under our

current $250 million stock repurchase program, excluding related expenses. Additionally, during fiscal 2008 we

settled $3.0 million on shares repurchased prior to the end of fiscal 2007.

Cash Dividend

On February 15, 2006, our Board of Directors declared a quarterly cash dividend, the first in our history. We

have paid quarterly dividends of $0.06 per share to stockholders of record for each of our subsequent quarters.

Subsequent to January 3, 2009, our Board of Directors declared a quarterly dividend of $0.06 per share to be paid on

April 10, 2009 to all common stockholders of record as of March 27, 2009.

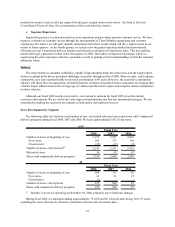

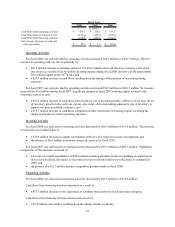

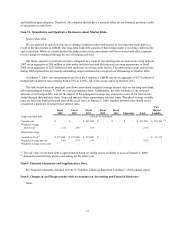

Analysis of Cash Flows

A summary and analysis of our cash flows for fiscal 2008, 2007 and 2006 is reflected in the table and following

discussion.