Advance Auto Parts 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

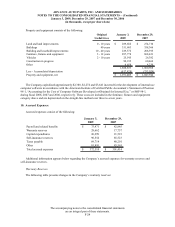

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-30

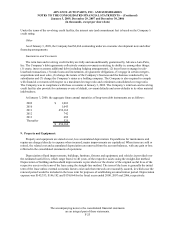

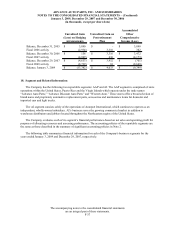

damages claimed against the Company in some of these proceedings are substantial. Because of the uncertainty of

the outcome of such legal matters and because the Company’s liability, if any, could vary widely, including the size

of any damages awarded if plaintiffs are successful in litigation or any negotiated settlement, the Company cannot

reasonably estimate the possible loss or range of loss which may arise. The Company is also involved in various

other claims and legal proceedings arising in the normal course of business. Although the final outcome of these

legal matters cannot be determined, based on the facts presently known, it is management’s opinion that the final

outcome of such claims and lawsuits will not have a material adverse effect on the Company’s financial position,

results of operations or liquidity. During fiscal 2008, the Company settled several lawsuits that exceeded previously

estimated amounts but did not have a material adverse impact on the Company’s financial position, results of

operations or liquidity.

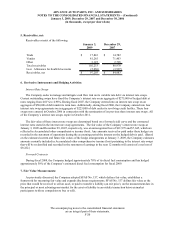

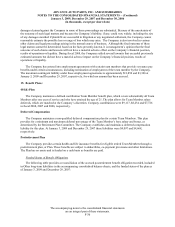

The Company has entered into employment agreements with certain team members that provide severance pay

benefits under certain circumstances, including termination of employment of the team member by the Company.

The maximum contingent liability under these employment agreements is approximately $11,850 and $3,306 at

January 3, 2009 and December 29, 2007, respectively, for which no amount has been accrued.

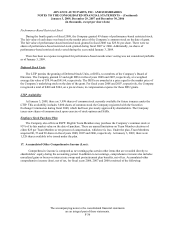

15. Benefit Plans:

401(k) Plan

The Company maintains a defined contribution Team Member benefit plan, which covers substantially all Team

Members after one year of service and who have attained the age of 21. The plan allows for Team Member salary

deferrals, which are matched at the Company’s discretion. Company contributions were $9,117, $8,234 and $7,726

in fiscal 2008, 2007 and 2006, respectively.

Deferred Compensation

The Company maintains a non-qualified deferred compensation plan for certain Team Members. This plan

provides for a minimum and maximum deferral percentage of the Team Member’s base salary and bonus, as

determined by the Retirement Plan Committee. The Company establishes and maintains a deferred compensation

liability for this plan. At January 3, 2009 and December 29, 2007 these liabilities were $4,097 and $4,668,

respectively.

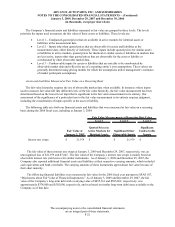

Postretirement Plan

The Company provides certain health and life insurance benefits for eligible retired Team Members through a

postretirement plan, or Plan. These benefits are subject to deductibles, co-payment provisions and other limitations.

The Plan has no assets and is funded on a cash basis as benefits are paid.

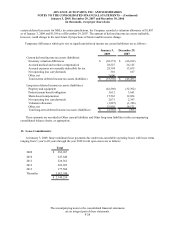

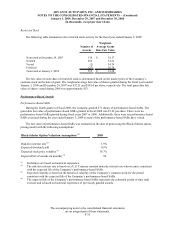

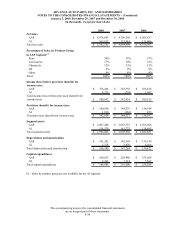

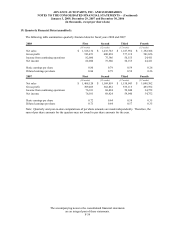

Funded Status of Benefit Obligations

The following table provides a reconciliation of the accrued postretirement benefit obligation recorded, included

in Other long-term liabilities in the accompanying consolidated balance sheets, and the funded status of the plan as

of January 3, 2009 and December 29, 2007: