Advance Auto Parts 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

Table of contents

-

Page 1

-

Page 2

-

Page 3

...

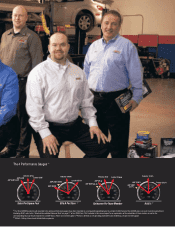

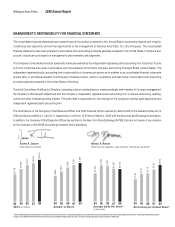

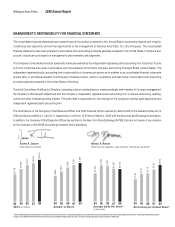

Industry 16.6% Leader 23.8%

Sales Per Square Foot

(1)

SG & A Per Store

(3)

Op Income Per Team Member

ROIC% (2)

Our fiscal 2008 financial results reported in the above performance gauges have been reported on a comparable operating basis to exclude the 53rd week of fiscal 2008 and a non-cash...

-

Page 4

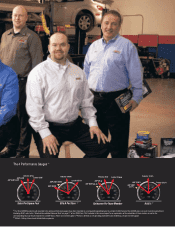

... when you talk to Mark. His store scored highest in the Team Calibration and Customer Satisfaction surveys, which was no small feat. If you ask Mark what the secret is he will tell you it's simple-make work fun. His entire team is also bilingual, which is a plus when communicating with customers!

-

Page 5

...our Stockholders

2008 Annual Report

3

I am honored on behalf of over 48,000 Advance Auto Parts Team Members to update you on our progress in 2008 and our opportunities for 2009 and beyond. During my first full year at Advance Auto Parts we have made measureable strategic and financial progress on...

-

Page 6

... Commercial Acceleration - Serving Commercial customers better than anyone else through superior delivery times, order accuracy and parts availability. • DIY Transformation - Serving retail customers better than anyone else by providing products, services and support tailored to local market needs...

-

Page 7

... Spring, Pennsylvania

If there's one Team Member who knows a thing or two about attachment selling, it's General Manager Donna Clinger. Donna understands the value of engaging with customers. When you understand the customer's project, it's easier to work with them and suggest additional items...

-

Page 8

... based on the Team Calibration and Customer Satisfaction surveys. Danny believes it all comes down to good communication. Through listening and communicating, Danny's built an all-star team that knows how to work together. Every morning his team reviews the reports, where the store stands and what...

-

Page 9

... quarters of double-digit Commercial sales growth • On a comparable operating basis, we achieved EPS growth of 16% • Free cash flow increased 19% to $280 million • Our Company's footprint was expanded by opening 109 new Advance stores and 18 new Autopart International stores • We added...

-

Page 10

...our 48,000 Team Members who helped us grow our Company's success and serve our customers better than anyone else. Throughout this Annual Report, you can see photos and read stories about some of our Team Members who are living examples of how we are growing and transforming our business. 2009 is the...

-

Page 11

...'s Chief Executive Officer has certified to the New York Stock Exchange (NYSE) that he is not aware of any violation by the Company of the NYSE corporate governance listing standards.

DARREN R. JACKSON

CHIEF EXECUTIVE OFFICER

MICHAEL A. NORONA

EXECUTIVE VICE PRESIDENT, CHIEF FINANCIAL OFFICER AND...

-

Page 12

... Road Roanoke, Virginia

(Address of Principal Executive Offices)

24012

(Zip Code)

(540) 362-4911

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock New York...

-

Page 13

... second fiscal quarter, the aggregate market value of the 95,066,907 shares of Common Stock held by non-affiliates of the registrant was $3,499,412,847, based on the last sales price of the Common Stock on July 11, 2008, as reported by the New York Stock Exchange. As of March 2, 2009, the registrant...

-

Page 14

... Data ...37 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...37

Item 9A. Controls and Procedures ...38 Item 9B. Other Information ...38

Part III. Item 10. Item 11. Item 12. Directors, Executive Officers and Corporate Governance ...39 Executive Compensation...

-

Page 15

... business strategies and achieve desired goals; • our ability to expand our business, including locating available and suitable real estate for new store locations and the integration of any acquired businesses; • competitive pricing and other competitive pressures; • our overall credit rating...

-

Page 16

.... Our parent company, Advance Auto Parts, Inc., was incorporated in 2001 in conjunction with the acquisition of Discount Auto Parts, Inc., or Discount. In 2005, we acquired Autopart International, Inc., or AI. Our Internet address is www.AdvanceAutoParts.com. We make available free of charge through...

-

Page 17

... Brake Pads Belts and Hoses Radiator Hoses Starters Alternators Batteries Shock Absorbers Struts Suspension Parts Spark Plugs Transmissions Clutches Electronic Ignition Components Engines Oil and Transmission Fluid Antifreeze Windshield Wipers Windshield Washer Fluid Floor Mats Steering Wheel Covers...

-

Page 18

... place of business, including independent garages, service stations and auto dealers. Our stores are supported by a Commercial sales team who are dedicated to the development of our Commercial customers, which include national and regional accounts. Under our Commercial Acceleration strategy, we are...

-

Page 19

...real-time, comprehensive information to store personnel, resulting in improved customer service levels, Team Member productivity and instock availability. Store Support Center Merchandising. Purchasing for virtually all of the merchandise for our stores is handled by our merchandise teams located in...

-

Page 20

... (i) reduced vendor to distribution center freight costs, (ii) visibility of purchase orders and shipments for the entire supply chain, (iii) a reduction in distribution center inventory, or safety stock, due to consistent transit times, (iv) decreased third party freight and billing service costs...

-

Page 21

... Delaware Maine Massachusetts

17 1 4 33

New Hampshire New Jersey New York

8 14 23

Pennsylvania Rhode Island Vermont

20 4 1

The following table sets forth information concerning increases in the total number of our AI stores:

Beginning Stores New Stores Stores Closed Ending Stores

(1)

2008 108...

-

Page 22

... believe that our Team Member relations are good. Intellectual Property We own a number of trade names and own and have federally registered several service marks and trademarks, including "Advance Auto Parts," "Western Auto," "Parts America," "Autopart International" and "PDQ" for use in connection...

-

Page 23

... our DIY customers may pay others to repair and maintain their cars or they may purchase new cars; the weather, as vehicle maintenance may be deferred during periods of unfavorable weather; the average duration of manufacturer warranties and the decrease in the number of annual miles driven, because...

-

Page 24

... amount of marketing activities, a larger number of stores, store locations, store layouts, longer operating histories, greater name recognition, larger and more established customer bases, lower prices, and better product warranties. Our response to these competitive disadvantages may require...

-

Page 25

...able to expand our business if our growth strategy is not successful, including the availability of suitable locations for new store openings or the successful integration of any acquired businesses, which could adversely affect our business, financial condition, results of operations and cash flows...

-

Page 26

... to properly merchandise, market and price the products desired by customers in these markets. Acquisitions, Investments or Strategic Alliances We may acquire stores or businesses from, make investments in, or enter into strategic alliances with companies that have stores or distribution networks in...

-

Page 27

... costs. Such price increases would increase the cost of doing business for us and our suppliers, and also would negatively impact our customers' disposable income and have an adverse impact on our business, sales, profit margins and results of operations. Risks Relating to Our Financial Condition...

-

Page 28

... certain information relating to our distribution and other principal facilities:

Opening Facility Main Distribution Centers: Roanoke, Virginia Lehigh, Pennsylvania Lakeland, Florida Gastonia, North Carolina Gallman, Mississippi Salina, Kansas Delaware, Ohio Thomson, Georgia Master PDQ® Warehouse...

-

Page 29

... by insurance, these claims could have a material adverse effect on our operating results, financial position and liquidity. If the number of claims filed against us or any of our subsidiaries alleging injury as a result of exposure to asbestos-containing products increases substantially, the costs...

-

Page 30

... common stock is listed on the New York Stock Exchange, or NYSE, under the symbol "AAP." The table below sets forth, for the fiscal periods indicated, the high and low sale prices per share for our common stock, as reported by the NYSE. High Low Fiscal Year Ended January 3, 2009 Fourth Quarter $ 37...

-

Page 31

... Year Total Return

$200

$150

$100

$50

$0 Jan 3, 2004 Jan 1, 2005 Dec 31, 2005 Dec 30, 2006 Dec 29, 2007 Jan 3, 2009

Advance Auto Parts

S&P 500 Index

S&P 500 Specialty Retail Index

Company / Index Advance Auto Parts S&P 500 Index S&P 500 Specialty Retail Index

Jan 3, 2004 100 100 100

Jan...

-

Page 32

Fiscal Year 2008

(1)(2)

2007 2006 2005 (in thousands, except per share data)

2004

Statement of Operations Data: Net sales (3) Cost of sales Gross profit Selling, general and administrative expenses Operating income Interest expense Gain (loss) on extinguishment of debt Other income, net Income ...

-

Page 33

... Total commercial sales, as a percentage of total sales SG&A expenses per store (in 000s) (11)(12) Operating income per team member (in 000s) (13) Total store square footage, end of period Average net sales per store (in 000s) (12)(14) Average net sales per square foot(12)(15) Gross margin return...

-

Page 34

... operate in two reportable segments: Advance Auto Parts, or AAP, and Autopart International, or AI. The AAP segment is comprised of our store operations within the United States, Puerto Rico and the Virgin Islands which operate under the trade names "Advance Auto Parts," "Advance Discount Auto Parts...

-

Page 35

... strategic business assessments during fiscal 2007 and the formulation of key initiatives discussed below. In addition to our CEO, other new management leaders joined Advance in fiscal 2008 to work with existing leaders on developing and executing a turnaround plan. Fiscal 2008 Highlights Highlights...

-

Page 36

...We are developing a sales force to drive our Commercial business, another key component of the Commercial Acceleration strategy. We are increasing the number of Commercial account managers and equipping them with tools to acquire new customers and increase the volume of existing customers' purchases...

-

Page 37

.... We are committed to making the necessary investments to help ensure our long-term success. Store Development by Segment The following table sets forth the total number of new, closed and relocated stores and stores with Commercial delivery programs during fiscal 2008, 2007 and 2006. We lease...

-

Page 38

... of operations are based on these financial statements. The preparation of these financial statements requires the application of accounting policies in addition to certain estimates and judgments by our management. Our estimates and judgments are based on currently available information, historical...

-

Page 39

... year. Although the increase in self-insured reserves in fiscal 2008 is less than in fiscal 2007, the increase in the number of claims continues to be driven by overall growth, including an increase in total number of stores, employees and Commercial delivery vehicles. While we do not expect the...

-

Page 40

... of net sales may be affected by (i) variations in our product mix, (ii) price changes in response to competitive factors and fluctuations in merchandise costs, (iii) vendor programs, (iv) inventory shrinkage, (v) defective merchandise and warranty costs and (v) warehouse and distribution costs. We...

-

Page 41

... week and sales from 17 net new stores opened within the last year. We expect to experience similar trends during fiscal 2009 as we continue to realize benefits from our turnaround strategies partially offset by the continuation of a challenging macroeconomic environment. Gross Profit Gross profit...

-

Page 42

.... The net sales increase was due to an increase in comparable store sales of 0.8% and contributions from the 196 AAP and AI stores opened within the prior year. The comparable store sales increase was driven by an increase in average ticket sales and customer traffic in our Commercial business and...

-

Page 43

... with the transition to AI's new distribution center early in fiscal 2007 and the reinvestment of resources to accelerate AI's store growth and roll out of certain AI branded product. Interest Interest expense for fiscal 2007 was $34.8 million, or 0.7% of net sales, as compared to $36.0 million...

-

Page 44

... of business. We retired the 2010 store format and related remodel program during fiscal 2008. We also plan to make continued investments in the maintenance of our existing stores and logistics network as well as investing in new information systems to support our turnaround strategies, including...

-

Page 45

... merchandise vendors to a customer-managed services arrangement, or vendor program, entered into during the fourth quarter of fiscal 2008. Under this vendor program, a third party provides an accounts payable tracking system which facilitates participating suppliers' ability to finance our payment...

-

Page 46

... levels of inventory to support our parts availability initiative; and a $35.7 million increase in cash flows comprised of other movements in working capital, including the timing in payment of certain operating expenses.

Investing Activities For fiscal 2008, net cash used in investing activities...

-

Page 47

... to our customer-managed services arrangement; a reduction of $78.6 million in net borrowings primarily under our credit facilities; and a $7.3 million decrease in additional tax benefits associated with the decreased number of stock options exercised.

For fiscal 2007, net cash used in financing...

-

Page 48

.... Our open purchase orders are based on current inventory or operational needs and are fulfilled by our vendors within short periods of time. We currently do not have minimum purchase commitments under our vendor supply agreements nor are our open purchase orders for goods and services binding...

-

Page 49

...If our credit ratings decline, our access to financing may become more limited. New Accounting Pronouncements In June 2008, the Financial Accounting Standards Board, or FASB, issued FASB Staff Position, or FSP, EITF 03-6-1, "Determining Whether Instruments Granted in Share-Based Payment Transactions...

-

Page 50

...of SFAS 157 during the first quarter of fiscal 2009 and will not have a material impact on our financial position, results of operations or cash flows. In December 2007, the FASB issued SFAS No. 141R, "Business Combinations," which replaces SFAS No. 141, "Business Combinations." SFAS No. 141R, among...

-

Page 51

... rate Weighted average interest rate Interest rate swap: Variable to fixed Weighted average pay rate Weighted average receive rate

(1) (2)

(2)

Fiscal 2010 $ 2.6%

Fiscal Fiscal Fiscal 2011 2012 2013 (dollars in thousands) $ 451,500 3.3% $ $ -

Thereafter $ -

Total $ 451,500 2.5%

Fair Market...

-

Page 52

... that information required to be disclosed by us in our reports that we file or submit under the Securities Exchange Act of 1934 is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions...

-

Page 53

...Directors," "Corporate Governance," "Meetings and Committees of the Board," "Information Concerning Our Executive Officers," "Audit Committee Report," and "Section 16(a) Beneficial Ownership Reporting Compliance" in our proxy statement for the 2009 annual meeting of stockholders to be filed with the...

-

Page 54

... Statement Schedules. (a)(1) Financial Statements Audited Consolidated Financial Statements of Advance Auto Parts, Inc. and Subsidiaries for the years ended January 3, 2009, December 29, 2007 and December 30, 2006: Management's Report on Internal Control over Financial Reporting ...F-1 Reports of...

-

Page 55

...acquisition, use, or disposition of the Company's assets that could have a material effect on the financial statements. As of January 3, 2009, management, including the Company's principal executive officer and principal financial officer, assessed the effectiveness of the Company's internal control...

-

Page 56

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Advance Auto Parts, Inc. and Subsidiaries Roanoke, Virginia We have audited the accompanying consolidated balance sheets of Advance Auto Parts, Inc. and subsidiaries (the "Company") as of January 3, 2009 and December...

-

Page 57

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Advance Auto Parts, Inc. and Subsidiaries Roanoke, Virginia We have audited the internal control over financial reporting of Advance Auto Parts, Inc. and subsidiaries (the "Company") as of January 3, 2009, based on...

-

Page 58

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS January 3, 2009 and December 29, 2007 (in thousands, except per share data)

Assets Current assets: Cash and cash equivalents Receivables, net Inventories, net Other current assets Total current assets Property and equipment, net ...

-

Page 59

... AUTO PARTS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data)

2008

(53 weeks)

Fiscal Years 2007

(52 weeks)

2006

(52 weeks)

Net sales Cost of sales, including purchasing...

-

Page 60

... of stock options

Tax benefit from share-based compensation

Issuance of restricted stock, net of forfeitures

Amortization of restricted stock balance

Share-based compensation

Stock issued under employee stock purchase plan

Treasury stock purchased

Treasury stock retired

Cash dividends...

-

Page 61

... under credit facilities Payments on credit facilities Payment of debt related costs Proceeds from the issuance of common stock, primarily exercise of stock options Excess tax benefit from share-based compensation Repurchase of common stock Other Net cash used in financing activities Net increase...

-

Page 62

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS - (Continued) For the Years Ended January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands)

2008 (53 weeks) Supplemental cash flow information: Interest paid Income tax payments, net Non-cash transactions:...

-

Page 63

... automotive replacement parts, accessories and maintenance items for domestic and imported cars and light trucks. In addition, the Company operates 28 stores located in Puerto Rico and the Virgin Islands under the "Western Auto" and "Advance Auto Parts" trade names. Autopart International, or...

-

Page 64

...promotional incentives earned under long-term agreements as a reduction to cost of sales. However, these incentives are recognized based on the cumulative net purchases as a percentage of total estimated net purchases over the life of the agreement. The Company's margins could be impacted positively...

-

Page 65

...of the Company's vendors. However, the Company has an obligation to provide customers free replacement of merchandise or merchandise at a prorated cost if under a warranty and not covered by the manufacturer. Merchandise sold with warranty coverage by the Company primarily includes batteries but may...

-

Page 66

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data)

Share-Based Payments The Company provides share-based compensation to its employees and directors, ...

-

Page 67

... value. Significant factors, which would trigger an impairment review, include the following Significant decrease in the market price of a long-lived asset (asset group); Significant changes in how assets are used or are planned to be used; Significant adverse change in legal factors or business...

-

Page 68

... the Company pay taxes, maintenance, insurance and certain other expenses applicable to the leased premises. Management expects that in the normal course of business leases that expire will be renewed or replaced by other leases. Closed Store Liabilities The Company continually reviews the operating...

-

Page 69

... after the customer has special-ordered the merchandise; â- Self-insurance costs; â- Professional services; and â- Other administrative costs, such as credit card service fees, supplies, travel and lodging.

New Accounting Pronouncements In June 2008, the Financial Accounting Standards Board...

-

Page 70

...SFAS 157 during the first quarter of fiscal 2009 and will not have a material impact on the Company's financial position, results of operations or cash flows. In December 2007, the FASB issued SFAS No. 141R, "Business Combinations," which replaces SFAS No. 141, "Business Combinations." SFAS No. 141R...

-

Page 71

... did not have a material effect on the Company's financial position, results of operations or cash flows. 3. Inventories, net: Merchandise Inventory Inventories are stated at the lower of cost or market. The Company uses the LIFO method of accounting for approximately 95% and 93% of inventories...

-

Page 72

... of product sales and (iii) current market conditions. The Company provides reserves when less than full credit is expected from a vendor or when the liquidation of excess or obsolete inventory will result in retail prices below recorded costs. At the end of fiscal 2008, the Company reviewed its...

-

Page 73

... retail chain. During the first quarter of fiscal 2008, the Company acquired from a Kentucky entity for $1,750 the limited territorial rights the Kentucky entity had in the "Advance Auto Parts" trademark, ownership of certain websites and access to the Louisville, Kentucky market. This acquisition...

-

Page 74

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data)

5. Receivables, net: Receivables consist of the following: January 3, 2009 Trade Vendor Other Total ...

-

Page 75

... a recurring basis during the 2008 fiscal year, including at January 3, 2009:

Fair Value Measurements at Reporting Date Using Level 1 Level 2 Level 3 Quoted Prices in Active Markets for Identical Assets $ Significant Unobservable Inputs $ -

Fair Value at January 3, 2009 Interest rate swaps $ 21,979...

-

Page 76

... revolving credit facility is based, at the Company's option, on an adjusted LIBOR rate, plus a margin, or an alternate base rate, plus a margin. The current margin is 0.75% and 0.0% per annum for the adjusted LIBOR and alternate base rate borrowings, respectively. The Company has elected to use the...

-

Page 77

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data) Under the terms of the revolving credit facility, the interest rate (and commitment fee) is based on ...

-

Page 78

... of Position 98-1, "Accounting for the Cost of Computer Software Developed or Obtained for Internal Use," or SOP 98-1, during fiscal 2008, 2007 and 2006, respectively. These costs are included in the furniture, fixtures and equipment category above and are depreciated on the straight-line method...

-

Page 79

... on the open market or in privately negotiated transactions from time to time in accordance with the requirements of the Securities and Exchange Commission. During fiscal 2008, the Company repurchased 6,136 shares of its common stock at an aggregate cost of $216,470, or an average price of $35.28...

-

Page 80

...3, 2009 the entire amount of unrecognized tax benefits, if recognized, would reduce the Company's annual effective tax rate. The Company has chosen to provide for potential interest and penalties associated with uncertain tax positions as a part of income tax expense. During fiscal 2008, the Company...

-

Page 81

...provision (benefit) for income taxes from continuing operations differed from the amount computed by applying the federal statutory income tax rate due to: 2008 Income from continuing operations at statutory U.S. federal income tax rate (35%) State income taxes, net of federal income tax benefit Non...

-

Page 82

... expenses not currently deductible for tax Net operating loss carryforwards Other, net Total current deferred income tax assets (liabilities) Long-term deferred income tax assets (liabilities): Property and equipment Postretirement benefit obligation Share-based compensation Net operating loss...

-

Page 83

...one or more of these claims and was ordered to pay damages that were not covered by insurance, these claims could have a material adverse affect on its operating results, financial position and liquidity. If the number of claims filed against the Company or any of its subsidiaries alleging injury as...

-

Page 84

... and $4,668, respectively. Postretirement Plan The Company provides certain health and life insurance benefits for eligible retired Team Members through a postretirement plan, or Plan. These benefits are subject to deductibles, co-payment provisions and other limitations. The Plan has no assets and...

-

Page 85

... service and interest cost would have been a decrease of $12 for fiscal 2008. The postretirement benefit obligation and net periodic postretirement benefit cost was computed using the following weighted average discount rates as determined by the Company's actuaries for each applicable year:

2008...

-

Page 86

...the amount of the reported obligation, annual expense and projected benefit payments. 16. Share-Based Compensation: Overview The Company grants share-based compensation awards to its employees and members of its Board of Directors as provided for under its Long-Term Incentive Plan, or LTIP. Prior to...

-

Page 87

... annually related to the issuance of share-based compensation is included in Selling, general and administrative expense. The Company also receives cash upon the exercise of stock options, as well as when employees purchase stock under the employee stock purchase plan, or ESPP. Total sharebased...

-

Page 88

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data) Time-Based Share Awards Stock Appreciation Rights and Stock Options The fair value of each SAR and ...

-

Page 89

... the market price of the Company's common stock on the date of grant. The weighted average fair value of shares granted during the fiscal years ended January 3, 2009 and December 29, 2007 was $32.21 and $38.14 per share, respectively. The total grant date fair value of shares vested during 2008 was...

-

Page 90

...2008, which had been previously approved by shareholders. The Company issues new shares of common stock upon exercise of stock options and SARs. Employee Stock Purchase Plan The Company also offers an ESPP. Eligible Team Members may purchase the Company's common stock at 95% of its fair market value...

-

Page 91

... Company has the following two reportable segments: AAP and AI. The AAP segment is comprised of store operations within the United States, Puerto Rico and the Virgin Islands which operate under the trade names "Advance Auto Parts," "Advance Discount Auto Parts" and "Western Auto." These stores offer...

-

Page 92

...THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data)

2008 Net Sales AAP AI Total net sales Percentage of Sales, by Product Group in AAP Segment Parts Accessories Chemicals Oil Other Total

(1)

2007 $ 4,709...

-

Page 93

... 30, 2006 (in thousands, except per share data) 19. Quarterly Financial Data (unaudited): The following table summarizes quarterly financial data for fiscal years 2008 and 2007:

2008 Net sales Gross profit Income from continuing operations Net income Basic earnings per share Diluted earnings per...

-

Page 94

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Advance Auto Parts, Inc. and Subsidiaries Roanoke, Virginia We have audited the consolidated financial statements of Advance Auto Parts, Inc. and subsidiaries (the "Company") as of January 3, 2009 and December...

-

Page 95

ADVANCE AUTO PARTS, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT Condensed Parent Company Balance Sheets January 3, 2009 and December 29, 2007 (in thousands, except per share data)

January 3, 2009 Assets Cash and cash equivalents Other current assets Property and equipment, ...

-

Page 96

ADVANCE AUTO PARTS, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT Condensed Parent Company Statements of Operations For the Years Ended January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands, except per share data)

Fiscal Years 2007

(52 Weeks)

2008

(53 Weeks)

...

-

Page 97

ADVANCE AUTO PARTS, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT Condensed Parent Company Statements of Cash Flows For the Years Ended January 3, 2009, December 29, 2007 and December 30, 2006 (in thousands)

Fiscal Years 2007

(52 Weeks)

2008

(53 Weeks)

2006

(52 Weeks)

Cash ...

-

Page 98

... rules and regulations, although management believes that the disclosures made are adequate to make the information presented not misleading. 2. Organization Advance Auto Parts, Inc. ("the Company") is a holding company, which is the 100% shareholder of Advance Stores Company, Incorporated and its...

-

Page 99

ADVANCE AUTO PARTS, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT Notes to the Condensed Parent Company Statements December 29, 2007 and December 30, 2006 (in thousands, except per share data)

attempt to improve consistency between the useful life of a recognized intangible ...

-

Page 100

ADVANCE AUTO PARTS, INC. SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (in thousands)

Allowance for doubtful accounts receivable: December 30, 2006 December 29, 2007 January 3, 2009

(1)

Balance at Beginning of Period $ 4,686 4,640 3,987

Charges to Expenses $ 1,228 996 3,340

Deductions $ (1,274...

-

Page 101

...duly authorized.

Dated: March 3, 2009 ADVANCE AUTO PARTS, INC. By: /s/ Michael A. Norona Michael A. Norona

Executive Vice President, Chief Financial Officer and Secretary

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons...

-

Page 102

...Auto 2001 Stock Option Agreement for holders of Discount Auto Parts, Inc. ("Discount") fully converted options. 10.11(2) Purchase Agreement dated as of October 31, 2001 among Advance Stores, Advance Trucking Corporation, LARALEV, INC., Western Auto Supply Company, J.P. Morgan Securities Inc., Credit...

-

Page 103

... on Form S-4 (No. 333-81180) of Advance Stores Company, Incorporated. (4) Filed on April 2, 2001 as an exhibit to the Quarterly Report on Form 10-Q of Discount. (5) Filed on August 16, 2004 as an exhibit to the Quarterly Report on Form 10-Q of Advance Auto Parts, Inc. (6) Filed on May 20, 2004 as an...

-

Page 104

... Common Stock: Ticker Symbol AAP Listing New York Stock Exchange Independent Registered Public Accounting Firm: Deloitte & Touche LLP 901 East Byrd Street Richmond, Virginia 23219 SEC FORM 10-K: Stockholders may obtain free of charge a copy of Advance Auto Parts' Annual Report on Form 10-K as filed...

-

Page 105

-

Page 106