XM Radio 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

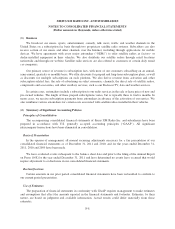

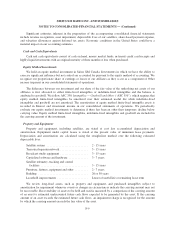

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

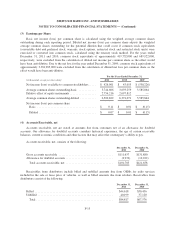

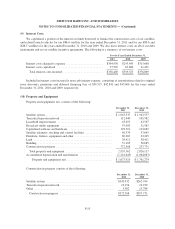

Goodwill and Other Intangible Assets

Goodwill represents the excess of the purchase price over the estimated fair value of net tangible and

identifiable intangible assets acquired in business combinations. Our annual impairment assessment of our single

reporting unit is performed as of October 1st of each year, and an assessment is performed at other times if events

or circumstances indicate it is more likely than not that the asset is impaired. Step one of the impairment

assessment compares the fair value of the entity to its carrying value and if the fair value exceeds its carrying

value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair value of goodwill is

compared to the carrying value of goodwill. If the implied fair value exceeds the carrying value then goodwill is

not impaired; otherwise, an impairment loss will be recorded by the amount the carrying value exceeds the

implied fair value. We did not record any impairments in 2011, 2010 or 2009.

The impairment test for other intangible assets not subject to amortization consists of a comparison of the

fair value of the intangible asset with its carrying value. This test is performed as of October 1st of each year, and

an assessment is performed at other times if events or circumstances indicate it is more likely than not that the

asset is impaired. Our indefinite life intangibles include FCC licenses and trademark. If the carrying value of the

intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that excess.

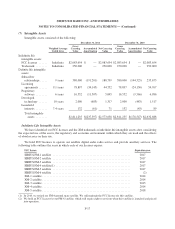

We use independent appraisals to assist in determining the fair value of our FCC licenses and trademark.

The income approach, which is commonly called the “Jefferson Pilot Method” or the “Greenfield Method”, has

been consistently used to estimate the fair value of our FCC licenses. This method attempts to isolate the income

that is properly attributable to the license alone (that is, apart from tangible and intangible assets and goodwill). It

is based upon modeling a hypothetical “Greenfield” build-up to a normalized enterprise that, by design, lacks

inherent goodwill and has essentially purchased (or added) all other assets as part of the build-up process. The

methodology assumes that, rather than acquiring such an operation as a going concern, the buyer would

hypothetically obtain a license at nominal cost and build a new operation with similar attributes from inception.

The significant assumption was that the hypothetical start up entity would begin its network build out phase at

the impairment testing date and revenues and variable costs would not be generated until the satellite network

was operational, approximately five years from inception. The Relief from Royalty method valuation approach

was utilized to value our trademark. This methodology involves the estimation of an amount of hypothetical

royalty income that could be generated if the asset was licensed to an independent, third-party owner. The value

of the intangible is the present value of the prospective stream of hypothetical royalty income that would be

generated over the useful life of the asset. We did not record any impairments in 2011, 2010 or 2009.

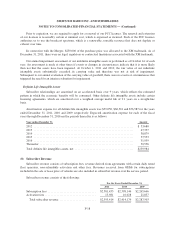

Other intangible assets with finite lives consists primarily of customer relationships acquired in business

combinations, licensing agreements, and certain IT related costs. These assets are amortized over their respective

estimated useful lives to their estimated residual values, and reviewed for impairment under the provisions of

ASC 360-10-35, Property, Plant and Equipment/Overall/Subsequent Measurement. We review intangible assets

subject to amortization for impairment whenever events or circumstances indicate that the carrying amount of an

asset may not be recoverable. If the sum of the expected cash flows, undiscounted and without interest, is less

than the carrying amount of the asset, an impairment loss is recognized as the amount by which the carrying

amount of the asset exceeds its fair value. We did not record any impairments in 2011, 2010 or 2009.

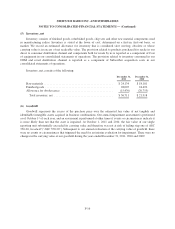

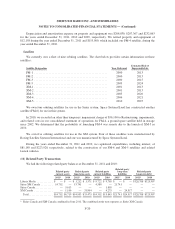

Revenue Recognition

We derive revenue primarily from subscribers, advertising and direct sales of merchandise. Revenue from

subscribers consists of subscription fees; revenue derived from our agreements with daily rental fleet programs;

and non-refundable activation and other fees. Revenue is recognized as it is realized or realizable and earned.

We recognize subscription fees as our services are provided.

F-10