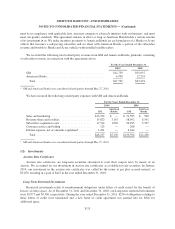

XM Radio 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Sirius Canada

We had an equity interest of 49.9% in Sirius Canada until June 21, 2011 when the transaction between XM

Canada and Sirius Canada closed. Our investment balance was zero as of December 31, 2010 as our investment

balance was absorbed by our share of net losses generated by Sirius Canada.

In 2005, we entered into a license and services agreement with Sirius Canada. Pursuant to such agreement,

we are reimbursed for certain costs incurred to provide Sirius Canada service, including certain costs incurred for

the production and distribution of radios, as well as information technology support costs. In consideration for

the rights granted pursuant to this license and services agreement, we have the right to receive a royalty equal to

a percentage of Sirius Canada’s gross revenues based on subscriber levels (ranging between 5% to 15%) and the

number of Canadian-specific channels made available to Sirius Canada.

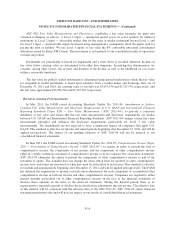

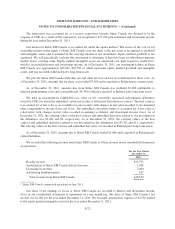

We recorded the following revenue from Sirius Canada. Royalty income is included in other revenue and

dividend income is included in Interest and investment income (loss) in our consolidated statements of

operations:

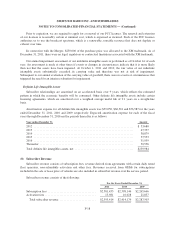

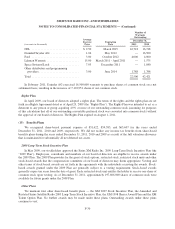

For the Years Ended December 31,

2011* 2010 2009

Royalty income ........................................ $ 9,945 $10,684 $5,797

Dividend income ....................................... 460 926 839

Total revenue from Sirius Canada ....................... $10,405 $11,610 $6,636

* Sirius Canada combined with XM Canada in June 2011.

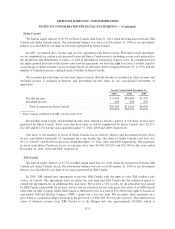

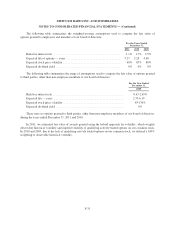

Receivables from royalty and dividend income were utilized to absorb a portion of our share of net losses

generated by Sirius Canada. Total costs that have been or will be reimbursed by Sirius Canada were $5,253,

$12,185 and $11,031 for the years ended December 31, 2011, 2010 and 2009, respectively.

Our share of net earnings or losses of Sirius Canada was recorded to Interest and investment income (loss)

in our consolidated statements of operations on a one month lag. Our share of Sirius Canada’s net loss was

$9,717, $10,257 and $6,636 for the years ended December 31, 2011, 2010 and 2009, respectively. The payments

received from Sirius Canada in excess of carrying value were $6,748, $10,281 and $13,738 for the years ended

December 31, 2011, 2010 and 2009, respectively.

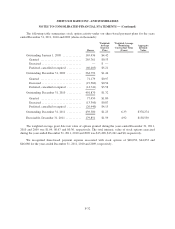

XM Canada

We had an equity interest of 21.5% in XM Canada until June 21, 2011 when the transaction between XM

Canada and Sirius Canada closed. Our investment balance was zero as of December 31, 2010 as our investment

balance was absorbed by our share of net losses generated by XM Canada.

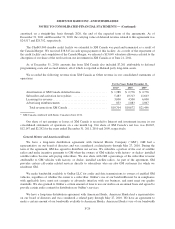

In 2005, XM entered into agreements to provide XM Canada with the right to offer XM satellite radio

service in Canada. The agreements have an initial ten year term and XM Canada has the unilateral option to

extend the agreements for an additional five year term. We receive a 15% royalty for all subscriber fees earned

by XM Canada each month for its basic service and an activation fee for each gross activation of an XM Canada

subscriber on XM’s system. Sirius XM Canada is obligated to pay us a total of $70,300 for the rights to broadcast

and market National Hockey League (“NHL”) games for a ten year term. We recognize these payments on a

gross basis as a principal obligor pursuant to the provisions of ASC 605, Revenue Recognition. The estimated fair

value of deferred revenue from XM Canada as of the Merger date was approximately $34,000, which is

F-23