XM Radio 2011 Annual Report Download - page 75

Download and view the complete annual report

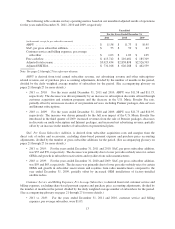

Please find page 75 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.if events or circumstances indicate it is more likely than not that the asset is impaired. Step one of the impairment

assessment compares the fair value of the entity to its carrying value and if the fair value exceeds its carrying

value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair value of goodwill is

compared to the carrying value of goodwill; an impairment loss will be recorded for the amount the carrying

value exceeds the implied fair value. At October 1, 2011, the fair value of our single reporting unit substantially

exceeded its carrying value and therefore was not at risk of failing step one of ASC 350-20, Goodwill (“ASC

350-20”). Subsequent to our annual evaluation of the carrying value of goodwill, there were no events or

circumstances that triggered the need for an interim evaluation for impairment. As a result, there were no

changes in the carrying value of our goodwill during the years ended December 31, 2011 and 2010.

Long-Lived and Indefinite-Lived Assets. We carry our long-lived assets at cost less accumulated

amortization and depreciation. We review our long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset is not recoverable. At the time an impairment in the

value of a long-lived asset is identified, the impairment is measured as the amount by which the carrying amount

of a long-lived asset exceeds its fair value.

Our annual impairment assessment of indefinite-lived assets, our FCC licenses and trademark, is performed

as of October 1st of each year and an assessment is made at other times if events or changes in circumstances

indicate that it is more likely than not that the asset is impaired. To determine fair value, we employ an expected

present value technique, which utilizes multiple cash flow scenarios for the FCC licenses and trademark that

reflect the range of possible outcomes and an appropriate discount rate.

We use independent appraisals to assist in determining the fair value of our FCC licenses and trademark.

The income approach, which is commonly called the “Jefferson Pilot Method” or the “Greenfield Method”, has

been consistently used to estimate the fair value of our FCC licenses. This method attempts to isolate the income

that is properly attributable to the license alone (that is, apart from tangible and intangible assets and goodwill). It

is based upon modeling a hypothetical “Greenfield” build-up to a normalized enterprise that, by design, lacks

inherent goodwill and has essentially purchased (or added) all other assets as part of the build-up process. The

methodology assumes that, rather than acquiring such an operation as a going concern, the buyer would

hypothetically obtain a license at nominal cost and build a new operation with similar attributes from inception.

The significant assumption was that the hypothetical start up entity would begin its network build out phase at

the impairment testing date and revenues and variable costs would not be generated until the satellite network

was operational, approximately five years from inception. The “Relief from Royalty” method valuation approach

was utilized to value our trademark. This methodology involves the estimation of an amount of hypothetical

royalty income that could be generated if the asset was licensed from an independent, third-party owner. The

value of the intangible is the present value of the prospective stream of hypothetical royalty income that would be

generated over the useful life of the asset.

At October 1, 2011, the fair value of our FCC licenses and trademark substantially exceeded the carrying

value and therefore was not at risk of impairment. Subsequent to our annual evaluation of the carrying value of

our long-lived assets, there were no events or circumstances that triggered the need for an interim impairment

evaluation.

There were no changes in the carrying value of our indefinite life intangible assets during the years ended

December 31, 2011 and 2010.

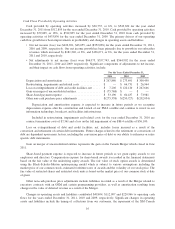

Useful Life of Broadcast/Transmission System. Our satellite system includes the costs of our satellite

construction, launch vehicles, launch insurance, capitalized interest, spare satellite, terrestrial repeater network

and satellite uplink facilities. We monitor our satellites for impairment whenever events or changes in

circumstances indicate that the carrying amount of the asset is not recoverable.

We currently expect our first two in-orbit Sirius satellites launched in 2000 to operate effectively through

2013, our FM-3 satellite, which was also launched in 2000, to operate effectively through 2015, and our FM-5

satellite, launched in 2009, to operate effectively through 2024. In December 2010, we recorded an other than

19