XM Radio 2011 Annual Report Download - page 34

Download and view the complete annual report

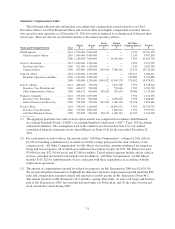

Please find page 34 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.total compensation that may be awarded to the officer, including salary, annual bonus, long-term incentives,

perquisites and other benefits. In addition, the Compensation Committee considers the other benefits to which the

officer is entitled under his or her employment agreement, including compensation payable upon termination of

employment. (The named executive officers are employed pursuant to agreements described under “Potential

Payments upon Termination or Change-in-Control — Employment Agreements” below.)

Executive Compensation Elements

Our practices with respect to the primary compensation elements identified above, as well as other elements

of compensation, are described below, followed by a discussion of the specific factors considered in determining

key compensation elements for the named executive officers for 2011.

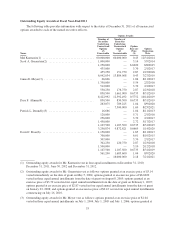

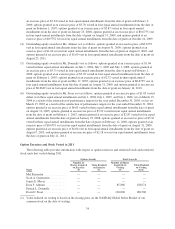

Base Salary

Base salaries for named executive officers are determined consistent with their employment agreements.

The minimum salaries set forth in the employment agreements and any increases over these salaries are

determined by the Compensation Committee based on a variety of factors, including:

• the nature and responsibility of the position and, to the extent available and deemed relevant, salary

norms for persons in similar positions at comparable companies;

• the expertise and past performance of the individual executive;

• the executive’s salary history and his or her total compensation, including other cash bonus and stock-

based awards;

• the competitiveness of the market for the executive’s services; and

• the recommendations of our Chief Executive Officer (except as to his own compensation).

In setting base salaries, the Compensation Committee also considers the percent of base salary as a

percentage of total compensation with the goal that a substantial percentage of each executive officer’s total

compensation should be performance-based.

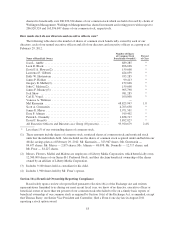

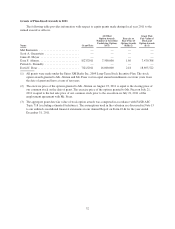

Annual Bonus

The Compensation Committee may award annual bonuses in cash, restricted stock, restricted stock units,

stock options or a combination thereof. The Compensation Committee believes that bonuses should take into

consideration all factors relevant to the Company’s and an executive’s performance, including numerous

financial and operational metrics, without being limited by a purely formulaic approach. None of our named

executive officers is entitled to a guaranteed or minimum bonus.

The bonuses approved by the Compensation Committee for 2011 were intended to achieve two principal

objectives:

• to link compensation with performance that enhances stockholder value, as measured at the Company and

individual levels; and

• to reward our named executive officers based on individual performance and contributions to the

Company.

In developing the compensation packages for the named executive officers, the Compensation Committee

considered the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code

(“Section 162(m)”). Section 162(m) generally disallows a tax deduction for compensation that is payable to the

chief executive officer or any of the next three most highly compensated executive officers (other than our Chief

Financial Officer) to the extent that the compensation for any such individual exceeds $1 million in any taxable

year. However, this deduction limitation does not apply to compensation that is “performance-based” under

Section 162(m).

24