XM Radio 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

under the Sirius XM Plan vest at a rate of 33

1

⁄

3

% for each year of employment and are fully vested after three

years of employment for all current and future contributions. Share-based payment expense resulting from the

matching contribution to the Sirius XM Plan was $3,041, $2,356 and $2,895 for the years ended December 31,

2011, 2010 and 2009, respectively.

We may also elect to contribute to the profit sharing portion of the Sirius XM Plan based upon the total

eligible compensation of eligible participants. These additional contributions in the form of shares of common

stock are determined by the compensation committee of our board of directors. Employees are only eligible to

receive profit-sharing contributions during any year in which they are employed on the last day of the year. We

did not contribute to the profit sharing portion of the Sirius XM Plan in 2011, 2010 or 2009.

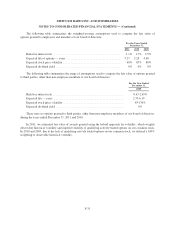

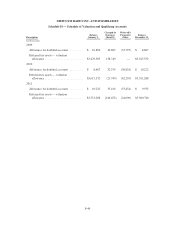

(16) Income Taxes

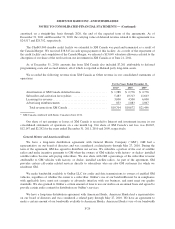

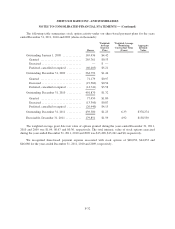

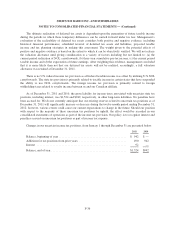

Our income tax expense consisted of the following:

For the Years Ended December 31,

2011 2010 2009

Current taxes:

Federal ....................................................... $ — $ — $ —

State ......................................................... 3,229 942 —

Foreign ...................................................... 2,741 1,370 1,622

Total current taxes .............................................. 5,970 2,312 1,622

Deferred taxes:

Federal ....................................................... 3,991 4,163 3,962

State ......................................................... 4,273 (1,855) 397

Total deferred taxes ............................................. 8,264 2,308 4,359

Total income tax expense ........................................ $14,234 $ 4,620 $5,981

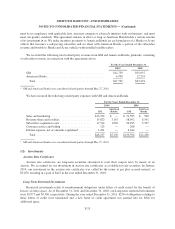

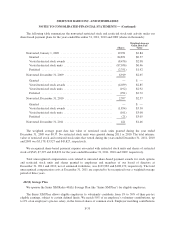

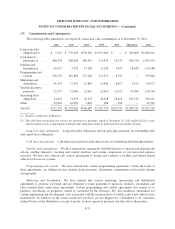

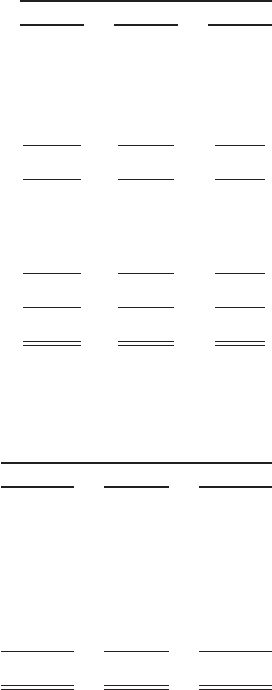

The following table indicates the significant elements contributing to the difference between the federal tax

expense (benefit) at the statutory rate and at our effective rate:

For the Years Ended December 31,

2011 2010 2009

Federal tax expense (benefit), at statutory rate ...................... $154,418 $ 16,678 $(117,883)

State income tax expense (benefit), net of federal benefit ............. 15,751 1,620 (11,788)

State rate changes ............................................ 3,851 (2,252) —

Non-deductible expenses ...................................... 457 4,130 1,849

Other, net .................................................. 6,209 6,193 (4,945)

Change in valuation allowance .................................. (166,452) (21,749) 138,748

Income tax expense ........................................... $ 14,234 $ 4,620 $ 5,981

F-34