XM Radio 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

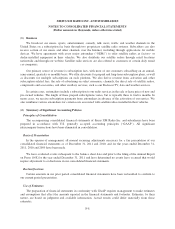

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

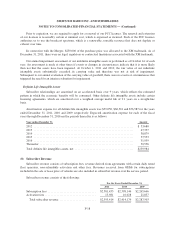

Significant estimates inherent in the preparation of the accompanying consolidated financial statements

include revenue recognition, asset impairment, depreciable lives of our satellites, share-based payment expense,

and valuation allowances against deferred tax assets. Economic conditions in the United States could have a

material impact on our accounting estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, money market funds, in-transit credit card receipts and

highly liquid investments with an original maturity of three months or less when purchased.

Equity Method Investments

We hold an equity method investment in Sirius XM Canada. Investments in which we have the ability to

exercise significant influence but not control are accounted for pursuant to the equity method of accounting. We

recognize our proportionate share of earnings or losses of our affiliates as they occur as a component of Other

income (expense) in our consolidated statements of operations.

The difference between our investment and our share of the fair value of the underlying net assets of our

affiliates is first allocated to either finite-lived intangibles or indefinite-lived intangibles and the balance is

attributed to goodwill. We follow ASC 350, Intangibles — Goodwill and Other (“ASC 350”), which requires that

equity method finite-lived intangibles be amortized over their estimated useful life while indefinite-lived

intangibles and goodwill are not amortized. The amortization of equity method finite-lived intangible assets is

recorded in Interest and investment income in our consolidated statements of operations. We periodically

evaluate our equity method investments to determine if there has been an other than temporary decline below

carrying value. Equity method finite-lived intangibles, indefinite-lived intangibles and goodwill are included in

the carrying amount of the investment.

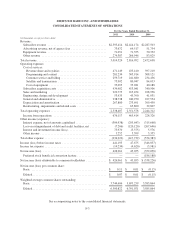

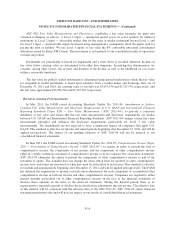

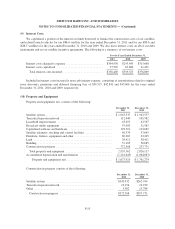

Property and Equipment

Property and equipment, including satellites, are stated at cost less accumulated depreciation and

amortization. Equipment under capital leases is stated at the present value of minimum lease payments.

Depreciation and amortization are calculated using the straight-line method over the following estimated

depreciable lives:

Satellite system ............................ 2-15years

Terrestrial repeater network ................... 5-15years

Broadcast studio equipment ................... 3-15years

Capitalized software and hardware ............. 3-7years

Satellite telemetry, tracking and control

facilities ................................ 3-15years

Furniture, fixtures, equipment and other ......... 2-7years

Building .................................. 20or30years

Leasehold improvements ..................... Lesser of useful life or remaining lease term

We review long-lived assets, such as property and equipment, and purchased intangibles subject to

amortization for impairment whenever events or changes in circumstances indicate the carrying amount may not

be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount

of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying

amount of an asset exceeds the estimated future cash flows, an impairment charge is recognized for the amount

by which the carrying amount exceeds the fair value of the asset.

F-9