XM Radio 2011 Annual Report Download - page 35

Download and view the complete annual report

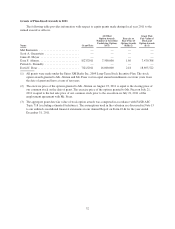

Please find page 35 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2011, the Compensation Committee adopted a bonus program under our 2009 Long-Term Stock

Incentive Plan, where the awards made under this bonus program were intended to qualify for the performance-

based exception under Section 162(m) (the “NEO Bonus Plan”). Pursuant the NEO Bonus Plan, a bonus pool

was established for our Chief Executive Officer and the four most highly compensated executive officers, other

than our Chief Financial Officer, consisting of 2.75% of our EBITDA, calculated in accordance with generally

accepted accounting principles. The maximum bonus that a named executive officer could receive under the

NEO Bonus Plan was (i) limited by the percentages set forth below (which percentages were not changed during

the performance year); and (ii) could not exceed the cash equivalent of 120 million shares (based on our share

price as of the end of 2011). In addition, (i) no amounts could be paid under the NEO Bonus Plan unless a

threshold amount of EBITDA was achieved for 2011, and (ii) the Compensation Committee retained the ability

to exercise its negative discretion to award bonuses in amounts less than the maximum percentages listed below:

Chief Executive Officer .................................................. 40%

President, Operations and Sales ............................................ 20%

President and Chief Content Officer ......................................... 20%

General Counsel ........................................................ 15%

Chief Administrative Officer .............................................. 5%

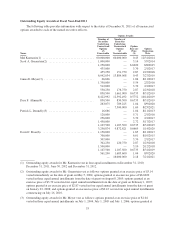

After the end of the year, the Compensation Committee evaluated our actual performance against a set of

guidelines, including a variety of key operating metrics included in our budget and business plan for 2011. As

part of such evaluation, the Compensation Committee considered several metrics, including our increase in

subscribers, revenue, adjusted EBITDA and free cash flow; our results in controlling subscriber churn and

operating expenses; the introduction of new products and services during the year; and additional

accomplishments and other factors the Compensation Committee deemed relevant. The Compensation

Committee did not weigh the metrics it considered as part of its evaluation of our performance. In addition, for

named executive officers (other than himself), our Chief Executive Officer recommended to the Compensation

Committee individual bonus amounts, taking into account the responsibilities and contributions of each

individual during the year, our performance and the percentage limits contained in the NEO Bonus Plan. These

amounts were reviewed and discussed with the Compensation Committee by our Chief Executive Officer and,

following consideration by the Compensation Committee, the Compensation Committee approved the amounts

while exercising its negative discretion regarding the permitted percentage limits set forth in the NEO Bonus

Plan. For our Chief Executive Officer, the Compensation Committee reviewed his performance for the year,

determined that he should receive a bonus and determined the bonus amount, while exercising its negative

discretion regarding the permitted percentage limits contained in the NEO Bonus Plan. The Compensation

Committee determined that the bonuses to our named executive officers would be paid solely in cash. The bonus

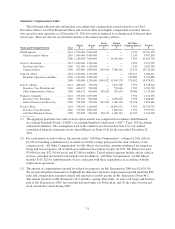

awards to our named executive officers are described below under “Fiscal Year 2011 Pay Implications —

Payment of Performance-Based Discretionary Annual Bonuses for 2011” and are reflected in the Summary

Compensation Table.

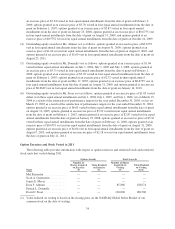

Long-term Incentive Compensation

The Compensation Committee grants long-term incentive awards in the form of stock options to directly

align compensation for our named executive officers over a multi-year period with the interests of our

stockholders by motivating and rewarding actions that enhance long-term stockholder value. The Compensation

Committee determines the level of long-term incentive compensation based on an evaluation of competitive

factors in conjunction with total compensation provided to named executive officers and the objectives of the

above-described compensation program.

Stock options have an exercise price equal to the market price on the date of grant, and therefore provide

value to the executives if the executives create value for our stockholders. In addition, stock options generally

vest over a period of four years and are generally subject to the executive’s continued employment, which

incentivizes the executives to sustain increases in stockholder value over extended periods of time. The specific

25