XM Radio 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

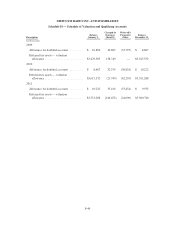

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

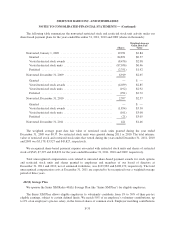

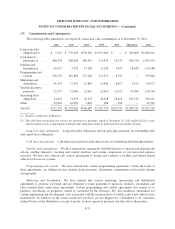

Satellite incentive payments. Boeing Satellite Systems International, Inc., the manufacturer of four of

XM’s in-orbit satellites, may be entitled to future in-orbit performance payments with respect to two of XM’s

satellites. As of December 31, 2011, we have accrued $27,925 related to contingent in-orbit performance

payments for XM-3 and XM-4 based on expected operating performance over their fifteen year design life.

Boeing may also be entitled to an additional $10,000 if XM-4 continues to operate above baseline specifications

during the five years beyond the satellite’s fifteen-year design life.

Space Systems/Loral, may be entitled to future in-orbit performance payments. As of December 31, 2011,

we have accrued $10,709 and $21,450 related to contingent performance payments for FM-5 and XM-5,

respectively, based on expected operating performance over their fifteen-year design life.

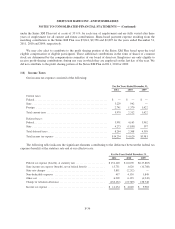

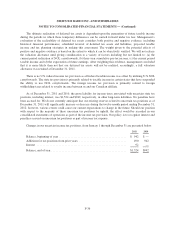

Operating lease obligations. We have entered into cancelable and non-cancelable operating leases for

office space, equipment and terrestrial repeaters. These leases provide for minimum lease payments, additional

operating expense charges, leasehold improvements and rent escalations that have initial terms ranging from one

to fifteen years, and certain leases that have options to renew. The effect of the rent holidays and rent concessions

are recognized on a straight-line basis over the lease term, including reasonably assured renewal periods. Total

rent recognized in connection with leases for the years ended December 31, 2011, 2010 and 2009 was $34,143,

$36,652 and $44,374, respectively.

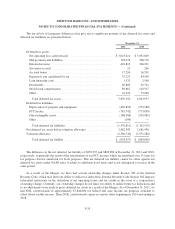

Other. We have entered into various agreements with third parties for general operating purposes. In

addition to the minimum contractual cash commitments described above, we have entered into agreements with

other variable cost arrangements. These future costs are dependent upon many factors, including subscriber

growth, and are difficult to anticipate; however, these costs may be substantial. We may enter into additional

programming, distribution, marketing and other agreements that contain similar variable cost provisions.

We do not have any other significant off-balance sheet financing arrangements that are reasonably likely to

have a material effect on our financial condition, results of operations, liquidity, capital expenditures or capital

resources.

Legal Proceedings

In the ordinary course of business, we are a defendant in various lawsuits and arbitration proceedings,

including derivative actions; actions filed by subscribers, both on behalf of themselves and on a class action

basis; former employees; parties to contracts or leases; and owners of patents, trademarks, copyrights or other

intellectual property. Our significant legal proceedings are discussed under Item 3, Legal Proceedings, in Part I

of the Annual Report on Form 10-K for the Year ended December 31, 2011.

F-38