XM Radio 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Depreciation and Amortization represents the systematic recognition in earnings of the acquisition cost of

assets used in operations, including our satellite constellations, property, equipment and intangible assets, over

their estimated service lives.

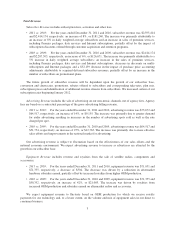

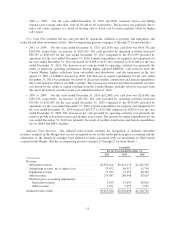

•2011 vs. 2010: For the years ended December 31, 2011 and 2010, depreciation and amortization

expense was $267,880 and $273,691, respectively, a decrease of 2%, or $5,811, and decreased as a

percentage of total revenue. The decrease was primarily due to a reduction in the amortization of

subscriber relationships, partially offset by depreciation recognized on additional assets placed in service.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, depreciation and amortization

expense was $273,691 and $309,450, respectively, a decrease of 12%, or $35,759, and decreased as a

percentage of total revenue. The decrease was primarily due to a $38,136 reduction in the depreciation of

acquired satellite constellation and amortization of subscriber relationships, partially offset by

depreciation recognized on additional assets placed in-service.

We expect depreciation expenses to increase in future periods as we complete construction and launch our

FM-6 satellite, which will be partially offset by reduced amortization associated with the stepped-up basis in

assets acquired in the Merger (including intangible assets, satellites, property and equipment) through the end of

their estimated service lives, principally through 2017.

Restructuring, Impairments and Related Costs represents charges related to the re-organization of our staff

and restructuring of contracts, as well as charges related to the impairment of assets when those costs are deemed

to provide no future benefit.

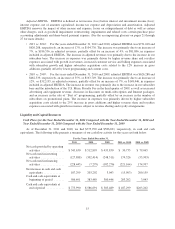

•2011 vs. 2010: In 2011, we did not record any restructuring, impairments, and related costs. For the

year ended December 31, 2010, restructuring, impairments and related costs were $63,800 primarily due

to the impairment of our FM-4 satellite as a result of the launch of XM-5 in 2010, and contract

terminations.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, restructuring, impairments and

related costs were $63,800 and $32,807, respectively, an increase of 94%, or $30,993. The increase was

primarily due to the impairment of our FM-4 satellite as a result of the launch of XM-5 in 2010, and

contract termination costs in the year ended December 31, 2010 compared to losses incurred on

capitalized installment payments which were expected to provide no future benefit due to the

counterparty’s bankruptcy filing in the year ended December 31, 2009.

Other Income (Expense)

Interest Expense, Net of Amounts Capitalized, includes interest on outstanding debt, reduced by interest

capitalized in connection with the construction of our satellites and related launch vehicles.

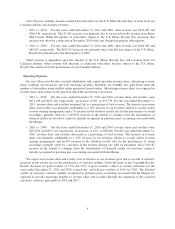

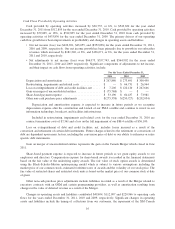

•2011 vs. 2010: For the years ended December 31, 2011 and 2010, interest expense was $304,938 and

$295,643, respectively, an increase of 3%, or $9,295. The increase was primarily due to lower capitalized

interest related to the construction of our satellites and related launch vehicles, partially offset by the mix

of outstanding debt with lower interest rates.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, interest expense was $295,643 and

$315,668, respectively, a decrease of 6%, or $20,025. The decrease was primarily due to decreases in the

weighted average interest rate on our outstanding debt in the year ended December 31, 2010 compared to

the year ended December 31, 2009 and the redemption of XM’s 10% Senior PIK Secured Notes due 2011

on June 1, 2010.

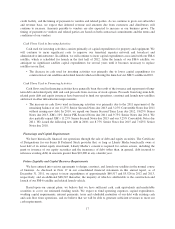

Following the launch of our FM-6 satellite, which is anticipated during the first half of 2012, the

capitalization of interest expense related to the construction of our satellites and related launch vehicles will be

eliminated. As a result, we expect interest expense to increase, offset partially as our outstanding debt declines

due to retirements at maturity, redemptions and repurchases.

8