XM Radio 2011 Annual Report Download - page 30

Download and view the complete annual report

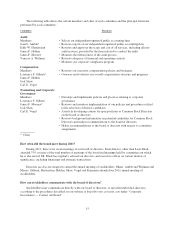

Please find page 30 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with the review and approval or ratification of a related person transaction, management must:

• disclose to the committee or disinterested directors, as applicable, the material terms of the related person

transaction, including the approximate dollar value of the amount involved in the transaction, and all the

material facts as to the related person’s direct or indirect interest in, or relationship to, the related person

transaction;

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

complies with the terms of our agreements governing our material outstanding indebtedness that limit or

restrict our ability to enter into a related person transaction;

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

will be required to be disclosed in our SEC filings. To the extent required to be disclosed, management

must ensure that the related person transaction is disclosed in accordance with SEC rules; and

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

constitutes a “personal loan” for purposes of Section 402 of the Sarbanes-Oxley Act of 2002.

In addition, the related person transaction policy provides that the Compensation Committee, in connection

with any approval or ratification of a related person transaction involving a non-employee director or director

nominee, should consider whether such transaction would compromise the director or director nominee’s status

as an “independent,” “outside,” or “non-employee” director, as applicable, under the rules and regulations of the

SEC, NASDAQ and Internal Revenue Code.

In 2011, there were no related party transactions that are required to be disclosed pursuant to the SEC rules

and regulations.

Relationship with Liberty Media

In February and March 2009, we entered into several transactions to borrow up to $530 million from Liberty

Media Corporation and its affiliates. All of the loans made were repaid during 2009 in cash from the proceeds of

notes issued by us and XM.

As part of the transactions with Liberty Media, on February 17, 2009, we entered into an investment

agreement (the “Investment Agreement”) with Liberty Radio, LLC, an indirect wholly-owned subsidiary of

Liberty Media Corporation. Pursuant to the Investment Agreement, we issued to Liberty Radio, LLC

12,500,000 shares of convertible preferred stock with a liquidation preference of $0.001 per share in partial

consideration for the loan investments described herein. The preferred stock is convertible into approximately

40% of our outstanding shares of common stock (after giving effect to such conversion).

The rights, preferences and privileges of the preferred stock are set forth in the Certificate of Designations

of Convertible Perpetual Preferred Stock, Series B-1 (the “Certificate of Designations”), filed with the Secretary

of State of the State of Delaware. The holder of our preferred stock is entitled to appoint a proportionate number

of our board of directors based on its ownership levels from time to time. The Certificate of Designations also

provides that so long as at least 6,250,000 shares of Series B-1 Preferred Stock are outstanding, we need the

consent of the holder of the Series B-1 Preferred Stock for certain actions, including:

• the grant or issuance of our equity securities;

• any merger or consolidation, or any sale of all or substantially all of our assets;

• any acquisition or disposition of assets other than in the ordinary course of business above certain

thresholds;

• the incurrence of debt in amounts greater than a stated threshold;

• engaging in a business different than the business currently conducted by us; and

20