XM Radio 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

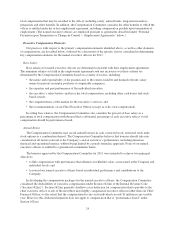

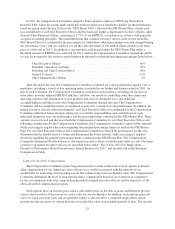

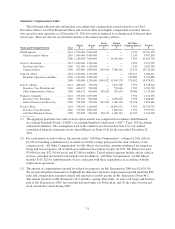

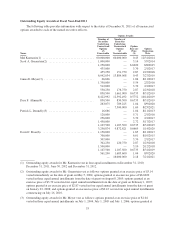

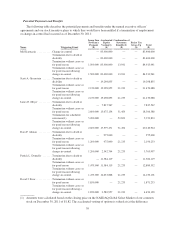

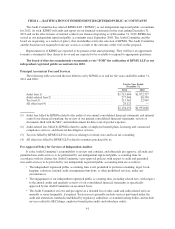

Summary Compensation Table

The following table provides information concerning total compensation earned or paid to our Chief

Executive Officer, our Chief Financial Officer and our four other most highly compensated executive officers

who served in such capacities as of December 31, 2011 for services rendered to us during each of the past three

fiscal years. These six officers are referred to herein as the named executive officers.

Name and Principal Position Year

Salary

$

Bonus

$

Stock

Awards(1)

$

Option

Awards(1)

$

All Other

Compensation(2)

$

Total(3)

$

Mel Karmazin ...................... 2011 1,500,000 9,200,000 — — 7,350 10,707,350

Chief Executive Officer 2010 1,500,000 8,400,000 — — 7,350 9,907,350

2009 1,250,000 7,000,000 — 35,209,440 7,350 43,466,790

Scott A. Greenstein .................. 2011 1,000,000 1,250,000 — — 7,350 2,257,350

President and Chief

Content Officer

2010 925,000 1,150,000 — — 7,350 2,082,350

2009 850,000 1,000,000 850,035 7,986,116 27,134 10,713,285

James E. Meyer ..................... 2011 1,100,000 1,750,000 — — 236,221 3,086,221

President, Operations and Sales 2010 1,100,000 1,500,000 — — 159,888 2,759,888

2009 950,000 1,250,000 1,000,022 11,500,278 176,632 14,876,932

Dara F. Altman ...................... 2011 465,666 775,000 — 7,470,308 7,350 8,718,324

Executive Vice President and

Chief Administrative Officer

2010 446,332 700,000 — 750,046 7,350 1,903,728

2009 446,332 600,000 500,029 750,139 19,006 2,315,506

Patrick L. Donnelly .................. 2011 575,000 1,050,000 — — 7,350 1,632,350

Executive Vice President,

General Counsel and Secretary

2010 573,301 900,000 — 6,000,000 7,350 7,480,651

2009 525,000 750,000 600,020 1,000,336 21,328 2,896,684

David J. Frear ....................... 2011 795,833 1,100,000 — 18,895,552 7,350 20,798,735

Executive Vice President

and Chief Financial Officer

2010 750,000 1,000,000 — 1,600,022 7,350 3,357,372

2009 750,000 850,000 700,012 1,000,336 23,650 3,323,998

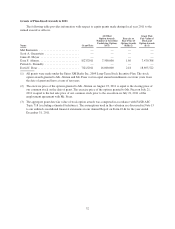

(1) The aggregate grant date fair value of stock option awards was computed in accordance with Financial

Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 718 (excluding

estimated forfeitures). The assumptions used in the valuation are discussed in Note 15 to our audited

consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31,

2011.

(2) For each named executive officer, the amount in the “All Other Compensation” column for 2011 reflects

$7,350 of matching contributions by us under our 401(k) savings plan paid in the form of shares of our

common stock. “All Other Compensation” for Mr. Meyer also includes amounts reimbursed for temporary

living and travel expenses, all of which are reimbursed based upon receipts. In 2011, Mr. Meyer was paid

$70,000 for rent, $52,309 for travel and $5,240 for utilities. Travel-related expenses include airfare, taxi/car

services, and other incidental travel-related costs. In addition, “All Other Compensation” for Mr. Meyer

includes $101,322 for reimbursement of taxes associated with these expenditures in accordance with his

employment agreement.

(3) The amount of compensation reported for federal tax purposes for Mr. Karmazin in 2009 was $1,620,316.

We are providing this information to highlight the difference between compensation reported under the SEC

rules and compensation amounts realized and reported as taxable income on Mr. Karmazin’s Form W-2.

The amount reported on Mr. Karmazin’s W-2 includes, among other items: (1) total cash wages and bonuses

paid to Mr. Karmazin in 2009, less amounts deferred under our 401(k) plan, and (2) the value of restricted

stock awards that vested during 2009.

31