XM Radio 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.credit facility, and the timing of payments to vendors and related parties. As we continue to grow our subscriber

and revenue base, we expect that deferred revenue and amounts due from customers and distributors will

continue to increase. Amounts payable to vendors are also expected to increase as our business grows. The

timing of payments to vendors and related parties are based on both contractual commitments and the terms and

conditions of our vendors.

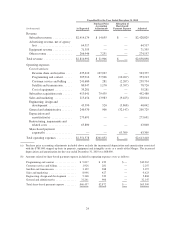

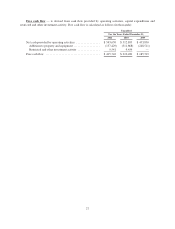

Cash Flows Used in Investing Activities

Cash used for investing activities consists primarily of capital expenditures for property and equipment. We

will continue to incur significant costs to improve our terrestrial repeater network and broadcast and

administrative infrastructure. In addition, we will continue to incur capital expenditures associated with our FM-6

satellite, which is scheduled for launch in the first half of 2012. After the launch of our FM-6 satellite, we

anticipate no significant satellite capital expenditures for several years until it becomes necessary to replace

satellites in our fleet.

• The decrease in cash used for investing activities was primarily due to lower capital expenditures for

construction of our satellites and related launch vehicles following the launch of our XM-5 satellite in 2010.

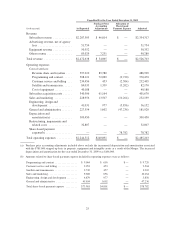

Cash Flows Used in Financing Activities

Cash flows used in financing activities have generally been the result of the issuance and repayment of long-

term debt and related party debt and cash proceeds from exercise of stock options. Proceeds from long-term debt,

related party debt and equity issuances have been used to fund our operations, construct and launch new satellites

and invest in other infrastructure improvements.

• The increase in cash flows used in financing activities was primarily due to the 2011 repayment of the

remaining balance of our 11.25% Senior Secured Notes due 2013 and 3.25% Convertible Notes due 2011

without issuing new debt. In 2010, we repaid our Senior Secured Term Loan due 2012, 9.625% Senior

Notes due 2013, XM’s 10% Senior PIK Secured Notes due 2011 and 9.75% Senior Notes due 2014. We

also partially repaid XM’s 11.25% Senior Secured Notes due 2013 and our 3.25% Convertible Notes due

2011. We issued the following new debt in 2010; our 8.75% Senior Notes due 2015 and 7.625% Senior

Notes due 2018.

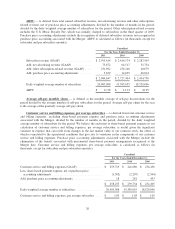

Financings and Capital Requirements

We have historically financed our operations through the sale of debt and equity securities. The Certificate

of Designations for our Series B Preferred Stock provides that, so long as Liberty Media beneficially owns at

least half of its initial equity investment, Liberty Media’s consent is required for certain actions, including the

grant or issuance of our equity securities and the incurrence of debt (other than, in general, debt incurred to

refinance existing debt) in amounts greater than $10,000 in any calendar year.

Future Liquidity and Capital Resource Requirements

We have entered into various agreements to design, construct, and launch our satellites in the normal course

of business. As disclosed in Note 17 in our consolidated financial statements in this annual report, as of

December 31, 2011, we expect to incur expenditures of approximately $60,517 and $5,526 in 2012 and 2013,

respectively, and an additional $48,545 thereafter, the majority of which is attributable to the construction and

launch of our FM-6 satellite and related launch vehicle.

Based upon our current plans, we believe that we have sufficient cash, cash equivalents and marketable

securities to cover our estimated funding needs. We expect to fund operating expenses, capital expenditures,

working capital requirements, interest payments, taxes and scheduled maturities of our debt with existing cash

and cash flow from operations, and we believe that we will be able to generate sufficient revenues to meet our

cash requirements.

17