XM Radio 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Corporate Secretary reviews all correspondence to our directors and forwards to the board a summary

and/or copies of any such correspondence that, in the opinion of the Corporate Secretary, deals with the functions

of the board or committees thereof or that he otherwise determines requires their attention. Directors may at any

time review all correspondence received by us that is addressed to members of our board.

In addition, the Audit Committee has established procedures for the receipt, retention and treatment, on a

confidential basis, of complaints received by us, our board of directors and the Audit Committee regarding

accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by

employees of concerns regarding questionable accounting or auditing matters. These procedures are available

upon written request to our Corporate Secretary.

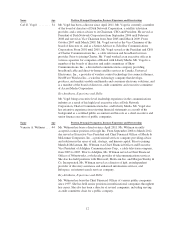

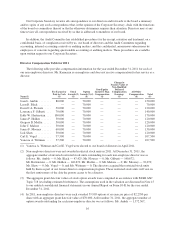

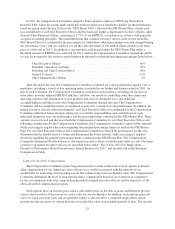

Director Compensation Table for 2011

The following table provides compensation information for the year ended December 31, 2011 for each of

our non-employee directors. Mr. Karmazin is an employee and does not receive compensation for his service as a

director.

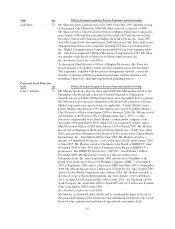

Name(1)

Fee Earned or

Paid in Cash

($)

Stock

Awards(2)

($)

Option

Awards(3)(4)

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value of

Non-Qualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Joan L. Amble ........ 80,000 — 70,000 — — — 150,000

Leon D. Black ........ — — 70,000 — — — 70,000

David J.A. Flowers .... 50,000 — 70,000 — — — 120,000

Lawrence F. Gilberti . . . 70,000 — 70,000 — — — 140,000

Eddy W. Hartenstein . . . 100,000 — 70,000 — — — 170,000

James P. Holden ....... 50,000 — 70,000 — — — 120,000

Gregory B. Maffei ..... 50,000 — 70,000 — — — 120,000

John C. Malone ....... 50,000 — 70,000 — — — 120,000

James F. Mooney ...... 60,000 — 70,000 — — — 130,000

Jack Shaw ........... 50,000 — 70,000 — — — 120,000

Carl E. Vogel ......... 37,500 — 70,000 — — — 107,500

Vanessa A. Wittman . . . 37,500 — 70,000 — — — 107,500

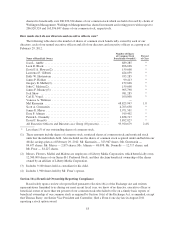

(1) Vanessa A. Wittman and Carl E. Vogel were elected to our board of directors in April 2011.

(2) Non-employee directors were not awarded restricted stock units in 2011. At December 31, 2011, the

aggregate number of unvested restricted stock units outstanding for each non-employee director was as

follows: Ms. Amble — 0; Mr. Black — 47,425; Mr. Flowers — 0; Mr. Gilberti — 140,672;

Mr. Hartenstein — 0; Mr. Holden — 140,672; Mr. Maffei — 0; Mr. Malone — 0; Mr. Mooney — 92,070;

Mr. Shaw — 0; Mr. Vogel — 0; and Ms. Wittman — 0. The directors acquired the restricted stock units

held by them as part of our former director compensation program. These restricted stock units will vest on

the first anniversary of the date the person ceases to be a director.

(3) The aggregate grant date fair values of stock option awards were computed in accordance with FASB ASC

Topic 718 (excluding estimated forfeitures). The assumptions used in the valuation are discussed in Note 15

to our audited consolidated financial statements in our Annual Report on Form 10-K for the year ended

December 31, 2011.

(4) In 2011, non-employee directors were each awarded 59,905 options at an exercise price of $2.2350 per

share with an aggregate grant date fair value of $70,000. At December 31, 2011, the aggregate number of

option awards outstanding for each non-employee director was as follows: Ms. Amble — 1,372,367;

16