XM Radio 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

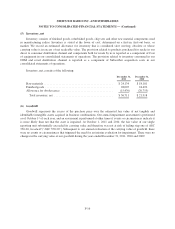

Subscriber Acquisition Costs

Subscriber acquisition costs consist of costs incurred to acquire new subscribers and include hardware

subsidies paid to radio manufacturers, distributors and automakers, including subsidies paid to automakers who

include a satellite radio and a prepaid subscription to our service in the sale or lease price of a new vehicle;

subsidies paid for chip sets and certain other components used in manufacturing radios; device royalties for

certain radios; commissions paid to retailers and automakers as incentives to purchase, install and activate radios;

product warranty obligations; and provisions for inventory allowance. Subscriber acquisition costs do not include

advertising, loyalty payments to distributors and dealers of radios and revenue share payments to automakers and

retailers of radios.

Subsidies paid to radio manufacturers and automakers are expensed upon installation, shipment, receipt of

product or activation and are included in Subscriber acquisition costs because we are responsible for providing

the service to the customers. Commissions paid to retailers and automakers are expensed upon either the sale or

activation of radios. Chip sets that are shipped to radio manufacturers and held on consignment are recorded as

inventory and expensed as Subscriber acquisition costs when placed into production by radio manufacturers.

Costs for chip sets not held on consignment are expensed as Subscriber acquisition costs when the automaker

confirms receipt.

We record product warranty obligations in accordance with ASC 460, Guarantees, which requires a

guarantor to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken

by issuing the guarantee. We warrant that certain products sold through our retail and direct to consumer

distribution channels will perform in all material respects in accordance with specifications in effect at the time

of the purchase of the products by the customer. The product warranty period on our products is 90 days from the

purchase date for repair or replacement of components and/or products that contain defects of material or

workmanship. We record a liability for costs that we expect to incur under our warranty obligations when the

product is shipped from the manufacturer. Factors affecting the warranty liability include the number of units

sold and historical and anticipated rates of claims and costs per claim. We periodically assess the adequacy of our

warranty liability based on changes in these factors.

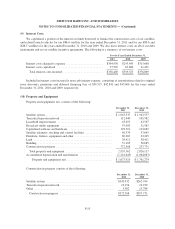

Research & Development Costs

Research and development costs are expensed as incurred and primarily include the cost of new product

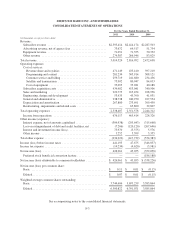

development, chip set design, software development and engineering. During the years ended December 31,

2011, 2010 and 2009, we recorded research and development costs of $48,574, $40,043 and $38,852,

respectively. These costs are reported as a component of Engineering, design and development expense in our

consolidated statements of operations.

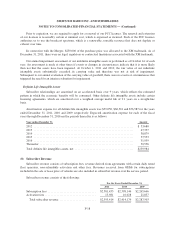

Share-Based Compensation

We account for equity instruments granted to employees in accordance with ASC 718, Compensation —

Stock Compensation. ASC 718 requires all share-based compensation payments to be recognized in the financial

statements based on fair value. ASC 718 requires forfeitures to be estimated at the time of grant and revised in

subsequent periods if actual forfeitures differ from initial estimates. We use the Black-Scholes-Merton option-

pricing model to value stock option awards and have elected to treat awards with graded vesting as a single

award. Share-based compensation expense is recognized ratably over the requisite service period, which is

generally the vesting period, net of forfeitures. We measure non-vested stock awards using the fair market value

of restricted shares of common stock on the day the award is granted.

Fair value as determined using Black-Scholes-Merton model varies based on assumptions used for the

expected life, expected stock price volatility and risk-free interest rates. In 2011, we estimate fair value of awards

F-12