XM Radio 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

amortized on a straight-line basis through 2020, the end of the expected term of the agreements. As of

December 31, 2011 and December 31, 2010, the carrying value of deferred revenue related to this agreement was

$24,517 and $28,792, respectively.

The Cdn$45,000 standby credit facility we extended to XM Canada was paid and terminated as a result of

the Canada Merger. We received $38,815 in cash upon payment of this facility. As a result of the repayment of

the credit facility and completion of the Canada Merger, we released a $15,649 valuation allowance related to the

absorption of our share of the net loss from our investment in XM Canada as of June 21, 2011.

As of December 31, 2010, amounts due from XM Canada also included $7,201 attributable to deferred

programming costs and accrued interest, all of which is reported as Related party long-term assets.

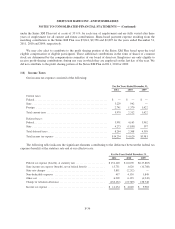

We recorded the following revenue from XM Canada as Other revenue in our consolidated statements of

operations:

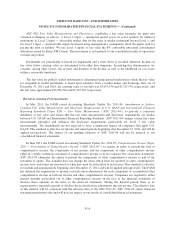

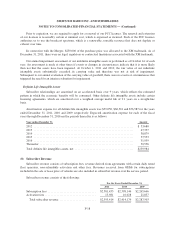

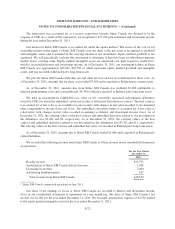

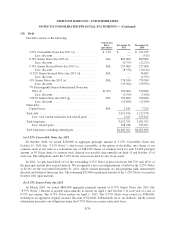

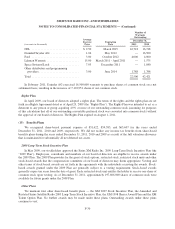

For the Years Ended December 31,

2011* 2010 2009

Amortization of XM Canada deferred income .................. $ 1,388 $ 2,776 $ 2,776

Subscriber and activation fee royalties ....................... 5,483 10,313 11,603

Licensing fee revenue ..................................... 3,000 4,500 6,000

Advertising reimbursements ............................... 833 1,083 1,067

Total revenue from XM Canada ........................... $10,704 $18,672 $21,446

* XM Canada combined with Sirius Canada in June 2011.

Our share of net earnings or losses of XM Canada is recorded to Interest and investment income in our

consolidated statements of operations on a one month lag. Our share of XM Canada’s net loss was $6,045,

$12,147 and $2,292 for the years ended December 31, 2011, 2010 and 2009, respectively.

General Motors and American Honda

We have a long-term distribution agreement with General Motors Company (“GM”). GM had a

representative on our board of directors and was considered a related party through May 27, 2010. During the

term of the agreement, GM has agreed to distribute our service. We subsidize a portion of the cost of satellite

radios and make incentive payments to GM when the owners of GM vehicles with factory- or dealer- installed

satellite radios become self-paying subscribers. We also share with GM a percentage of the subscriber revenue

attributable to GM vehicles with factory- or dealer- installed satellite radios. As part of the agreement, GM

provides certain call-center related services directly to subscribers who are also GM customers for which we

reimburse GM.

We make bandwidth available to OnStar LLC for audio and data transmissions to owners of enabled GM

vehicles, regardless of whether the owner is a subscriber. OnStar’s use of our bandwidth must be in compliance

with applicable laws, must not compete or adversely interfere with our business, and must meet our quality

standards. We also granted to OnStar a certain amount of time to use our studios on an annual basis and agreed to

provide certain audio content for distribution on OnStar’s services.

We have a long-term distribution agreement with American Honda. American Honda had a representative

on our board of directors and was considered a related party through May 27, 2010. We have an agreement to

make a certain amount of our bandwidth available to American Honda. American Honda’s use of our bandwidth

F-24