XM Radio 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

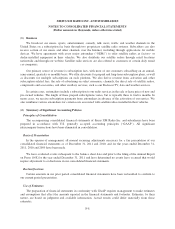

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

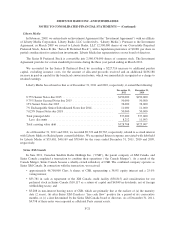

ASC 820, Fair Value Measurements and Disclosures, establishes a fair value hierarchy for input into

valuation techniques as follows: i) Level 1 input — unadjusted quoted prices in active markets for identical

instrument; ii) Level 2 input — observable market data for the same or similar instrument but not Level 1; and

iii) Level 3 input — unobservable inputs developed using management’s assumptions about the inputs used for

pricing the asset or liability. We use Level 3 inputs to fair value the 8% convertible unsecured subordinated

debentures issued by Sirius XM Canada. This investment is not material to our consolidated results of operations

or financial position.

Investments are periodically reviewed for impairment and a write down is recorded whenever declines in

fair value below carrying value are determined to be other than temporary. In making this determination, we

consider, among other factors, the severity and duration of the decline as well as the likelihood of a recovery

within a reasonable timeframe.

The fair value for publicly traded instruments is determined using quoted market prices while the fair value

for non-publicly traded instruments is based upon estimates from a market maker and brokerage firm. As of

December 31, 2011 and 2010, the carrying value of our debt was $3,013,974 and $3,217,578, respectively; and

the fair value approximated $3,506,546 and $3,722,905, respectively.

Recent Accounting Pronouncements

In May 2011, the FASB issued Accounting Standards Update No. 2011-04, Amendments to Achieve

Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial

Reporting Standards (Topic 820) — Fair Value Measurement (“ASU 2011-04”), to provide a consistent

definition of fair value and ensure that the fair value measurement and disclosure requirements are similar

between U.S. GAAP and International Financial Reporting Standards. ASU 2011-04 changes certain fair value

measurement principles and enhances the disclosure requirements particularly for Level 3 fair value

measurements. The amendments are not expected to have a significant impact on companies that apply U.S.

GAAP. This standard is effective for interim and annual periods beginning after December 15, 2011 and will be

applied prospectively. The impact of our pending adoption of ASU 2011-04 will not be material to our

consolidated financial statements.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05, Comprehensive Income (Topic

220) —Presentation of Comprehensive Income (“ASU 2011-05”), to require an entity to present the total of

comprehensive income, the components of net income, and the components of other comprehensive income

either in a single continuous statement of comprehensive income or in two separate but consecutive statements.

ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the

statement of equity. The standard does not change the items which must be reported in other comprehensive

income, how such items are measured or when they must be reclassified to net income. This standard is effective

for interim and annual periods beginning after December 15, 2011 and will be applied retrospectively. The FASB

has deferred the requirement to present reclassification adjustments for each component of accumulated other

comprehensive income in both net income and other comprehensive income. Companies are required to either

present amounts reclassified out of other comprehensive income on the face of the financial statements or

disclose those amounts in the notes to the financial statements. During the deferral period, there is no

requirement to separately present or disclose the reclassification adjustments into net income. The effective date

of this deferral will be consistent with the effective date of the ASU 2011-05. ASU 2011-05 affects financial

statement presentation only and will have no impact on our results of consolidated financial statements.

F-14