XM Radio 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

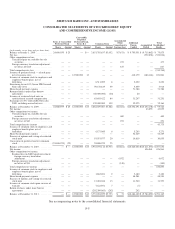

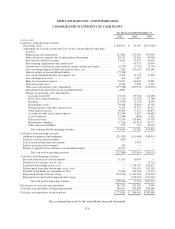

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

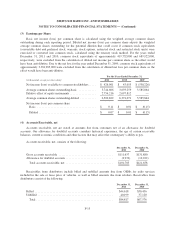

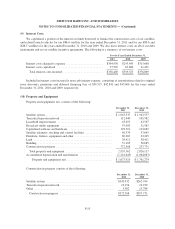

(3) Earnings per Share

Basic net income (loss) per common share is calculated using the weighted average common shares

outstanding during each reporting period. Diluted net income (loss) per common share adjusts the weighted

average common shares outstanding for the potential dilution that could occur if common stock equivalents

(convertible debt and preferred stock, warrants, stock options, restricted stock and restricted stock units) were

exercised or converted into common stock, calculated using the treasury stock method. For the years ended

December 31, 2011 and 2010, common stock equivalents of approximately 419,752,000 and 689,922,000,

respectively, were excluded from the calculation of diluted net income per common share as the effect would

have been anti-dilutive. Due to the net loss for the year ended December 31, 2009, common stock equivalents of

approximately 3,381,905,000 were excluded from the calculation of diluted net loss per common share as the

effect would have been anti-dilutive.

For the Years Ended December 31,

(in thousands, except per share data) 2011 2010 2009

Net income (loss) available to common stockholders ..... $ 426,961 $ 43,055 $ (538,226)

Average common shares outstanding-basic ............ 3,744,606 3,693,259 3,585,864

Dilutive effect of equity instruments .................. 2,756,216 2,697,812 —

Average common shares outstanding-diluted ........... 6,500,822 6,391,071 3,585,864

Net income (loss) per common share

Basic ........................................ $ 0.11 $ 0.01 $ (0.15)

Diluted ....................................... $ 0.07 $ 0.01 $ (0.15)

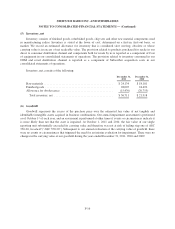

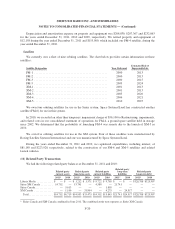

(4) Accounts Receivable, net

Accounts receivable, net are stated at amounts due from customers net of an allowance for doubtful

accounts. Our allowance for doubtful accounts considers historical experience, the age of certain receivable

balances, current economic conditions and other factors that may affect the counterparty’s ability to pay.

Accounts receivable, net, consists of the following:

December 31,

2011

December 31,

2010

Gross accounts receivable ..................................... $111,637 $131,880

Allowance for doubtful accounts ................................ (9,932) (10,222)

Total accounts receivable, net ................................ $101,705 $121,658

Receivables from distributors include billed and unbilled amounts due from OEMs for radio services

included in the sale or lease price of vehicles, as well as billed amounts due from retailers. Receivables from

distributors consist of the following:

December 31,

2011

December 31,

2010

Billed ..................................................... $44,618 $30,456

Unbilled ................................................... 40,199 37,120

Total .................................................... $84,817 $67,576

F-15