XM Radio 2011 Annual Report Download - page 76

Download and view the complete annual report

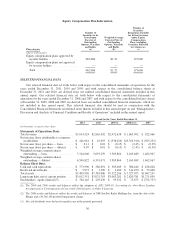

Please find page 76 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.temporary charge for our FM-4 satellite, the ground spare held in storage since 2002. We operate five in-orbit

XM satellites, three of which function as in-orbit spares. Two of the three in-orbit spare satellites were launched

in 2001 and the other in 2010 while the other two satellites were launched in 2005 and 2006. We estimate that

our XM-3, XM-4 and XM-5 satellites will meet their 15 year predicted depreciable lives, and that the depreciable

lives of XM-1 and XM-2 will end in 2013.

Certain of our in-orbit satellites have experienced circuit failures on their solar arrays. We continue to

monitor the operating condition of our in-orbit satellites. If events or circumstances indicate that the depreciable

lives of our in-orbit satellites have changed, we will modify the depreciable life accordingly. If we were to revise

our estimates, our depreciation expense would change. For example, a 10% decrease in the expected depreciable

lives of satellites and spacecraft control facilities during 2011 would have resulted in approximately $20,614 of

additional depreciation expense.

Income Taxes. Deferred income taxes are recognized for the tax consequences related to temporary

differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts

used for tax purposes, based on enacted tax laws and statutory tax rates applicable to the periods in which the

differences are expected to affect taxable income. A valuation allowance is recognized when, based on the

weight of all available evidence, it is considered more likely than not that all, or some portion, of the deferred tax

assets will not be realized. Income tax expense is the sum of current income tax plus the change in deferred tax

assets and liabilities. As of December 31, 2011 and 2010, we maintained a full valuation allowance against our

deferred tax assets due to our prior history of pre-tax losses and uncertainty about the timing of and ability to

generate taxable income in the future and our assessment that the realization of the deferred tax assets did not

meet the “more likely than not” criterion under ASC 740.

Recent Accounting Pronouncements

In May 2011, the FASB issued Accounting Standards Update No. 2011-04, Amendments to Achieve

Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial

Reporting Standards (Topic 820) — Fair Value Measurement (“ASU 2011-04”), to provide a consistent

definition of fair value and ensure that the fair value measurement and disclosure requirements are similar

between U.S. GAAP and International Financial Reporting Standards. ASU 2011-04 changes certain fair value

measurement principles and enhances the disclosure requirements particularly for Level 3 fair value

measurements. The amendments are not expected to have a significant impact on companies that apply U.S.

GAAP. This standard is effective for interim and annual periods beginning after December 15, 2011 and will be

applied prospectively. The impact of our pending adoption of ASU 2011-04 will not be material to our

consolidated financial statements.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05, Comprehensive Income (Topic

220) —Presentation of Comprehensive Income (“ASU 2011-05”), to require an entity to present the total of

comprehensive income, the components of net income, and the components of other comprehensive income

either in a single continuous statement of comprehensive income or in two separate but consecutive statements.

ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the

statement of equity. The standard does not change the items which must be reported in other comprehensive

income, how such items are measured or when they must be reclassified to net income. This standard is effective

for interim and annual periods beginning after December 15, 2011 and will be applied retrospectively. The FASB

has deferred the requirement to present reclassification adjustments for each component of accumulated other

comprehensive income in both net income and other comprehensive income. Companies are required to either

present amounts reclassified out of other comprehensive income on the face of the financial statements or

disclose those amounts in the notes to the financial statements. During the deferral period, there is no

requirement to separately present or disclose the reclassification adjustments into net income. The effective date

of this deferral will be consistent with the effective date of the ASU 2011-05. ASU 2011-05 affects financial

statement presentation only and will have no impact on our results of operations or financial position.

20