XM Radio 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In assessing the recoverability of our deferred tax assets, management regularly considers whether some

portion or all of the deferred tax assets will not be realized based on the recognition threshold and measurement

of tax positions in accordance with the Income Tax Topic of the FASB Accounting Standards Codification (the

“Income Taxes Topic”). The ultimate realization of deferred tax assets is dependent upon the generation of future

taxable income during the periods in which those temporary differences become deductible. Management

considers the scheduled reversal of deferred tax assets and liabilities, projected taxable income and tax planning

strategies in making this assessment. Management’s evaluation of the realizability of deferred tax assets

considers both positive and negative evidence. The weight given to the potential effects of positive and negative

evidence is based on the extent to which it can be objectively verified. Our conclusion with regard to maintaining

or releasing the valuation allowance gives consideration to a variety of factors including but not limited to: (a)

our ability to utilize net operating losses within the carryforward period, (b) a three-year cumulative pre-tax

income, (c) current period taxable income and (d) the expectation of future earnings. After weighting this

evidence, management will conclude whether it is more likely than not that our deferred tax assets will be

realized.

We have maintained a deferred tax valuation allowance against our deferred tax assets through

December 31, 2011. In 2010, we had our first year of pre-tax earnings, but continued to generate taxable losses.

For the year ended December 31, 2011, we have continued to report positive earnings and have generated taxable

income. If such earnings trends continue, we may realize the benefits of all or a significant portion of our net

deferred tax assets in 2012 through a reduction in our deferred tax valuation allowance. This would result in an

income tax benefit that would be reflected in net income. As of December 31, 2011, we had approximately

$3.4 billion of valuation allowances established against the deferred tax assets.

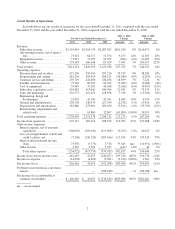

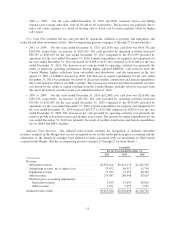

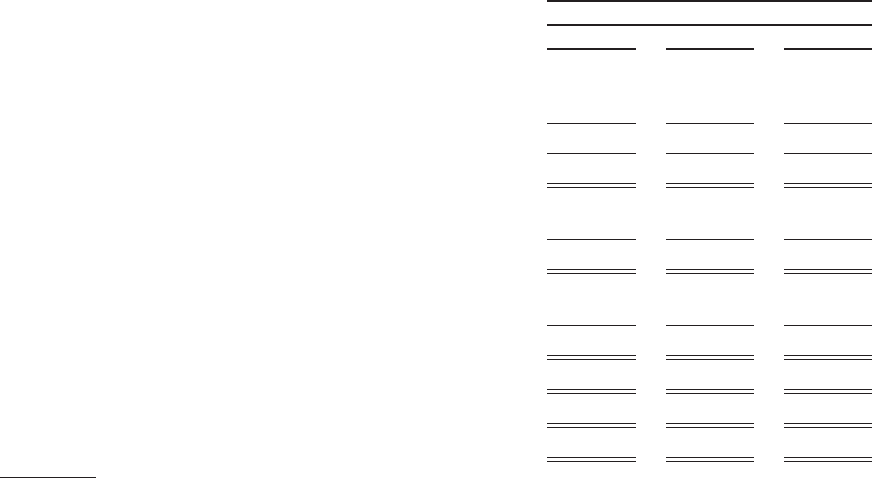

Subscriber Data

The following table contains actual subscriber data for the years ended December 31, 2011, 2010 and 2009,

respectively.

Unaudited

For the Years Ended December 31,

2011 2010 2009

Beginning subscribers .............................. 20,190,964 18,772,758 19,003,856

Gross subscriber additions ........................... 8,696,020 7,768,827 6,208,482

Deactivated subscribers ............................. (6,994,160) (6,350,621) (6,439,580)

Net additions ...................................... 1,701,860 1,418,206 (231,098)

Ending subscribers ................................. 21,892,824 20,190,964 18,772,758

Self-pay ....................................... 17,908,742 16,686,799 15,703,932

Paid promotional ................................ 3,984,082 3,504,165 3,068,826

Ending subscribers ................................. 21,892,824 20,190,964 18,772,758

Self-pay ....................................... 1,221,943 982,867 154,275

Paid promotional ................................ 479,917 435,339 (385,373)

Net additions ...................................... 1,701,860 1,418,206 (231,098)

Daily weighted average number of subscribers ........... 20,903,908 19,385,055 18,529,696

Average self-pay monthly churn ...................... 1.9% 1.9% 2.0%

New vehicle consumer conversion rate ................. 45% 46% 45%

Note: See pages 21 through 27 for a glossary of terms.

10