XM Radio 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

granted using the hybrid approach for volatility, which weights observable historical volatility and implied

volatility of qualifying actively traded options on our common stock. In 2010 and 2009, due to the lack of

qualifying actively traded options on our common stock, we utilized a 100% weighting to observable historical

volatility. The expected life assumption represents the weighted-average period stock-based awards are expected

to remain outstanding. These expected life assumptions are established through a review of historical exercise

behavior of stock-based award grants with similar vesting periods. Where historical patterns do not exist,

contractual terms are used. The risk-free interest rate represents the daily treasury yield curve rate at the grant

date based on the closing market bid yields on actively traded U.S. treasury securities in the over-the-counter

market for the expected term. Our assumptions may change in future periods.

Equity instruments granted to non-employees are accounted for in accordance with ASC 505, Equity. The

final measurement date for the fair value of equity instruments with performance criteria is the date that each

performance commitment for such equity instrument is satisfied or there is a significant disincentive for

non-performance.

Stock-based awards granted to employees, non-employees and members of our board of directors include

warrants, stock options, restricted stock and restricted stock units.

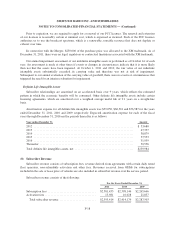

Income Taxes

Deferred income taxes are recognized for the tax consequences related to temporary differences between the

carrying amount of assets and liabilities for financial reporting purposes and the amounts used for tax purposes at

each year-end, based on enacted tax laws and statutory tax rates applicable to the periods in which the differences

are expected to affect taxable income. A valuation allowance is recognized when, based on the weight of all

available evidence, it is considered more likely than not that all, or some portion, of the deferred tax assets will

not be realized. Income tax expense is the sum of current income tax plus the change in deferred tax assets and

liabilities.

ASC 740, Income Taxes, requires a company to first determine whether it is more-likely-than-not that a tax

position will be sustained based on its technical merits as of the reporting date, assuming that taxing authorities

will examine the position and have full knowledge of all relevant information. A tax position that meets this

more-likely-than-not threshold is then measured and recognized at the largest amount of benefit that is greater

than fifty percent likely to be realized upon effective settlement with a taxing authority. Changes in recognition

or measurement are reflected in the period in which the change in judgment occurs. We record interest and

penalties related to uncertain tax positions in income tax expense in our consolidated statement of operations.

We report revenues net of any tax assessed by a governmental authority that is both imposed on, and

concurrent with, a specific revenue-producing transaction between a seller and a customer in our consolidated

statements of operations.

As of December 31, 2011 and 2010, we maintained a full valuation allowance against our deferred tax assets

due to our prior history of pre-tax losses and uncertainty about the timing of and ability to generate taxable

income in the future and our assessment that the realization of the deferred tax assets did meet the “more likely

than not” criterion under ASC 740.

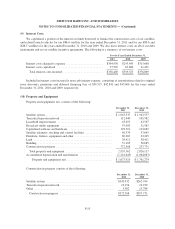

Fair Value of Financial Instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in an

orderly transaction between market participants to sell the asset or transfer the liability. As of December 31, 2011

and 2010, the carrying amounts of cash and cash equivalents, accounts and other receivables, and accounts

payable approximated fair value due to the short-term nature of these instruments.

F-13