XM Radio 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ability to meet our debt and other obligations depends on our future operating performance and on

economic, financial, competitive and other factors. We continually review our operations for opportunities to

adjust the timing of expenditures to ensure that sufficient resources are maintained.

We regularly evaluate our business plans and strategy. These evaluations often result in changes to our

business plans and strategy, some of which may be material and significantly change our cash requirements.

These changes in our business plans or strategy may include: the acquisition of unique or compelling

programming; the introduction of new features or services; significant new or enhanced distribution

arrangements; investments in infrastructure, such as satellites, equipment or radio spectrum; and acquisitions,

including acquisitions that are not directly related to our satellite radio business. In addition, our operations are

affected by the FCC order approving the Merger, which imposed certain conditions upon, among other things,

our program offerings.

Debt Covenants

The indentures governing our debt include restrictive covenants. As of December 31, 2011, we were in

compliance with our debt covenants.

For a discussion of our “Debt Covenants”, refer to Note 13 to our consolidated financial statements in this

annual report.

Off-Balance Sheet Arrangements

We do not have any significant off-balance sheet financing arrangements other than those disclosed in Note

17 to our consolidated financial statements in this annual report that are reasonably likely to have a material

effect on our financial condition, results of operations, liquidity, capital expenditures or capital resources.

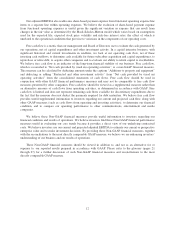

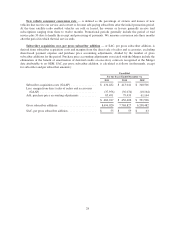

Contractual Cash Commitments

For a discussion of our “Contractual Cash Commitments,” refer to Note 17 to our consolidated financial

statements in this annual report.

Related Party Transactions

For a discussion of “Related Party Transactions,” refer to Note 11 to our consolidated financial statements

in this annual report.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with U.S. GAAP, which require

management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the periods.

Accounting estimates require the use of significant management assumptions and judgments as to future events,

and the effect of those events cannot be predicted with certainty. The accounting estimates will change as new

events occur, more experience is acquired and more information is obtained. We evaluate and update our

assumptions and estimates on an ongoing basis and use outside experts to assist in that evaluation when we deem

necessary. We have disclosed all significant accounting policies in Note 2 to our consolidated financial

statements in this annual report.

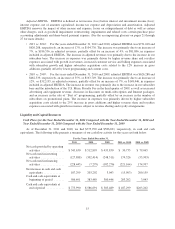

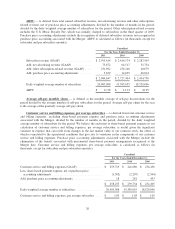

Goodwill. Goodwill represents the excess of the purchase price over the estimated fair value of net

tangible and identifiable intangible assets acquired in business combinations. Our annual impairment assessment

of our single reporting unit is performed as of October 1st of each year. Assessments are performed at other times

18