XM Radio 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

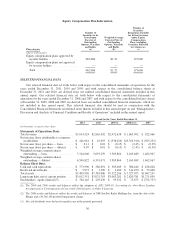

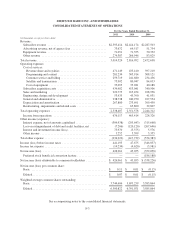

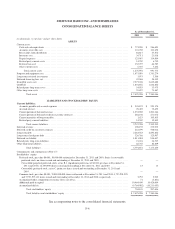

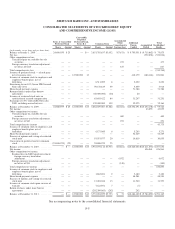

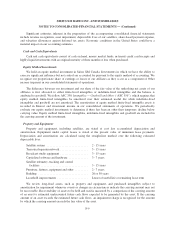

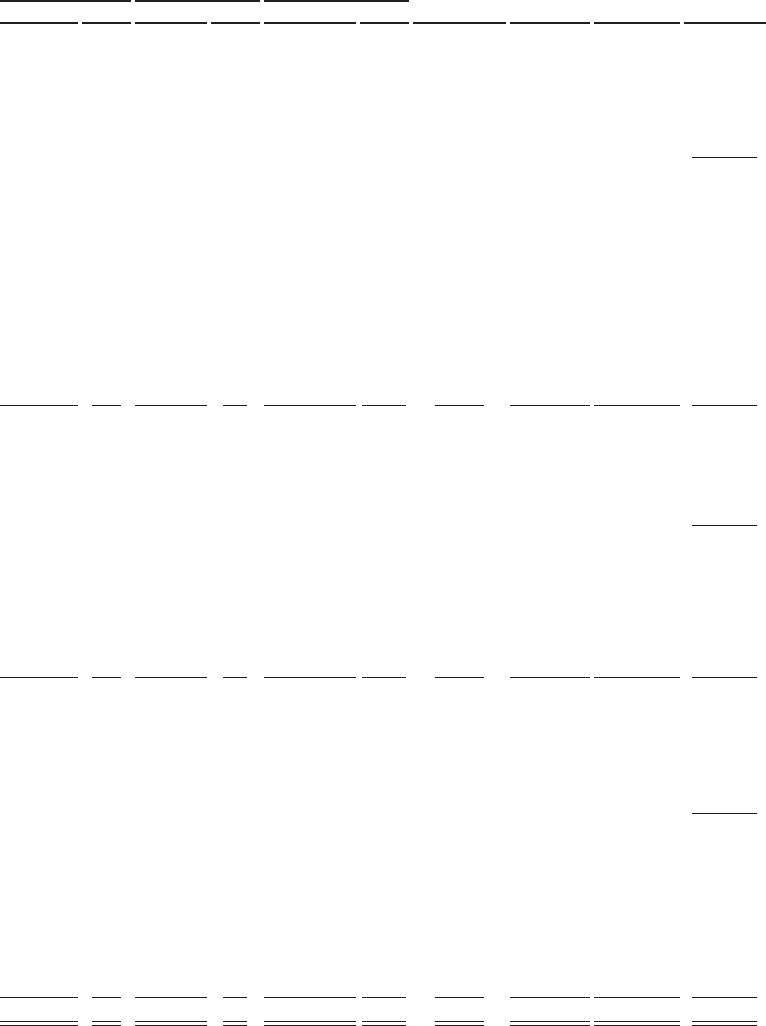

SIRIUS XM RADIO INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (LOSS)

Series A Convertible

Preferred Stock

Convertible

Perpetual

Preferred Stock,

Series B-1 Common Stock

Accumulated

Other

Comprehensive

Income (loss)

Additional

Paid-in

Capital

Accumulated

Deficit

Total

Stockholders’

EquityShares Amount Shares Amount Shares Amount

(in thousands, except share and per share data)

Balance at January 1, 2009 .............. 24,808,959 $ 25 — $— 3,651,765,837 $3,652 $(7,871) $ 9,795,951 $ (9,715,882) $ 75,875

Net loss ............................. (352,038) (352,038)

Other comprehensive loss:

Unrealized gain on available-for-sale

securities ........................ — — — — — — 473 — — 473

Foreign currency translation adjustment,

net of tax of $110 ................. — — — — — — 817 — — 817

Total comprehensive loss ............... — — — — — — — — — (350,748)

Issuance of preferred stock — related party,

net of issuance costs ................. — — 12,500,000 13 — — — 410,179 (186,188) 224,004

Issuance of common stock to employees and

employee benefit plans, net of

forfeitures ......................... — — — — 8,511,009 8 — 2,622 — 2,630

Structuring fee on 10% Senior PIK Secured

Notes due 2011 ..................... — — — — 59,178,819 59 — 5,859 — 5,918

Share-based payment expense ........... — — — — — — — 71,388 — 71,388

Returned shares under share borrow

agreements ........................ — — — — (60,000,000) (60) — 60 — —

Issuance of restricted stock units in

satisfaction of accrued compensation .... — — — — 83,803,422 84 — 31,207 — 31,291

Exchange of 2.5% Convertible Notes due

2009, including accrued interest ........ — — — — 139,400,000 139 — 35,025 — 35,164

Balance at December 31, 2009 ........... 24,808,959 $ 25 12,500,000 $13 3,882,659,087 $3,882 $(6,581) $10,352,291 $(10,254,108) $ 95,522

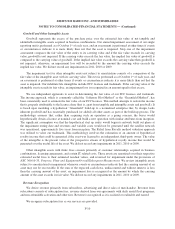

Net income .......................... 43,055 43,055

Other comprehensive income:

Unrealized gain on available-for-sale

securities ........................ — — — — — — 469 — — 469

Foreign currency translation adjustment,

netoftaxof$63 .................. — — — — — — 251 — — 251

Total comprehensive income ............ — — — — — — — — — 43,775

Issuance of common stock to employees and

employee benefit plans, net of

forfeitures ......................... — — — — 6,175,089 6 — 5,265 — 5,271

Share-based payment expense ........... — — — — — — — 52,229 — 52,229

Exercise of options and vesting of restricted

stock units ......................... — — — — 19,551,977 20 — 10,819 — 10,839

Conversion of preferred stock to common

stock .............................(24,808,959) (25) — — 24,808,959 25 — — — —

Balance at December 31, 2010 ........... — $— 12,500,000 $13 3,933,195,112 $3,933 $(5,861) $10,420,604 $(10,211,053) $ 207,636

Net income .......................... 426,961 426,961

Other comprehensive income:

Realized loss on XM Canada investment

foreign currency translation

adjustment ....................... — — — — — — 6,072 — — 6,072

Foreign currency translation adjustment,

netoftaxof$11 .................. — — — — — — (140) — — (140)

Total comprehensive income ............ — — — — — — — — — 432,893

Issuance of common stock to employees and

employee benefit plans, net of

forfeitures ......................... — — — — 1,882,801 2 — 3,480 — 3,482

Share-based payment expense ........... — — — — — — — 48,581 — 48,581

Exercise of options and vesting of restricted

stock units ......................... — — — — 13,401,048 13 — 11,540 — 11,553

Issuance of common stock upon exercise of

warrants .......................... — — — — 7,122,951 7 — (7) — —

Return of shares under share borrow

agreements ........................ — — — — (202,399,983) (202) — 202 — —

Balance at December 31, 2011 ........... — $— 12,500,000 $13 3,753,201,929 $3,753 $ 71 $10,484,400 $ (9,784,092) $ 704,145

See accompanying notes to the consolidated financial statements.

F-5