XM Radio 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• amending our certificate of incorporation or by-laws in a manner that materially adversely affects the

holders of the preferred stock.

The preferred stock, with respect to dividend rights, ranks on parity with our common stock, and with

respect to rights on liquidation, winding-up and dissolution, ranks senior to our common stock. Dividends on the

preferred stock are payable, on a non-cumulative basis, as and if declared on our common stock, in cash, on an

as-converted basis.

On March 30, 2012, in response to the filing by Liberty Media Corporation with the Federal Communications

Commission (the “FCC”) of an application for consent to transfer of de facto control of Sirius XM, we filed a

petition to dismiss or deny such application. Liberty Media’s application was not filed in connection with a

transaction between Liberty Media and us.

Does SIRIUS XM have corporate governance guidelines and a code of ethics?

Our board of directors adopted the Guidelines which set forth a flexible framework within which the board,

assisted by its committees, directs our affairs. The Guidelines cover, among other things, the composition and

functions of our board of directors, director independence, management succession and review, committee

assignments and selection of new members of our board of directors.

Our board of directors has also adopted a Code of Ethics, which is applicable to all our directors and

employees, including our chief executive officer, principal financial officer and principal accounting officer.

Our Guidelines and the Code of Ethics are available on our website at http://investor.siriusxm.com under

“Corporate Governance” and in print to any stockholder who provides a written request for either document to

our Corporate Secretary. If we amend or waive any provision of the Code of Ethics with respect to our directors,

chief executive officer, principal financial officer or principal accounting officer, we will post the amendment or

waiver at this location on our website.

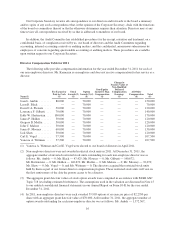

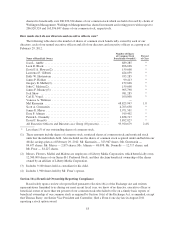

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis, or “CD&A,” describes and analyzes our executive

compensation program for our Chief Executive Officer, our Chief Financial Officer and the four other officers

named in our Summary Compensation Table. We refer to these six officers throughout the CD&A and the

accompanying tables as our “named executive officers.”

Executive Summary

The Compensation Committee is responsible for developing and maintaining compensation programs for

our named executive officers. The Compensation Committee has strived to design these compensation programs

with great care, focusing first and foremost on the incentives that the programs promote. The Compensation

Committee is keenly aware of the heightened sensitivity that compensation programs have been subjected to in

recent years, particularly with regard to pay packages that could be deemed excessive. In the final analysis, the

Compensation Committee believes that our ability to recruit and retain top executive talent is essential to our

long-term success. Accordingly, the Compensation Committee believes it has successfully balanced the

sometimes competing obligations to make decisions which meet the needs of our company against various “one-

size-fits-all” legislative, regulatory and “best practice” mandates.

Our compensation program consists primarily of three elements: base salary; performance-based annual bonus

and long-term equity compensation. We believe that these three elements, when taken together, provide an optimum

mix of fixed compensation and short- and long-term incentives, and therefore serve as the most effective means of

attracting, retaining and motivating executives with the skills and experience necessary to achieve our business

goals and enhance stockholder value, while also avoiding unnecessary or excessive risk-taking.

21