Westjet 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

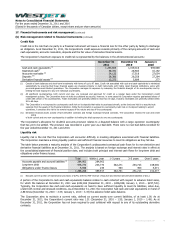

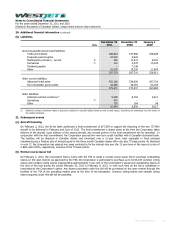

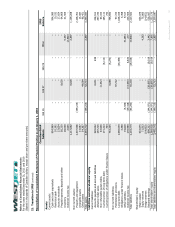

18. Commitments

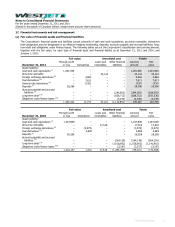

(a) Purchased aircraft

As at December 31, 2011, the Corporation is committed to purchase 35 737-700 and two 737-800 aircraft for delivery between

2012 and 2018. The remaining estimated amounts to be paid in deposits and purchase prices for the 37 aircraft in US dollars and

Canadian dollar equivalents are as follows:

USD CAD

Within 1 year 99,550 101,240

1 – 3 years 421,238 428,392

3 – 5 years 703,952 715,907

Over 5 years 386,466 393,030

1,611,206 1,638,569

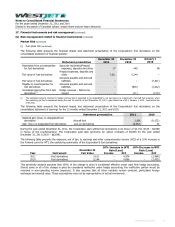

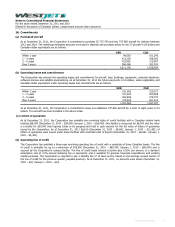

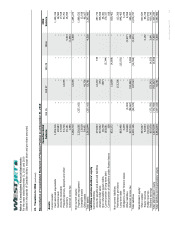

(b) Operating leases and commitments

The Corporation has entered into operating leases and commitments for aircraft, land, buildings, equipment, computer hardware,

software licenses and satellite programming. As at December 31, 2011 the future payments in US dollars, where applicable, and

Canadian dollar equivalents under operating leases and commitments are as follows:

USD CAD

Within 1 year 191,462 219,271

1 – 3 years 371,634 400,588

3 – 5 years 262,846 279,747

Over 5 years 215,642 261,441

1,041,584 1,161,047

As at December 31, 2011, the Corporation is committed to lease one additional 737-800 aircraft for a term of eight years in US

dollars. This aircraft has been included in the above totals.

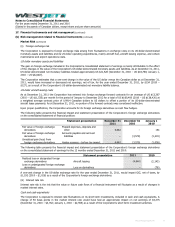

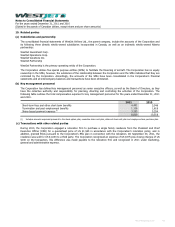

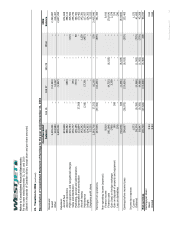

(c) Letters of guarantee

As at December 31, 2011, the Corporation has available two revolving letter of credit facilities with a Canadian charter bank

totaling $38,000 (December 31, 2010 – $38,000; January 1, 2010 – $38,000). One facility is unsecured for $8,000 and the other

is a facility for $30,000 that requires funds to be assigned and held in cash security for the full value of letters of guarantee

issued by the Corporation. As at December 31, 2011 $6,610 (December 31, 2010 – $6,691; January 1, 2010 – $12,491) of

letters of guarantee were issued under these facilities with restricted cash of $6,610 (December 31, 2010 – $6,691; January 1,

2010 – $4,491).

(d) Operating line of credit

The Corporation has available a three-year revolving operating line of credit with a syndicate of three Canadian banks. The line

of credit is available for up to a maximum of $76,500 (December 31, 2010 – $80,750; January 1, 2010 – $85,000) and is

secured by the Corporation’s campus facility. The line of credit bears interest at prime plus 0.50% per annum, or a banker’s

acceptance rate at 2.0% annual stamping fee or equivalent, and is available for general corporate expenditures and working

capital purposes. The Corporation is required to pay a standby fee of 15 basis points, based on the average unused portion of

the line of credit for the previous quarter, payable quarterly. As at December 31, 2011, no amounts were drawn (December 31,

2010 – $nil; January 1, 2010 – $nil).

WestJet Annual Report 2011 99