Westjet 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

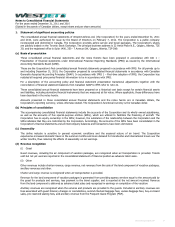

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

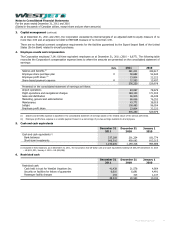

1. Statement of significant accounting policies (continued)

(i) Inventory

Inventories are valued at the lower of cost and net realizable value, with cost being determined on a first-in, first-out basis and a

specific item basis depending on the nature of the inventory. The Corporation’s inventory balance consists of aircraft fuel, de-

icing fluid, retail merchandise and aircraft expendables.

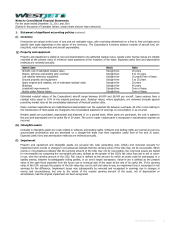

(j) Property and equipment

Property and equipment is stated at cost and depreciated to its estimated residual value. Assets under finance leases are initially

recorded at the present value of minimum lease payments at the inception of the lease. Expected useful lives and depreciation

methods are reviewed annually.

Asset class Basis Rate

Aircraft, net of estimated residual value Straight-line 20 years

Engine, airframe and landing gear overhaul Straight-line 8 to 15 years

Live satellite television equipment Straight-line 10 years/Term of lease

Ground property and equipment Straight-line 5 to 25 years

Spare engines and rotables, net of estimated residual value Straight-line 20 years

Buildings Straight-line 40 years

Leasehold improvements Straight-line Term of lease

Assets under finance leases Straight-line Term of lease

Estimated residual values of the Corporation’s aircraft range between $4,000 and $6,000 per aircraft. Spare engines have a

residual value equal to 10% of the original purchase price. Residual values, where applicable, are reviewed annually against

prevailing market rates at the consolidated statement of financial position date.

Major overhaul expenditures are capitalized and depreciated over the expected life between overhauls. All other costs relating to

the maintenance of fleet assets are charged to the consolidated statement of earnings on consumption or as incurred.

Rotable assets are purchased, depreciated and disposed of on a pooled basis. When parts are purchased, the cost is added to

the pool and depreciated over its useful life of 20 years. The cost to repair rotable parts is recognized in maintenance expense as

incurred.

(k) Intangible assets

Included in intangible assets are costs related to software and landing rights. Software and landing rights are carried at cost less

accumulated amortization and are amortized on a straight-line basis over their respective useful lives of five and 20 years.

Expected useful lives and amortization methods are reviewed annually.

(l) Impairment

Property and equipment and intangible assets are grouped into cash generating units (CGUs) and reviewed annually for

impairment when events or changes in circumstances indicate that the carrying value of the CGU may not be recoverable. When

events or circumstances indicate that the carrying amount of the CGU may not be recoverable, the long-lived assets are tested

for recoverability by comparing the recoverable amounts, defined as the greater of the CGU’s fair value less cost to sell or value-

in-use, with the carrying amount of the CGU. Fair value is defined as the amount for which an asset could be exchanged, or a

liability settled, between knowledgeable willing parties, in an arm’s length transaction. Value-in-use is defined as the present

value of the cash flows expected from the future use or eventual sale of the asset at the end of its useful life. If the carrying

value of the CGU exceeds the greater of the fair value less cost to sell and value-in-use, an impairment loss is recognized in net

earnings for the difference. Impairment losses may subsequently be reversed and recognized in earnings due to changes in

events and circumstances, but only to the extent of the original carrying amount of the asset, net of depreciation or

amortization, had the original impairment not been recognized.

WestJet Annual Report 2011 72