Westjet 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

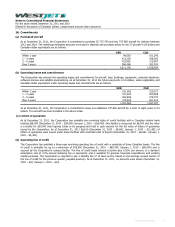

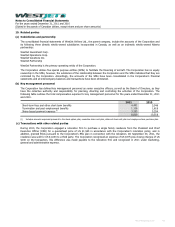

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

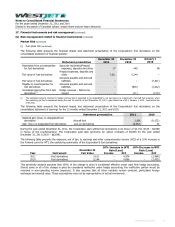

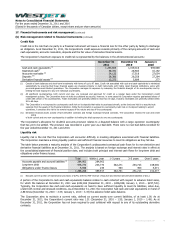

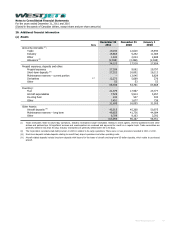

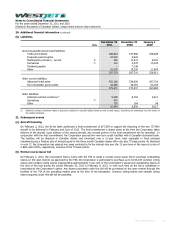

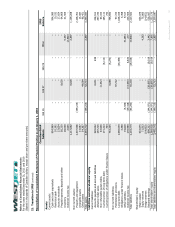

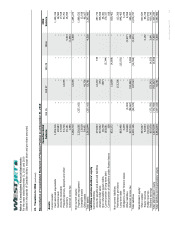

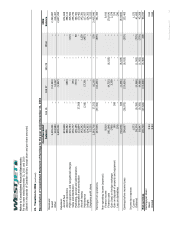

20. Additional financial information (continued)

(b) Liabilities

Note December 31

2011 December 31

2010 January 1

2010

Accounts payable and accrued liabilities:

Trade and industry 268,624 237,668 198,828

Frequent guest program 22,020 6,823 −

Maintenance provision - current 9 245 12,372 8,031

Derivatives 17 112 4,379 10,193

Dividend payable − 7,148 −

Other

16,278 19,320 11,859

307,279 287,710 228,911

Other current liabilities:

Advanced ticket sales 432,186 336,926 297,720

Non-refundable guest credits 43,485 36,381 63,164

475,671 373,307 360,884

Other liabilities:

Deferred contract incentives (i) 9,299 8,794 9,421

Derivatives 17 420 − −

Other

730 164 96

10,449 8,958 9,517

(i) Deferred contract incentives relate to discounts received on aircraft related items as well as land leases. Incentives are amortized over the terms of

the related contracts.

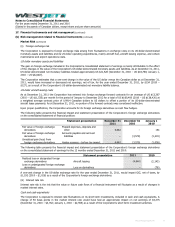

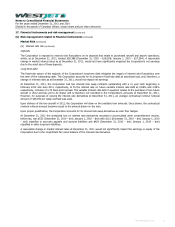

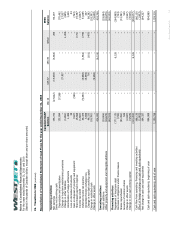

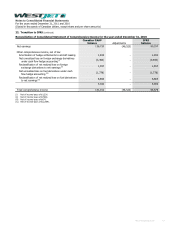

21. Subsequent events

(a) Aircraft financing

On February 2, 2012, the Ex-Im Bank authorized a final commitment of $77,559 to support the financing of the two 737-800

aircraft to be delivered in February and June of 2012. The final commitment is drawn down at the time the Corporation takes

delivery of the aircraft. Upon delivery of the second aircraft, any unused portion of the final commitment will be cancelled. In

conjunction with the final commitment, the Corporation secured two new term credit facilities with a Canadian chartered bank.

The facilities will be financed in Canadian dollars and amortized over a 12-year term, each repayable in fixed principal

instalments plus a floating rate of interest equal to the three month Canadian dealer offer rate plus 75 basis points. As disclosed

in note 17, the Corporation has entered into swap contracts to fix the interest rate over the 12 year term of the loans at a rate of

2.89% and 2.99%, respectively, inclusive of the 75 basis points.

(b) Normal course issuer bid

On February 7, 2012, the Corporation filed a notice with the TSX to make a normal course issuer bid to purchase outstanding

shares on the open market. As approved by the TSX, the Corporation is authorized to purchase up to 6,914,330 common voting

shares and variable voting shares (representing approximately 5 per cent of the Corporation’s issued and outstanding shares at

the time of the bid) during the period February 10, 2012 to February 9, 2013, or until such time as the bid is completed or

terminated at the Corporation’s option. Any shares purchased under this bid will be purchased on the open market through the

facilities of the TSX at the prevailing market price at the time of the transaction. Common voting shares and variable voting

shares acquired under this bid will be cancelled.

WestJet Annual Report 2011 102