Westjet 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

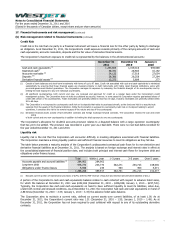

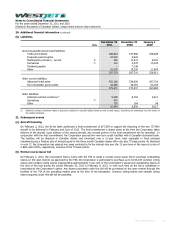

17. Financial instruments and risk management (continued)

(b) Risk management related to financial instruments (continued)

Market Risk (continued)

(i) Fuel price risk (continued)

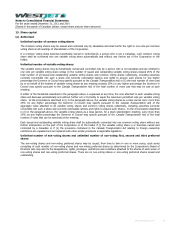

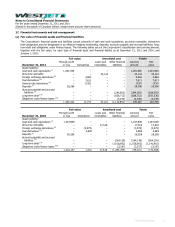

The following table presents the financial impact and statement presentation of the Corporation’s fuel derivatives on the

consolidated statement of financial position:

Statement presentation December 31

2011 December 31

2010 January 1

2010

Receivable from counterparties

for fuel derivatives

Accounts receivable/Prepaid

expenses, deposits and other 27 445 96

Fair value of fuel derivatives

Prepaid expenses, deposits and

other 7,611 5,244 −

Fair value of fuel derivatives

Accounts payable and accrued

liabilities − − (7,521)

Payable to counterparties for

fuel derivatives

Accounts payable and accrued

liabilities −(800) (1,242)

Unrealized (gain)/loss from fuel

derivatives (i)

Hedge reserves – before tax

impact −)11( 6,713

(i) The estimated amount reported in hedge reserves that is expected to be reclassified to net earnings as a component of aircraft fuel expense, when

the underlying jet fuel is consumed during the next 12 months, is $nil (December 31, 2010 – gain before tax of $11; January 1, 2010 – loss before tax

of $6,713).

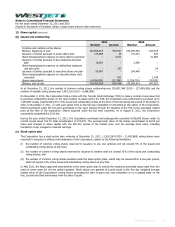

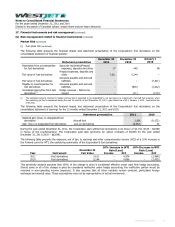

The following table presents the financial impact and statement presentation of the Corporation’s fuel derivatives on the

consolidated statement of earnings for the 12 months ended December 31, 2011 and 2010:

Statement presentation 2011 2010

Realized gain (loss) on designated fuel

derivatives Aircraft fuel 2,656 )9,172(

Gain (loss) on designated fuel derivatives Loss on derivatives (6,052) 44

During the year ended December 31, 2011, the Corporation cash settled fuel derivatives in its favour of $2,732 (2010 – $8,980

in favour of the counterparties). The Corporation paid cash premiums for option contracts of $8,506 for the year ended

December 31, 2011 (2010 – $6,189).

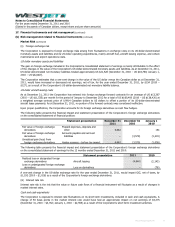

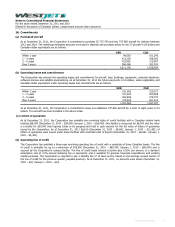

The following table presents the exposure, net of tax, to earnings and other comprehensive income (OCI) of a 10% increase in

the forward curve for WTI, the underlying commodity of the Corporation’s fuel derivatives:

December 31 10% Increase in WTI

Gain

(

Loss

)

10% Decrease in WTI

Gain

(

Loss

)

Year Instrument Fair Value Income OCI Income OCI

2011 Fuel derivatives 7,611 − 4,974 (2,986)

2010 Fuel derivatives 5,244 − 4,896 − (2,455)

This sensitivity analysis assumes that 100% of the change in price is considered effective under cash flow hedge accounting.

Should some or all of the change in price be considered ineffective under hedge accounting, the ineffective portion would be

recorded in non-operating income (expense). It also assumes that all other variables remain constant, particularly foreign

exchange and interest rates. These assumptions may not be representative of actual movements.

WestJet Annual Report 2011 95