Westjet 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

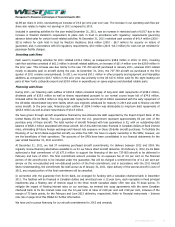

$2.89 per share in 2010, representing an increase of 24.6 per cent year over year. The increase in our operating cash flow per

share also relates to higher net earnings in 2011 compared to 2010.

Included in operating activities for the year ended December 31, 2011, was an increase in restricted cash of $19.7 due to the

increase in WestJet Vacation’s requirement to place cash in trust in accordance with regulatory requirements governing

advance ticket sales for certain travel-related activities. At December 31, 2011 restricted cash consists of $41.4 million (2010 -

$21.6 million) for cash held in trust by WestJet Vacations; $6.6 million (2010 - $6.7 million) for security on letters of

guarantee; and, in accordance with US regulatory requirements, $0.3 million (2010 –$0.3 million) for cash not yet remitted for

passenger facility charges.

Investing cash flows

Cash used in investing activities for 2011 totalled $118.4 million, as compared to $48.6 million in 2010. In 2011, investing

cash flow activities consisted of $61.3 million in aircraft related additions, an increase of $31.4 million over the $29.9 million in

the prior year. This increase was due mainly to the new 737-700 aircraft purchased in January 2011, whereas 2010 related

mostly to deposits paid on aircraft during the year. At December 31, 2011, the 737-700 aircraft we purchased in the first

quarter of 2011 remains unencumbered. In 2011, we incurred $57.1 million in other property and equipment and intangibles

additions as compared to $18.7 million in the prior year due primarily to the US $17.6 million paid for the eight landing slot

pairs at New York's LaGuardia airport and $18.9 million in expenditures on spare engines and standard rotable parts.

Financing cash flows

During 2011, our financing cash outflow of $302.6 million consisted largely of long-term debt repayments of $199.2 million,

dividends paid of $35.0 million as well as shares repurchased pursuant to our normal course issuer bid of $74.6 million.

Included within the $199.2 million in long-term debt repayments was US $21.8 million associated with the early repayment of

the US-dollar denominated long-term facility which was originally scheduled for maturity in 2014 and used to finance one 800

series aircraft. In the prior year, financing cash outflow of $204.0 million was attributable to long-term debt repayments of

$165.0 million as well as share repurchases of $31.4 million.

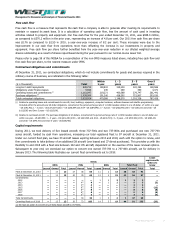

We have grown through aircraft acquisitions financed by low-interest-rate debt supported by the Export-Import Bank of the

United States (Ex-Im Bank). The loan guarantees from the U.S. government represent approximately 85 per cent of the

purchase price of these aircraft. The total number of aircraft financed with loan guarantees is 52, with an outstanding debt

balance of $828.1 million associated with those aircraft. All of this debt has been financed in Canadian dollars at fixed interest

rates, eliminating all future foreign exchange and interest rate exposure on these US-dollar aircraft purchases. To facilitate the

financing of our Ex-Im Bank–supported aircraft, we utilize five SPE. We have no equity ownership in the SPEs; however, we

are the beneficiary of their operations. The accounts of the SPEs have been consolidated in our financial statements for the

year ended December 31, 2011 and 2010.

At December 31, 2011, we had 37 remaining purchased aircraft commitments, for delivery between 2012 and 2018. We

regularly review financing alternatives available to us for our future direct aircraft deliveries. On February 2, 2012, Ex-Im Bank

authorized a final commitment of US $77.6 million to support the financing of the two 737-800 aircraft to be delivered in

February and June of 2012. The final commitment amount provides for an exposure fee of 4.0 per cent on the financed

portion of the aircraft price to be included under the guarantee. We will be charged a commitment fee of 0.2 per cent per

annum on the non-cancelled and non-disbursed portion of the final commitment, and in accordance with the 2011 Aircraft

Sector Understanding, the commitment fee shall accrue as of January 31, 2011. Upon delivery of the second aircraft in June of

2012, any unused portion of the final commitment will be cancelled.

In connection with the guarantee from Ex-Im Bank, we arranged for funding with a Canadian chartered bank in December

2011. The facilities will be financed in Canadian dollars and amortized over a 12-year term, each repayable in fixed principal

instalments plus a floating rate of interest equal to the three month Canadian dealer offer rate plus 75 basis points. To

mitigate the impact of floating interest rates on our earnings, we entered into swap agreements with the same Canadian

chartered bank to fix the interest rates over the 12-year term at rates of 2.89 per cent and 2.99 per cent, inclusive of the

margin of 75 basis points, for the February and June 2012 deliveries, respectively. Refer to Financial instruments – Interest

rate risk on page 40 of this MD&A for further information.

We have yet to pursue financing for our aircraft commitments for 2013 and onwards.

WestJet Annual Report 2011 35