Westjet 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

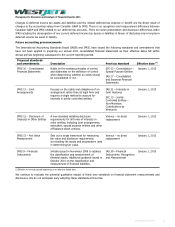

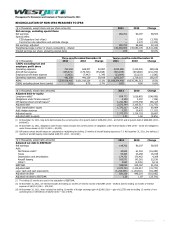

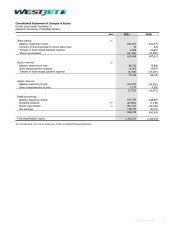

RECONCILIATION OF NON-IFRS MEASURES TO IFRS

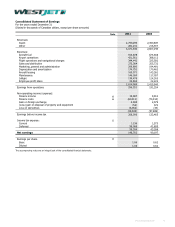

($ in thousands, except share and per share amounts) 2011 2010 Change

Net earnings, excluding special items

Net earnings 148,702 90,197 58,505

Special items:

CEO departure (net of tax) ― 3,700 (3,700)

Income tax rate reductions and estimate change ― 2,372 (2,372)

Net earnings, adjusted 148,702 96,269 52,433

Weighted average number of shares outstanding - diluted 140,638,659 145,080,105 (4,441,446)

Diluted earnings per share, excluding special items 1.06 0.66 60.6%

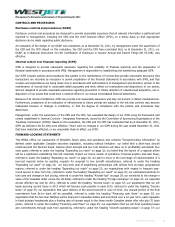

Three months ended December 31 Twelve months ended December 31

($ in thousands) 2011 2010 Change 2011 2010 Change

CASM, excluding fuel and

employee profit share

Operating expenses 722,294 628,307 93,987 2,814,989 2,415,940 399,049

Aircraft fuel expense (235,574) (179,726) (55,848) (915,878) (674,608) (241,270)

Employee profit share expense (5,662) (7,442) 1,780 (23,804) (22,222) (1,582)

Operating expenses, adjusted 481,058 441,139 39,919 1,875,307 1,719,110 156,197

ASMs 5,328,928,405 5,021,010,134 6.1% 21,186,304,409 19,535,291,313 8.5%

CASM, excluding above items (cents) 9.03 8.79 2.7% 8.85 8.80 0.6%

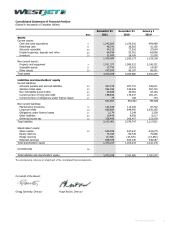

($ in thousands, except ratio amounts) 2011 2010 Change

Adjusted debt-to-equity

Long-term debt(i) 828,712 1,026,802 (198,090)

Obligations under finance leases(ii) 3,249 3,357 (108)

Off-balance-sheet aircraft leases(iii) 1,241,783 1,075,358 166,425

Adjusted debt 2,073,744 2,105,517 (31,773)

Total shareholders’ equity 1,370,217 1,304,233 65,984

Add: Hedge reserves 3,353 10,470 (7,117)

Adjusted equity 1,373,570 1,314,703 58,867

Adjusted debt-to-equity 1.51 1.60 (5.6%)

(i) At December 31, 2011, long-term debt includes the current portion of long-term debt of $158,832 (2010 – $178,337) and long-term debt of $669,880 (2010 –

$848,465).

(ii) At December 31, 2011, obligations under finance leases includes the current portion of obligations under finance leases of $75 (2010 – $108) and obligations

under finance leases of $3,174 (2010 – $3,249).

(iii) Off-balance-sheet aircraft leases are calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. At December 31, 2011, the trailing 12

months of aircraft leasing costs totalled $165,571 (2010 – $143,381).

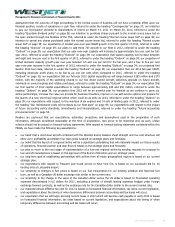

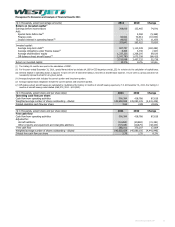

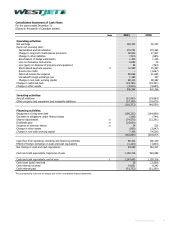

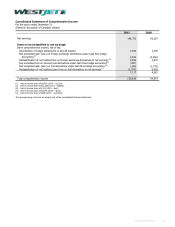

($ in thousands, except ratio amounts) 2011 2010 Change

Adjusted net debt to EBITDAR(i)

Net earnings 148,702 90,197 58,505

Add:

Net finance costs(ii) 44,924 61,004 (16,080)

Taxes 59,304 43,268 16,036

Depreciation and amortization 174,751 170,462 4,289

Aircraft leasing 165,571 143,381 22,190

Other(iii) 3,567 (2,545) 6,112

EBITDAR 596,819 505,767 91,052

Adjusted debt 2,073,744 2,105,517 (31,773)

Less: Cash and cash equivalents (1,243,605) (1,159,316) (84,289)

Adjusted net debt 830,139 946,201 (116,062)

Adjusted net debt to EBITDAR 1.39 1.87 (25.7%)

(i) The trailing 12 months are used in the calculation of EBITDAR.

(ii) At December 31, 2011, net interest includes the trailing 12 months of interest income of $15,987 (2010 – $9,910) and the trailing 12 months of interest

expense of $60,911 (2010 – $70,914).

(iii) At December 31, 2011, other includes the trailing 12 months of foreign exchange gain of $2,485 (2010 – gain of $2,579) and the trailing 12 months of non-

operating loss on derivatives of $6,052 (2010 – loss of $34).

WestJet Annual Report 2011 59