Westjet 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

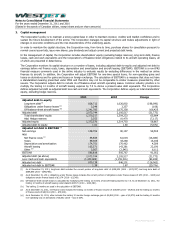

1. Statement of significant accounting policies (continued)

(s) Critical accounting judgments and estimates

The preparation of these consolidated financial statements in conformity with IFRS requires management to make judgments

and estimates that could materially affect the amounts recognized in the financial statements. By their nature, judgments and

estimates may change in light of new facts and circumstances in the internal and external environment. The following judgments

and estimates are those deemed by management to be material to the Corporation’s financial statements.

Judgments

(i) Componentization

The componentization of the Corporation’s assets, namely aircraft, are based on management’s judgment of what components

constitute a significant cost in relation to the total cost of an asset and whether these components have similar or dissimilar

patterns of consumption and useful lives for purposes of calculating depreciation and amortization.

(ii) Depreciation and amortization

Depreciation and amortization methods for aircraft and related components as well as other property, plant and equipment and

intangible assets are based on management’s judgment of the most appropriate method to reflect the pattern of an asset’s

future economic benefit expected to be consumed by the Corporation. Among other factors, these judgments are based on

industry standards, manufacturers’ guidelines and company specific history and experience.

(iii) Impairment

Assessment of impairment is based on management’s judgment of whether there are sufficient internal and external factors that

would indicate that an asset or CGU is impaired. The determination of CGUs is also based on management’s judgment and is an

assessment of the smallest group of assets that generate cash inflows independently of other assets. Factors considered include

whether an active market exists for the output produced by the asset or group of assets as well as how management monitors

and makes decisions about the Corporation’s operations.

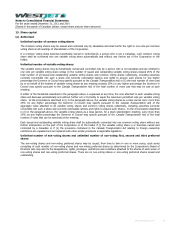

(iv) Lease classification

Assessing whether a lease is a finance lease or an operating lease is based on management’s judgment of the criteria applied in

IAS 17 – Leases. The most prevalent leases of the Corporation are those for aircraft. Management has determined that all of the

Corporation’s leased aircraft are operating leases.

Estimates

(v) Depreciation and amortization

Depreciation and amortization are calculated to write off the cost, less estimated residual value, of assets on a systematic and

rational basis over their expected useful lives. Estimates of residual value and useful lives are based on data and information

from various sources including vendors, industry practice, and company-specific history. Expected useful lives and residual values

are reviewed annually for any change to estimates and assumptions.

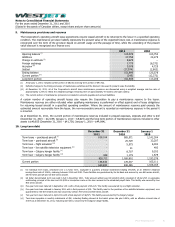

(vi) Maintenance provisions

The Corporation has a legal obligation to adhere to certain maintenance conditions set out in its aircraft operating lease

agreements relating to the condition of the aircraft when it is returned to the lessor. To fulfill these obligations, a provision is

made during the lease term. Estimates related to the maintenance provision include the likely utilization of the aircraft, the

expected future cost of the maintenance, the point in time at which maintenance is expected to occur, the discount rate used to

present value the future cash flows and the lifespan of life-limited parts. These estimates are based on data and information

obtained from various sources including the lessor, current maintenance schedules and fleet plans, contracted costs with

maintenance service providers, other vendors and company-specific history.

(vii) Fair value of awards and breakage associated with the Frequent Guest Program

Estimates are required in determining the amount of revenue to be recognized or deferred from revenue received in relation to

credits awarded under the FGP. These estimates are based on the amount of FGP credits expected to expire (breakage).

Management bases its estimates on company specific redemption history, industry results and future forecasts of expected

redemption.

WestJet Annual Report 2011 75