Westjet 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

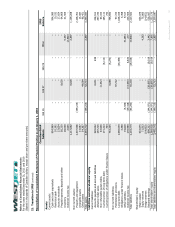

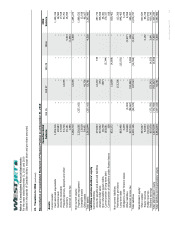

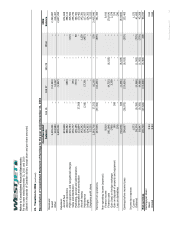

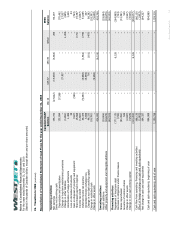

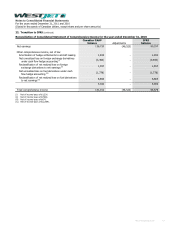

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

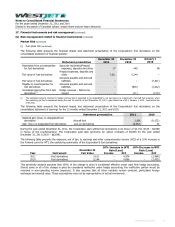

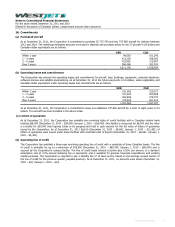

22. Transition to IFRS (continued)

Significant IFRS accounting policy differences (continued)

(ii) Maintenance reserves (continued)

IFRS: To the extent maintenance deposits paid to the lessor are expected to be recoverable through qualifying maintenance

activities, a maintenance reserve asset is recorded. As qualifying maintenance is performed and reimbursed, the maintenance

reserve is drawn down. Any amounts deposited that are not expected to be recoverable through future qualifying maintenance

activities are expensed as incurred. The Corporation recognizes both a current and long-term maintenance reserve based on the

expected timing of reimbursements. Maintenance deposits denominated in US dollars are revalued to Canadian dollars at each

reporting period until settlement.

Impact: Creation of a maintenance reserve asset on the consolidated statement of financial position and a one-time reduction in

maintenance expense recognized on transition. A foreign exchange gain or loss is recognized at each reporting period for the

revaluation of the US-dollar denominated maintenance reserve asset.

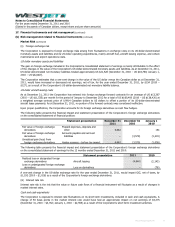

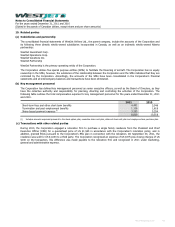

(iii) Soft dollar credit files

Credit files are presented on the consolidated statement of financial position as non-refundable guest credits. These credits are

made up of both soft dollar and hard dollar credit files. Soft dollar credit files are provided to guests for inconveniences such as

flight and baggage delays as a sign of goodwill to be used towards future travel. Hard dollar credit files are provided to guests

for flight changes and cancellations, as well as for the purchase of gift certificates.

Canadian GAAP: Soft dollar credit files issued were recorded as an expense and related liability upon issuance at the incremental

cost of flying an additional guest.

IFRS: Soft dollar credit files do not require a performance obligation to be fulfilled by the Corporation nor are they issued as part

of a sales transaction. As a result, no obligation or liability is recognized under IFRS at the time when a soft dollar credit file is

issued. When soft dollar credit files are redeemed by the guest they are recognized as a reduction to guest revenue for the full

amount of the credit.

Impact: Elimination of the soft dollar credit file liability on transition with a related increase to retained earnings. There was no

effect on hard dollar credit files due to the adoption of IFRS.

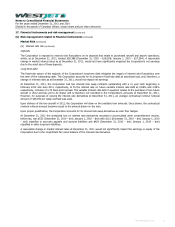

IAS 39 – Financial Instruments: Recognition and Measurement

WestJet has incurred various transaction costs, including agency, advisory and legal fees, related to its aircraft debt financing.

Canadian GAAP: As permitted under Canadian GAAP, these transaction costs were expensed as incurred.

IFRS: Requires costs that are incremental and directly attributable to the acquisition of a financial liability to be included in the

initial measurement of the financial liability. These costs are recorded against the liability and amortized using the effective

interest rate method over the term of the debt. The expense is recorded as a finance cost in the consolidated statement of

earnings.

Impact: On transition, current and long-term debt was reduced with a related increase to retained earnings. Finance costs are

increased for the amortization of the transaction costs.

WestJet Annual Report 2011 105