Westjet 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

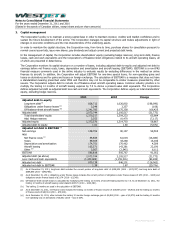

12. Income taxes (continued)

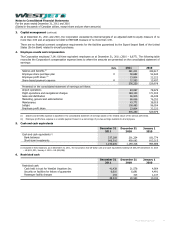

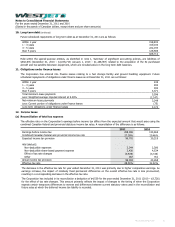

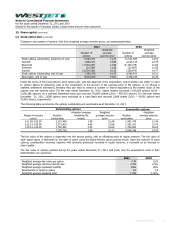

(b) Tax on earnings from continuing operations

2011 2010

Current tax:

Current tax

1,443 1,573

Adjustments of current tax of a prior year (207) −

1,236 1,573

Deferred tax:

Origination and reversal of temporary differences

57,991 41,695

Change in tax rate(i) 89 −

Adjustment for prior year (12) −

58,068 41,695

59

,

304 43

,

268

(i) Effect of substantively enacted corporate income tax rate changes

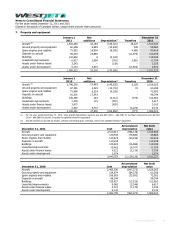

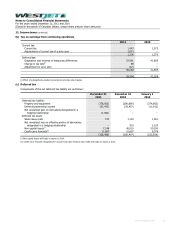

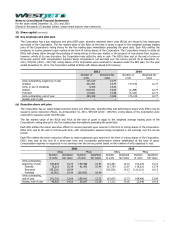

(c) Deferred tax

Components of the net deferred tax liability are as follows:

December 31

2011 December 31

2010 January 1

2010

Deferred tax liability:

Property and equipment (278,003) (280,899) (274,853)

Deferred partnership income (67,473) (43,437) (11,913)

Net unrealized gain on derivatives designated in a

hedging relationship (1,062) − −

Deferred tax asset:

Share issue costs 747 1,143 1,561

Net unrealized loss on effective portion of derivatives

designated in a hedging relationship −919 2,120

Non-capital losses(i) 7,348 45,010 50,200

Credit carry forwards(ii) 11,987 10,857 9,376

(326,456) (266,407) (223,509)

(i) Non-capital losses will begin to expire in 2014.

(ii) Credit carry forwards recognized for unused corporate minimum tax credits will begin to expire in 2013.

WestJet Annual Report 2011 84