Westjet 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

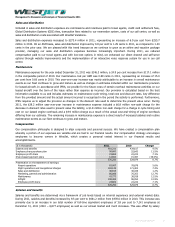

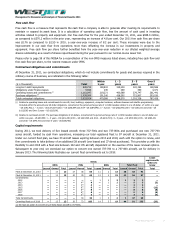

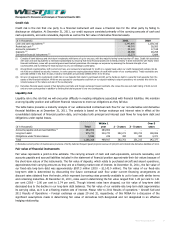

Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to

discharge an obligation. At December 31, 2011, our credit exposure consisted primarily of the carrying amounts of cash and

cash equivalents, accounts receivable, deposits as well as the fair value of derivative financial assets.

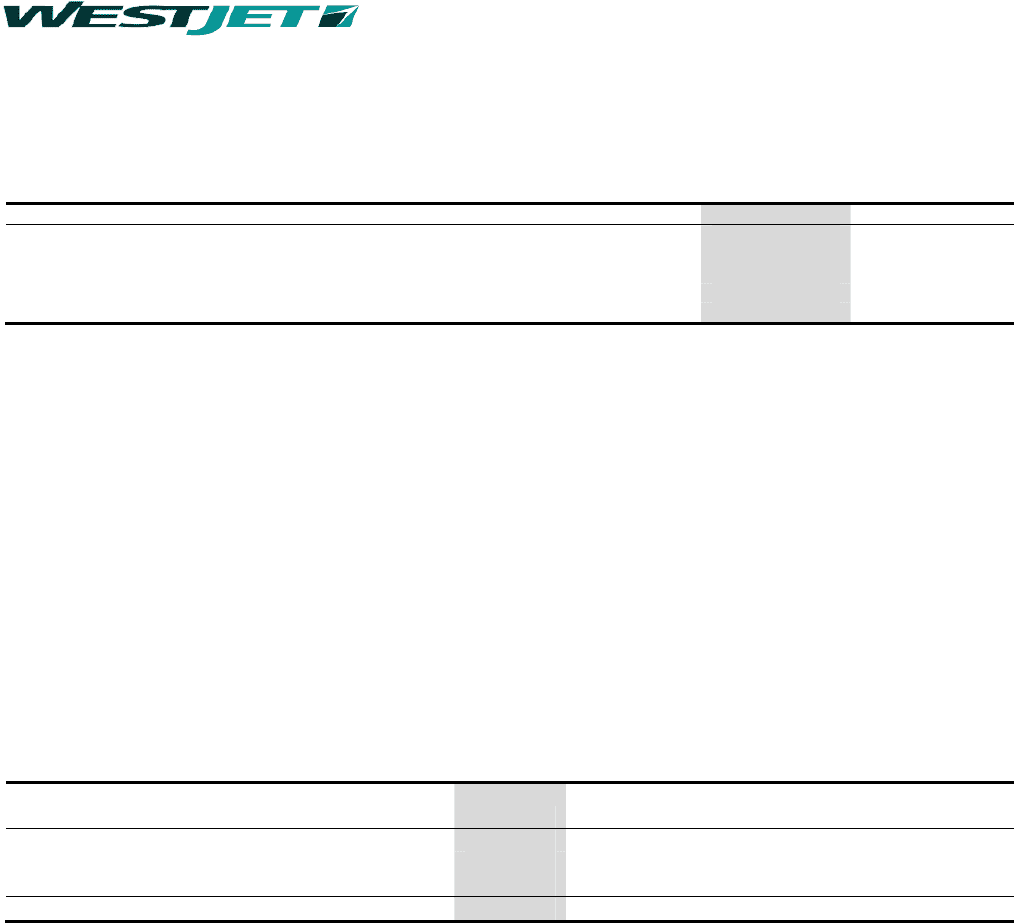

($ in thousands) 2011 2010

Cash and cash equivalents (i) 1,243,605 1,159,316

Restricted cash (i) 48,341 28,583

Accounts receivable (ii) 34,122 17,518

Deposits (iii) 28,386 28,258

Derivative financial instruments (iv)

12,273 5,689

(i) Consists of bank balances and short-term investments with terms of up to one year, with the majority having terms less than 97 days. Credit risk associated

with cash and cash equivalents is minimized substantially by ensuring that these financial assets are invested primarily in debt instruments with highly rated

financial institutions, some with provincial-government-backed guarantees. We manage our exposure by assessing the financial strength of our

counterparties and by limiting the total exposure to any one individual counterparty.

(ii) All significant counterparties, both current and new, are reviewed and approved for credit on a regular basis under our credit management policies. We do

not hold any collateral as security; however, in some cases we require guaranteed letters of credit with certain of our counterparties. Trade receivables are

generally settled in less than 30 days. Industry receivables are generally settled within 30 to 60 days.

(iii) We are not exposed to counterparty credit risk on our deposits that relate to purchased aircraft, as the funds are held in a security trust separate from the

assets of the financial institution. While we are exposed to counterparty credit risk on our deposit relating to airport operations, we consider this risk to be

remote because of the nature and size of the counterparty.

(iv) Derivative financial assets consist of fuel derivative contracts and foreign exchange forward contracts. We review the size and credit rating of both current

and any new counterparties in addition to limiting the total exposure to any one counterparty.

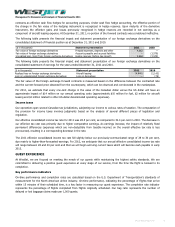

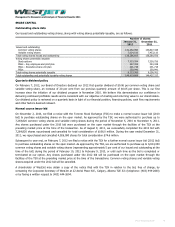

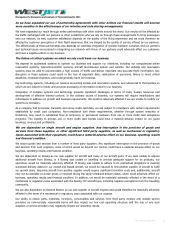

Liquidity risk

Liquidity risk is the risk that we will encounter difficulty in meeting obligations associated with financial liabilities. We maintain

a strong liquidity position and sufficient financial resources to meet our obligations as they fall due.

The table below presents a maturity analysis of our undiscounted contractual cash flow for our non-derivative and derivative

financial liabilities as at December 31, 2011. The analysis is based on foreign exchange and interest rates in effect at the

consolidated statement of financial position date, and includes both principal and interest cash flows for long-term debt and

obligations under capital leases.

($ in thousands) Total Within 1

year 1 - 3 years 3 - 5 years Over 5

years

Accounts payable and accrued liabilities (i) 284,902 284,902 − − −

Long-term debt 975,770 204,770 382,271 250,723 138,006

Obligations under finance leases 5,596 245 490 490 4,371

Total 1,266,268 489,917 382,761 251,213 142,377

(i) Excludes current portion of maintenance provisions of $245, deferred frequent guest program revenue of $22,020 and interest rate derivative liabilities of $112.

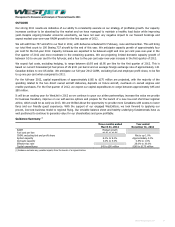

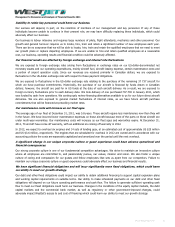

Fair value of financial instruments

Fair value represents a point-in-time estimate. The carrying amount of cash and cash equivalents, accounts receivable, and

accounts payable and accrued liabilities included in the statement of financial position approximate their fair values because of

the short-term nature of the instruments. The fair value of deposits, which relate to purchased aircraft and airport operations,

approximates their carrying amounts as they are at a floating market rate of interest. At December 31, 2011, the fair value of

our fixed-rate long-term debt was approximately $937.3 million (2010 – $1,142.0 million). The fair value of our fixed-rate

long-term debt is determined by discounting the future contractual cash flow under current financing arrangements at

discount rates obtained from the lender, which represent borrowing rates presently available to us for loans with similar terms

and remaining maturities. At December 31, 2011, rates used in determining the fair value ranged from 1.28 per cent to 1.61

per cent (2010 – 2.00 per cent to 2.74 per cent). Though interest rates have dropped, our fair value of long-term debt

decreased due to the decline in our long-term debt balances. The fair value of our variable-rate long-term debt approximates

its carrying value, as it is at a floating market rate of interest. Please refer to 2011 Results of operations – Aircraft fuel and

2011 Results of Operations – Foreign exchange on pages 29 and 32, respectively, of this MD&A for a discussion of the

significant assumptions made in determining fair value of derivatives both designated and not designated in an effective

hedging relationship.

WestJet Annual Report 2011 41