Westjet 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

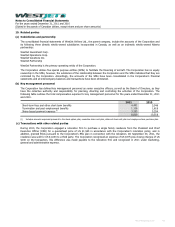

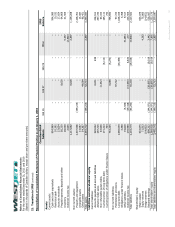

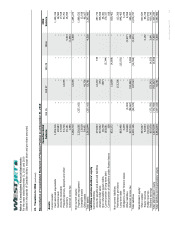

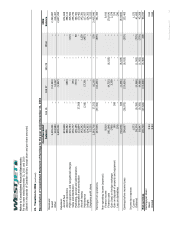

22. Transition to IFRS

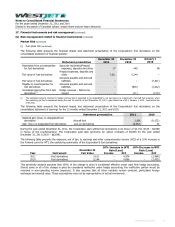

The following discussion describes the principal adjustments made by the Corporation in restating its Canadian GAAP

consolidated financial statements to IFRS for the year ended December 31, 2010 as well as the opening statement of financial

position as at January 1, 2010. Tables reconciling the balances from Canadian GAAP to IFRS are also provided following the

narrative discussion below.

Exemptions applied

IFRS 1 contains mandatory and optional exemptions required by publicly accountable enterprises adopting IFRS for the first time.

The Corporation has assessed each of the mandatory and optional exemptions in detail and concluded there was no impact to

the recognition, measurement, presentation or disclosure of past transactions related to these exemptions.

The Corporation has applied the optional transitional exemption under IFRS 1 – First-time Adoption of International Financial

Reporting Standards in the preparation of these consolidated financial statements. IFRS 1 provides the option to apply IFRIC 4,

Determining Whether an Arrangement Contains a Lease, to arrangements existing at the transition date on the basis of facts and

circumstances at that date. The result of this election is to allow the Corporation to determine whether an arrangement contains

a lease at the date of transition based on the facts and circumstances existing at that date instead of making this determination

at the original inception of the arrangement. Based on the analysis performed, there are no effects to the accounts of the

Corporation from the adoption of IFRIC 4.

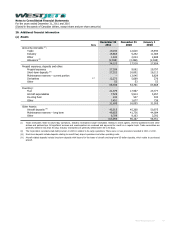

Transition impacts

IFRS employs a conceptual framework that is similar to Canadian GAAP; however, significant differences exist in certain matters

of recognition, measurement and disclosure. While adoption of IFRS has not changed the Corporation’s actual cash flows, it has

resulted in changes to the Corporation’s reported financial position and results of operations. In order to allow the users of the

financial statements to better understand these changes, the Corporation’s Canadian GAAP consolidated statement of financial

position as at January 1, 2010 and December 31, 2010, and the Corporation’s consolidated statement of earnings, consolidated

statement of cash flows and consolidated statement of comprehensive income for the 12 months ended December 31, 2010,

have been reconciled to IFRS with the resulting differences explained.

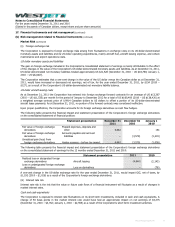

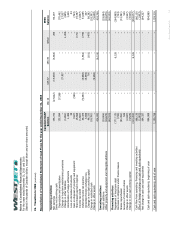

Recast information

Since the first IFRS interim condensed consolidated financial statements were reported by the Corporation as at and for the

periods ending March 31, 2011 and 2010, the Corporation has amended its opening statement of financial position balance for

maintenance provisions to reflect a correction to the pre-tax, risk-free discount rate as at January 1, 2010. This adjustment

reflects a discount rate equal to the remaining term until cash flow instead of the full term of the aircraft lease. The resulting

effect is an adjustment to the opening statement of financial position balances for long-term maintenance provisions of $6,495,

$1,662 to deferred income tax and $4,833 to retained earnings from those amounts reported at March 31, 2011. The tables in

this note reflect the amended opening statement of financial position.

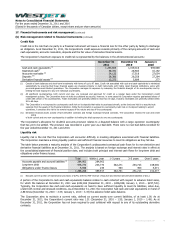

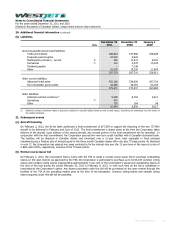

Significant IFRS accounting policy differences

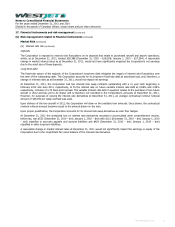

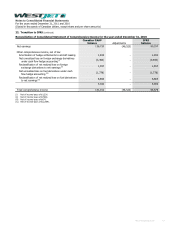

IAS 16 – Property, Plant and Equipment

Aircraft are required to have periodic maintenance performed at predetermined time intervals to maintain the integrity and

efficiency of the aircraft and its major components, including the airframe, landing gear, and engines.

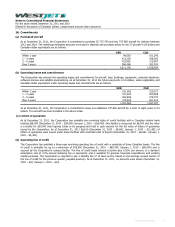

(i) Componentization

Canadian GAAP: Maintenance and repair costs for owned aircraft and aircraft under operating leases, including major overhauls,

were charged to expense at the time maintenance was performed.

IFRS: For owned aircraft, each item of property and equipment with a significant cost in relation to the total cost and/or a

different useful life is required to be depreciated separately. The costs of activities that restore the service potential of airframes,

engines and landing gear are considered components of the aircraft and are separately capitalized and amortized over the period

until the next overhaul.

For aircraft under operating leases, where the Corporation is required to return the aircraft to the lessor in a specified condition,

a provision is recorded. See discussion under section IAS 37 – Provisions, contingent liabilities and contingent assets for more

information.

Impact: More aircraft components with different useful lives were recognized under IFRS. This resulted in increased depreciation

expense, as certain components have a shorter useful life than under Canadian GAAP. However, this increase is offset by a

decrease in maintenance expense, as the costs to perform major maintenance are now capitalized whereas they were previously

expensed. There is no change to the cost of maintenance activities and no overall impact to earnings over the life of the aircraft,

only a timing difference in expense recognition.

WestJet Annual Report 2011 103