Westjet 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

OUTLOOK

Our strong 2011 results are indicative of our ability to consistently execute on our strategy of profitable growth. Our capacity

increases continue to be absorbed by the market and we have managed to maintain a healthy load factor while improving

yield. Despite ongoing broader economic uncertainty, we have not seen any negative impact to our forward bookings and

expect modest year-over-year RASM growth for the first quarter of 2012.

We will add three 737 aircraft to our fleet in 2012, with deliveries scheduled for February, June and December. This will bring

our total fleet count to 100 Boeing 737 aircraft by the end of this year. We anticipate capacity growth of approximately four

per cent for the full-year 2012. Capacity increases are expected to be between eight and nine per cent year-over-year in the

first quarter of 2012 and more moderate in the remaining quarters. We are projecting limited domestic capacity growth of

between 0.5 to one per cent for the full-year, and a four to five per cent year-over-year increase in the first quarter of 2012.

We expect fuel costs, excluding hedging, to range between $0.93 and $0.95 per litre for the first quarter of 2012. This is

based on current forecasted jet fuel prices of US $131 per barrel and an average foreign exchange rate of approximately 1.01

Canadian dollars to one US dollar. We anticipate our full-year 2012 CASM, excluding fuel and employee profit share, to be flat

to up one per cent when compared to 2011.

For the full-year 2012, capital expenditures of approximately $165 to $175 million are projected, with the majority of the

spending related to the two direct owned aircraft deliveries, deposits on future aircraft, overhauls on owned engines and

rotable purchases. For the first quarter of 2012, we expect our capital expenditures to range between approximately $45 and

$50 million.

It will be an exciting year for WestJet in 2012 as we continue to grow our airline partnerships, increase the value we provide

for business travellers, improve on our self-service options and prepare for the launch of a new low-cost short-haul regional

airline, which could be as early as 2013. We are thrilled about the opportunity to provide more Canadians with access to lower

fares and our friendly guest experience. With the support of our engaged WestJetters, we look forward to applying our

proven, low-cost business model to regional flying. Our enviable balance sheet and healthy underlying fundamentals have us

well positioned to continue to generate value for our shareholders and grow profitably.

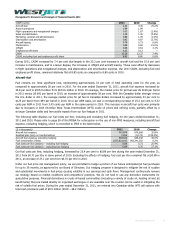

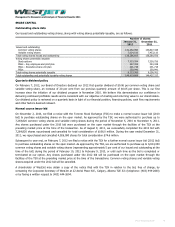

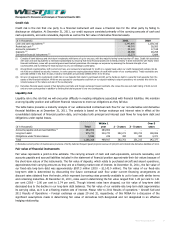

Guidance Summary (i)

Three months ended

March 31, 2012 Year ended

December 31, 2012

RASM Modest growth

Fuel cost per litre $0.93 to $0.95

CASM, excluding fuel and profit share Flat to up 1.0%

System capacity 8.0% to 9.0% Approximately 4.0%

Domestic capacity 4.0% to 5.0% 0.5% to 1.0%

Effective tax rate 28.0% to 30.0%

Capital expenditures $45 to $50 million $165 to $175 million

(i) Guidance excludes any possible impacts from the launch of a regional airline.

WestJet Annual Report 2011 39