Westjet 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

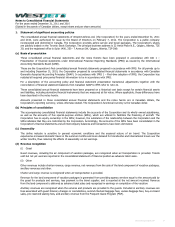

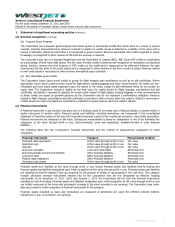

1. Significant accounting policies (continued)

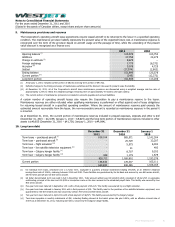

(m) Maintenance provisions and reserves

Provisions are made when it is probable that an outflow of economic benefits will be required to settle a present legal or

constructive obligation in respect of a past event and where the amount of the obligation can be reliably estimated.

The Corporation’s aircraft operating lease agreements require leased aircraft to be returned to the lessor in a specified operating

condition. This obligation requires the Corporation to record a maintenance provision liability for certain return conditions

specified in the operating lease agreements. Certain obligations are based on aircraft usage and the passage of time, while

others are fixed amounts regardless of aircraft usage or passage of time. Expected future costs are estimated based on

contractual commitments and company specific history. Each period, the Corporation recognizes additional maintenance expense

based on increased aircraft usage, the passage of time and any changes to judgments or estimates, including discount rates and

expected timing of maintenance activities. The unwinding of the discounted present value is recorded as a finance cost on the

consolidated statement of earnings. The discount rate used by the Corporation is the current pre-tax risk-free rate approximated

by the corresponding term of a Government of Canada Bond to the remaining term until cash flow. Any difference between the

provision recorded and the actual amount incurred at the time the maintenance activity is performed is recorded to maintenance

expense.

A certain number of aircraft leases also require the Corporation to pay a maintenance reserve to the lessor. Payments are based

on aircraft usage. The purpose of these deposits is to provide the lessor with collateral should an aircraft be returned in an

operating condition that does not meet the requirements stipulated in the lease agreement. Maintenance reserves are refunded

to the Corporation when qualifying maintenance is performed, or if not refunded, act to reduce the end of lease obligation

payments arising from the requirement to return leased aircraft in a specific operating condition. Where the amount of

maintenance reserves paid exceeds the estimated amount recoverable from the lessor, the non-recoverable amount is recorded

as maintenance expense in the period it is incurred.

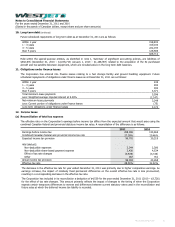

(n) Leases

The determination of whether an arrangement is, or contains, a lease is made at the inception of the arrangement based on the

substance of the arrangement and whether (i) fulfillment of the arrangement is dependent on the use of a specific asset and (ii)

whether the arrangement conveys a right to use the asset.

Finance leases transfer substantially all the risks and rewards incidental to ownership. Finance leases are recognized as assets

and liabilities on the consolidated statement of financial position at the fair value of the leased property or, if lower, the present

value of the minimum lease payments, each determined at the inception of the lease. Any costs directly attributable to the

finance lease are added to the cost of the leased asset. Minimum lease payments are apportioned between a finance charge,

which produces a constant rate of interest on the outstanding liability, and a principal reduction of the lease liability. Depreciation

of finance lease assets follows the same methods used for other similar owned assets over the term of the lease.

Operating leases do not result in the transfer of substantially all risks and rewards incidental to ownership. Non-contingent lease

payments are recognized as an expense in the consolidated statement of earnings on a straight-line basis over the term of the

lease.

(o) Borrowing costs

Interest and other borrowing costs are capitalized to a qualifying asset provided they are directly attributable to the acquisition,

construction or production of the qualifying asset. For specific borrowings, any investment income on the temporary investment

of borrowed funds is offset against the capitalized borrowing costs.

To the extent the Corporation borrows funds generally for the purpose of obtaining a qualifying asset, a capitalization rate is

determined and added to the cost of the qualifying asset.

Interest and other borrowing costs are capitalized beginning when the Corporation incurs expenditures for the qualifying asset,

and undertakes activities necessary to prepare the asset for its intended use. Capitalization ceases during any extended periods

of suspension of development or when substantially all activities necessary to prepare the qualifying asset for its intended use

are complete.

WestJet Annual Report 2011 73