Westjet 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

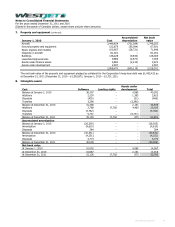

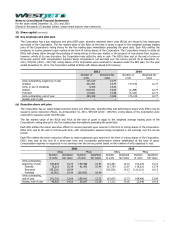

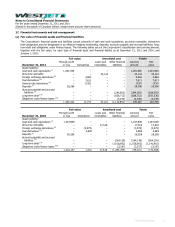

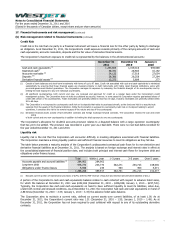

17. Financial instruments and risk management

(a) Fair value of financial assets and financial liabilities

The Corporation’s financial assets and liabilities consist primarily of cash and cash equivalents, accounts receivable, derivatives

both designated and not designated in an effective hedging relationship, deposits, accounts payable and accrued liabilities, long-

term debt and obligations under finance leases. The following tables set out the Corporation’s classification and carrying amount,

together with the fair value, for each type of financial asset and financial liability as at December 31, 2011 and 2010, and

January 1, 2010:

Fair value Amortized cost Totals

December 31, 2011 Through profit

or loss Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents (i) 1,291,946 – – – 1,291,946 1,291,946

Accounts receivable – – 34,122 – 34,122 34,122

Foreign exchange derivatives (ii) –4,662 – – 4,662 4,662

Fuel derivatives (iii) –7,611 – – 7,611 7,611

Interest rate derivatives (iv) – (532) – – (532) (532)

Deposits (v) 28,386 – – – 28,386 28,386

Accounts payable and accrued

liabilities (vi) – – – (284,902) (284,902) (284,902)

Long-term debt (vii) –– – (828,712) (828,712) (937,336)

Obligations under finance leases

(viii)

–– – (3,249) (3,249) (3,249)

1,320,332 11,741 34,122 (1,116,863) 249,332 140,708

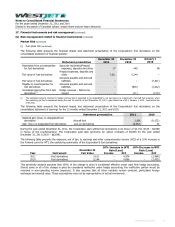

Fair value Amortized cost Totals

December 31, 2010 Through profit

or loss Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents (i) 1,187,899 – – – 1,187,899 1,187,899

Accounts receivable – – 17,518 – 17,518 17,518

Foreign exchange derivatives (ii) – (3,579) – – (3,579) (3,579)

Fuel derivatives (iii) – 4,889 – – 4,889 4,889

Deposits (v) 28,258 – – – 28,258 28,258

Accounts payable and accrued

liabilities (vi) – – – (264,136) (264,136) (264,136)

Long-term debt (vii) – – – (1,026,802) (1,026,802) (1,141,961)

Obligations under finance leases

(viii)

– – – (3,357) (3,357) (3,357)

1,216,157 1,310 17,518 (1,294,295) (59,310) (174,469)

WestJet Annual Report 2011 91