Westjet 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

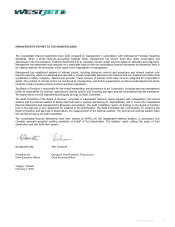

CONTROLS AND PROCEDURES

Disclosure controls and procedures (DC&P)

Disclosure controls and procedures are designed to provide reasonable assurance that all relevant information is gathered and

reported to management, including the CEO and the chief financial officer (CFO), on a timely basis so that appropriate

decisions can be made regarding public disclosure.

An evaluation of the design of our DC&P was conducted, as at December 31, 2011, by management under the supervision of

the CEO and the CFO. Based on this evaluation, the CEO and the CFO have concluded that, as at December 31, 2011, our

DC&P, as in National Instrument 52-109, Certification of Disclosure in Issuers’ Annual and Interim Filings (NI 52-109), was

effective.

Internal control over financial reporting (ICFR)

ICFR is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of

financial statements in accordance with IFRS. Management is responsible for establishing and maintaining adequate ICFR.

Our ICFR includes policies and procedures that pertain to the maintenance of records that provide reasonable assurance that

transactions are recorded as necessary to permit preparation of the financial statements in accordance with IFRS, and that

receipts and expenditures are being made only in accordance with authorizations of management and directors; pertain to the

maintenance of records that in reasonable detail accurately and fairly reflect our transactions and dispositions of our assets;

and are designed to provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or

disposition of our assets that could have a material effect on our annual consolidated financial statements.

Because of its inherent limitations, ICFR can provide only reasonable assurance and may not prevent or detect misstatements.

Furthermore, projections of an evaluation of effectiveness to future periods are subject to the risk that controls may become

inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may

deteriorate.

Management, under the supervision of the CEO and the CFO, has evaluated the design of our ICFR using the framework and

criteria established in Internal Controls – Integrated Framework, issued by the Committee of Sponsoring Organizations of the

Treadway Commission (COSO). Based on this evaluation, the CEO and the CFO has concluded that as at December 31, 2011,

ICFR (as defined in NI 52-109) were effective. There were no changes in our ICFR during the year ended December 31, 2011

that have materially affected, or are reasonably likely to affect, our ICFR.

FORWARD-LOOKING STATEMENTS

This MD&A offers our assessment of WestJet’s future plans and operations and contains “forward-looking information” as

defined under applicable Canadian securities legislation, including without limitation: our belief that a short-haul aircraft

combined with the WestJet brand, balance sheet strength and low cost structure will allow us to profitability accomplish four

main goals, referred to under the heading “Expanding our reach” on page 22; our belief that the launch of a regional airline

will be a significant undertaking that will materially impact our future results of operations, financial position and cash flows,

referred to under the heading “Expanding our reach” on page 22; our plan to move to the next stage of implementation of a

low-cost regional airline by sending requests for proposal to two aircraft manufactures, referred to under the heading

“Expanding our reach” on page 22; our long-term goal of establishing partnerships with airlines from all major geographical

regions, referred to under the heading “Expanding our reach” on page 22; our expectations with respect to frequent year-

round service to New York City, referred to under the heading “Expanding our reach” on page 22; our estimated sensitivity to

fuel costs and changes in fuel pricing, referred to under the heading “Aircraft fuel” on page 29; our sensitivity to the change in

value of the Canadian dollar versus the US dollar, referred to under the heading “Foreign exchange” on page 32; our expected

annual effective tax rate for 2012, referred to under the heading “Income taxes” on page 33; our expectation that we will

begin accruing current taxes in 2012 which will become cash payable in early 2013, referred to under the heading “Income

taxes” on page 33; our expectation that upon delivery of the second aircraft in June of 2012, any unused portion of the final

commitment from Ex-Im bank will be cancelled, referred to under the heading “Financing cash flows” on page 35; our

expectation that the two loan facilities will be financed in Canadian dollars and amortized over a 12-year term, each repayable

in fixed principal instalments plus a floating rate of interest equal to the three month Canadian dealer offer rate plus 75 basis

points, referred to under the heading “Financing cash flows” on page 35; our expectation that we will fund operating leases

and commitments through cash from operations, referred to under the heading “Aircraft operating leases” on page 37; our

WestJet Annual Report 2011 55