Westjet 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

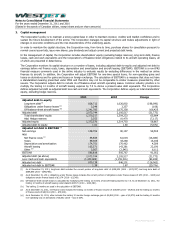

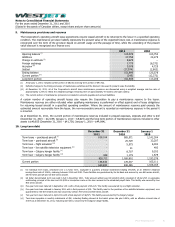

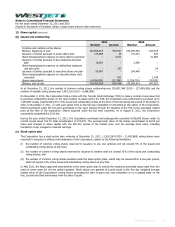

10. Long-term debt (continued)

Future scheduled repayments of long-term debt as at December 31, 2011 are as follows:

Within 1 year 158,832

1 – 3 years 319,100

3 – 5 years 222,194

Over 5 years 128,586

828,712

Held within the special-purpose entities, as identified in note 1, Summary of significant accounting policies, are liabilities of

$842,976 (December 31, 2010 – $1,005,719; January 1, 2010 – $1,168,907) related to the acquisition of the 52 purchased

aircraft and live satellite television equipment, which are included above in the long-term debt balances.

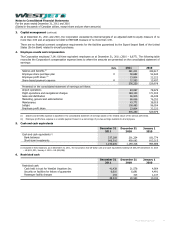

11. Obligations under finance leases

The Corporation has entered into finance leases relating to a fuel storage facility and ground handling equipment. Future

scheduled repayments of obligations under finance leases as at December 31, 2011 are as follows:

Within 1 year 245

1 – 3 years 490

3 – 5 years 490

Over 5 years 4,371

Total minimum lease payments 5,596

Less: Weighted average imputed interest at 5.28% )2,347(

Net minimum lease payments 3,249

Less: Current portion of obligations under finance leases (75)

Long term obligations under finance leases 3,174

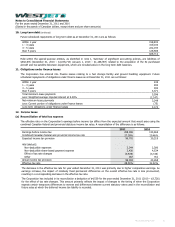

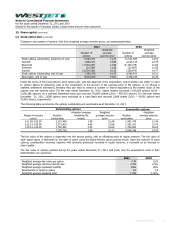

12. Income taxes

(a) Reconciliation of total tax expense

The effective rate on the Corporation’s earnings before income tax differs from the expected amount that would arise using the

combined Canadian federal and provincial statutory income tax rates. A reconciliation of the difference is as follows:

2011 2010

Earnings before income tax 208,006 133,465

Combined Canadian federal and provincial income tax rate 27.26% 29.46%

Expected income tax provision 56,702 39,319

Add (deduct):

Non-deductible expenses 3,344 2,380

Non-deductible share-based payment expense 3,430 4,534

Effect of tax rate changes (4,539) (3,726)

Other 367 761

Actual income tax provision 59,304 43,268

Effective tax rate 28.51% 32.42%

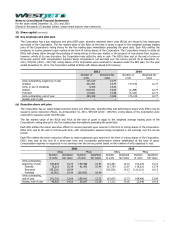

The decrease in the effective tax rate for year ended December 31, 2011 was primarily due to higher comparative earnings. As

earnings increase, the impact of relatively fixed permanent differences on the overall effective tax rate is less pronounced,

resulting in a corresponding decrease in the effective tax rate.

The Corporation has included in its reconciliation a deduction of $4,539 for the year ended December 31, 2011 (2010 – $3,726)

for the effect of tax rate changes. This amount primarily reflects the impact of changes to the timing of when the Corporation

expects certain temporary differences to reverse and differences between current statutory rates used in the reconciliation and

future rates at which the deferred income tax liability is recorded.

WestJet Annual Report 2011 83